Fiscal FactCheck: Third Republican Debate

This blog is part of the “Fiscal FactCheck” series designated to examine the accuracy of budget-related statements made during the 2016 presidential campaign.

Last night, the GOP candidates convened for their third debate of this campaign season. This debate highlighted many budget issues including entitlements, debt, deficit, and the economy. We conducted a live analysis of the candidates’ claims on Twitter at @FiscalFactCheck and posted out findings at our fact check site of fiscalfactcheck.crfb.org/.

For easy reading, we've summarized our coverage below. Full details are available at our FiscalFactCheck page.

1. Entitlements

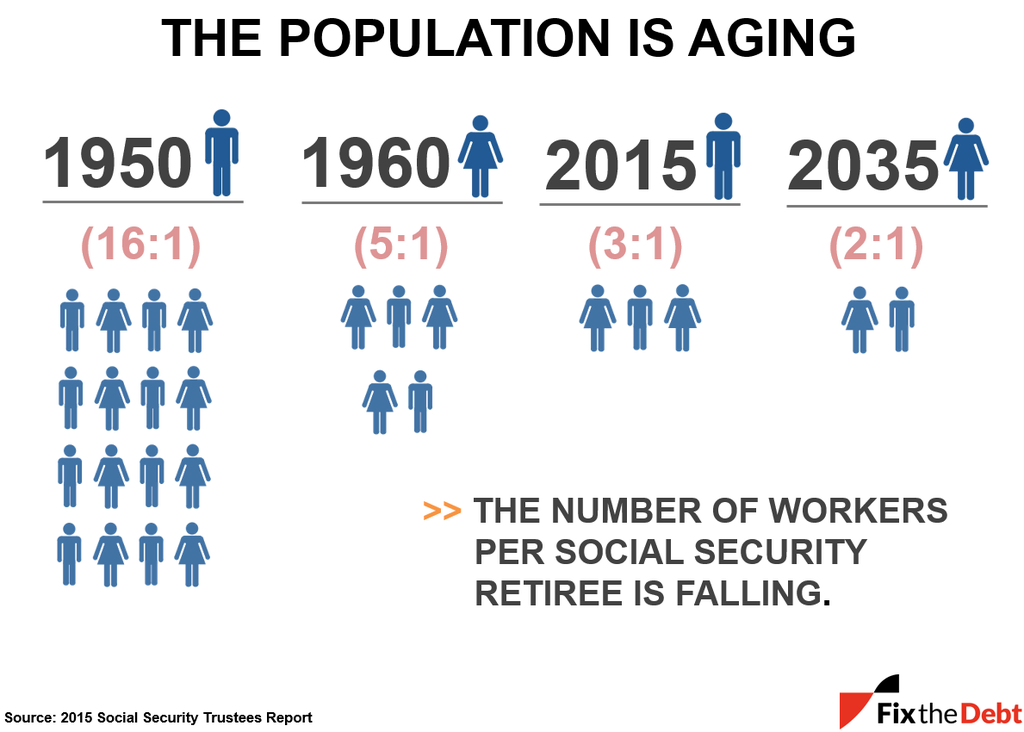

Governor Christie again claimed that Social Security will be insolvent in 7 to 8 years, however this is largely false because the Social Security Trustees estimate that the combined trust funds will be depleted by 2034 (in 19 years). Even the Harvard-Dartmouth study that Christie cites does not give a specific insolvency date. Senator Rand Paul was correct to say that the ratio of workers to Social Security beneficiaries has declined from 16:1 to 3:1. Senator Paul also correctly said that the average person pays $100,000 in lifetime Medicare taxes while receiving about $350,000 in benefits.

2. The Debt and Deficit

Several candidates have said that the debt is $19 trillion, which given that the debt is $18.15 trillion, this statement is largely true; Senator Paul also correctly identified that this roughly equates to borrowing a million dollars a minute.

Regarding the debt, Governor Kasich was right to say that the debt cannot be eliminated by cutting out only waste, fraud, and abuse, while both Governors Bush and Kasich correctly stated that we cannot grow our way out of debt. Governor Kasich was incorrect, however, when he said that a balanced budget amendment would fix the deficit problem by itself.

3. Tax Reform

Donald Trump claimed during the debate that his tax plan, which is expected to cost $10-$12 trillion dollars, won’t increase the deficit. This is largely false as a plan with that price tag would raise debt to 125% of GDP, up from today’s level 74%, and well above the projected level of 77% in 2025.

Ben Carson said that we couldn’t make a dent in the debt by taxing everything held by the top 1%, which is largely false. Increasing the top tax rate by 1 percent for those making over about $400,000 would raise $91 billion, and additional revenue could be gained by adjusting or eliminating the tax breaks that this constituency receives. These reforms and others of this type would certainly make a dent in the debt.

4. The Recent Budget Deal

Senator Paul claimed that the budget deal allows the President to borrow unlimited amounts of money, but this is largely false. Governor Huckabee also claimed that the budget deal takes $150 billion dollars from Social Security and spent it elsewhere, which is largely false.

* * * * *

Don't forget to follow us on Twitter at @FiscalFactCheck for updates. As the election season continues, we will using our Fiscal FactCheck page to examine the truthfulness of statements that the candidates make. If you believe we have omitted a particular statement that should be addressed, contact us and we will do our best to run the claim through Fiscal FactCheck.