The Fed's Effect on Deficits and Debt

As monetary policy watchers descend upon Jackson Hole, Wyoming, for the Federal Reserve Bank of Kansas City’s annual economic policy symposium, we wanted to show the impact of the Federal Reserve on U.S. debt and deficits. The Federal Reserve has a balance sheet of $4.5 trillion, which includes $2.5 trillion of the U.S. federal debt. The interest received on that debt is given back to the federal government, which partially obscures the annual deficit.

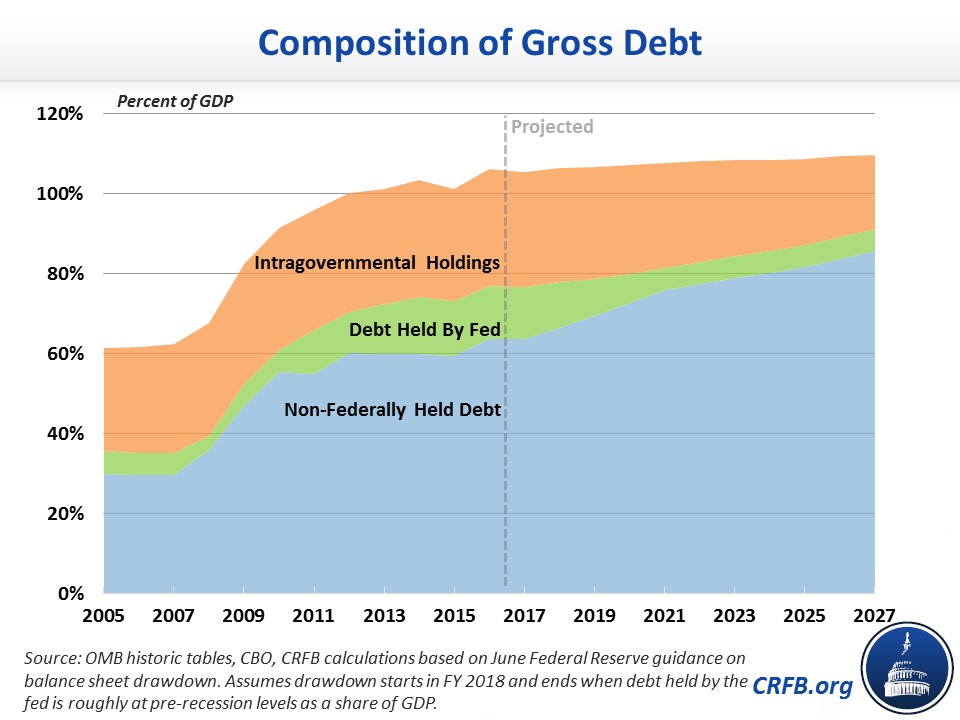

The Federal Reserve holds $2.5 trillion of U.S. Treasuries, which is roughly one-sixth of U.S. debt held by the public and one-eighth of the gross debt. The rest of the Federal Reserve's balance sheet contains other bonds and mortgage-backed securities bought as part of quantitative easing. The Federal Reserve currently plans to reduce its holdings of debt and other securities over time.

The assets held by the Federal Reserve generate interest; for instance, the federal government pays interest to the Federal Reserve on the Treasury bonds the Fed holds. Particularly after the Fed made large purchases as part of quantitative easing, its balance sheet (and income) grew, while its expenses stayed fairly constant. The Federal Reserve's expenses are largely the costs of maintaining its facilities and the budget of the Consumer Financial Protection Bureau.

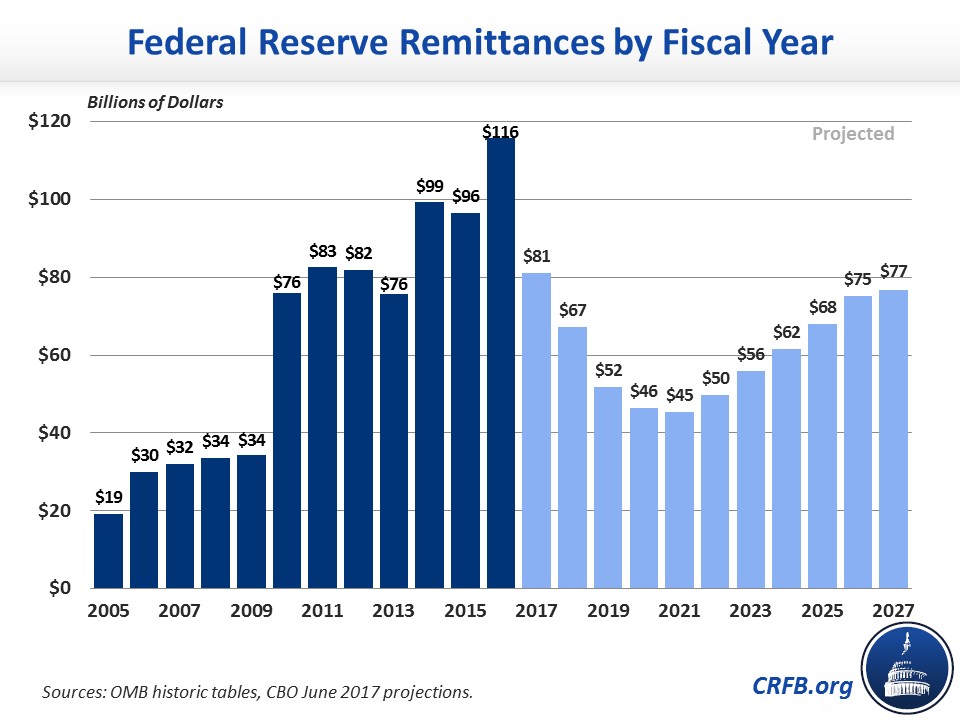

By law, the Federal Reserve returns its excess profits to the U.S. Treasury. In Fiscal Year (FY) 2016, the Federal Reserve remitted $116 billion to the Treasury, $19.3 billion of which was from the Fed having to draw down its capital account – a budget gimmick employed by the FAST Act. Remittances more than doubled between 2009 and 2010 as the Federal Reserve expanded its balance sheet.

Much of this profit was "earned" from the interest on holding U.S. Treasuries. Thus, the U.S. government is sending interest payments to the Federal Reserve, and the Federal Reserve sends the money back to the general fund as profits. This is a mostly temporary phenomenon lowering the short-term budget deficit. When the Federal Reserve starts unwinding quantitative easing by allowing a gradual decay of its holdings, its profits will decline.

The payments from the Federal Reserve due to its large balance sheet partially obscure the federal deficit. For instance, the FY 2016 budget deficit was $585 billion. Without remittance payments from the Federal Reserve, the deficit would have been $700 billion, or about one-fifth larger. If remittances had been closer to their pre-recession level, deficits would still have been about 15 percent larger.

The Federal Reserve’s profits are projected by the Congressional Budget Office to decline in the next several years as the Federal Reserve gradually reduces the size of its balance sheet. Later in the decade, profits will increase after the Federal Reserve finishes its balance sheet reductions and interest rates stabilize.

The Federal Reserve’s actions in response to the Great Recession have generally helped federal finances in recent years by helping keep interest rates low and increasing the Federal Reserve’s remittances to the Treasury. But as the central bank plans to unwind its balance sheet, the temporary effects that have been keeping deficits and interest rates low will come to an end. Lawmakers should prepare for less help from the Federal Reserve and act sooner rather than later to put the country on a more sustainable fiscal path.