As the Fed Meets, CRFB Quantifies Interest Rate Risk Facing the Budget

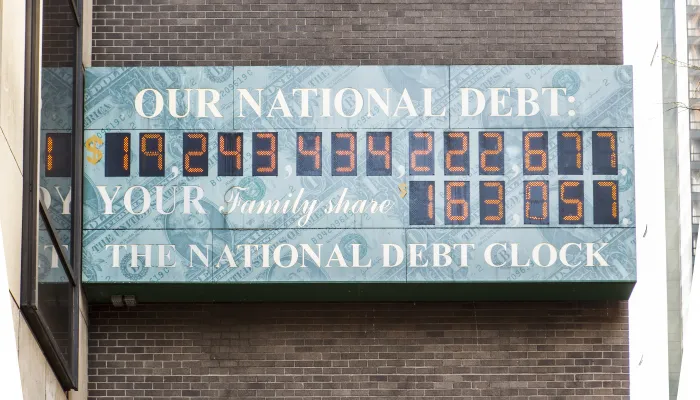

Beginning tomorrow, the Federal Open Market Committee, the Fed's interest rate setting and deliberative body that meets eight times a year -- will meet for two days to make decisions about the future path of U.S. monetary policy. In particular, many are looking to see whether the Fed will begin a "taper" and slow the rate of asset purchases, signaling the beginning of an unwind of the Fed's expanded balance sheet. Whatever the Fed decides is likely to have a significant impact on interest rates. Changes in interest rate then have substantial impacts of the federal budget and on debt projections going forward, the focus of CRFB's latest analysis: Interest Rate Risk and the U.S. Debt. With interest rates likely to return to historical levels at some point, it will significantly increase spending on interest on the debt. As debt rises, we risk further increases in interest rates that will put greater pressure on the budget. Ultimately, the best way to guard against interest rate risks is to put debt on a downward path to lessen the negative effect of interest rate increases.

We show that even under CBO's modest projected interest rates, interest spending will by far become the fastest growing part of the budget this decade and beyond as interest rates return to more normal levels and as the nation's stock of debt continues to grow. Under the CRFB Realistic Baseline, interest payments are projected to increase from 1.3 percent of GDP in 2013 to 3.1 percent by 2023 and 6.4 percent by 2050.

To put that in perspective, interest payments will exceed federal spending on all non-defense discretionary programs, food stamps, and federal retirement spending by 2025, and those programs plus defense spending by 2045. Interest payments will also roughly equal the size of Social Security in 2045. If the challenges posed by rising interest payments -- namely that they will reduce the resources available for other important priorities and will take years to bring under control -- is not reason enough for lawmakers to take action to control the debt, the risk that interest rates could rise even higher than projected should add further concern. Even small interest rate changes could have profound effect on the federal budget.

Source: Rough CRFB calculations based on CBO data

If interest rates were 1 percentage point higher than expected, debt would rise by $1.2 trillion over ten years – enough to wipe out all of the savings from sequestration. And as the table below shows, the impact higher interest rates would have is greater than what lower interest rates might save, in part due to the "zero bound" on interest rates.

Whereas interest rates can change quickly, even overnight, debt usually takes a long time to turn around. We have talked before of the importance of slowly phasing in policies to give households and businesses time to adjust, but that might not be an option if the country faces a unexpected interest rate increase. Furthermore, as the paper points out:

Not only do lower levels of debt reduce a country's risk of and exposure to changes in interest rates, but lower-debt economies have added fiscal flexibility to absorb unexpected increases in debt. For these reasons and more, it would be prudent for policymakers to enact further deficit reduction today to phase in gradually as the economy recovers and begin to bring debt levels down as a share of the economy.

There are clear benefits to being proactive and agreeing upon a comprehensive plan, and that remains the best way to protect against interest rate risk. Hopefully lawmakers can use the upcoming fiscal negotiations as an opportunity to do just that.

Click here to read the full report.