FAQ's About the New Framework From Simpson and Bowles

On Tuesday, former Fiscal Commission co-chairs Erskine Bowles and Alan Simpson released a framework that calls for an additional $2.4 trillion in deficit reduction over the next ten years. The proposal has been met with much support from commentators and media, and should further the conversation on debt and deficits as lawmakers move into the next round of budget negotiations. Bowles and Simpson will release more details about the framework in the coming weeks, but in the meantime they have addressed many questions and concerns that people might have about the proposal.

One point raised by some commentators was that Al Simpson and Erskine Bowles called for more deficit reduction than the original Fiscal Commission recommendations. But this isn't true. We addressed similiar claims in the past about the total savings called for by the Fiscal Commission plan; it depends on the budget window and baseline.

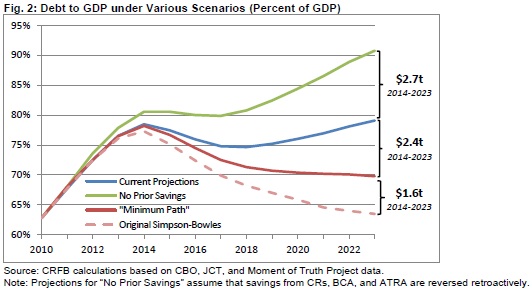

The baseline the Commission originally used has changed since 2010, most notably the 2001/2003/2010 tax cuts they assumed to expire for those making above $250,000/$200,000 (household/individual); by contrast, most budget negotiations used a full extension of the tax cuts as their baseline. In addition the budget window has shifted from 2011-2020 to 2014-2023 and due to dropping low savings years and replacing high savings years, the amount of deficit reduction is greater. While the plan was originally estimated to save $4 trillion through 2020 relative to the original baseline, it would now save about $6.5 trillion through 2023. The chart below from our recent report on a $2.4 trillion plan shows about $1.6 trillion less in savings than the original Fiscal Commission approach, with debt at a higher level in 2023.

Source: CRFB

Another common question was why this framework contained less revenue than the original Fiscal Commssion recommendations, asked by Derek Thompson and Ezra Klein among others. It's important note that the framework was not considered to be Simpson-Bowles 2.0, instead starting from where the fiscal cliff negotiations left off. Bowles explained further in an interview with Ezra Klein:

Ezra Klein: Your original plan asked for more than $2.5 trillion in taxes over the next decade. This plan asks for about half that. Why did your tax ask fall so far?

Erskine Bowles: A couple of reasons. The point was to start where the two sides were at the end and try to beef it up so that it would actually get debt down below 70 percent of GDP and keep it on a downward path. I think it is fair to say if you go back and look at what was said after we came out with the original Simpson-Bowles plan, the White House and the president hit us up pretty hard for two things. They said we had too much revenue and too much defense cuts. Remember that? If you wanted to do at that point in time at least $4 trillion in deficit reduction, that didn’t leave you many places to go.

We weren’t going to go after income support programs. In addition, as I look at the president’s final offer — it looked to me like if you dressed it up, it was around $1.4 trillion in revenue — if you look at what we’re doing here, and you look at our proposal for revenues in transportation, which you left out, then it’s not too different a number. And being far out front of the president on revenues wasn’t something I wanted to do again. And since I’d already been called back on defense, that only left the other areas.

The President of the AFL-CIO Richard Trumka issued a statement against the plan, saying that it "cuts tax rates for the richest Americans and corporations and pays for these lower tax rates by cutting Social Security COLAs, taxing health benefits, and cutting federal employees’ health and retirement benefits." But the new proposal from Simpson and Bowles says nothing of cutting the tax liability for the richest Americans. In fact, it calls for $600 billion in revenue from tax reform and specifically states that it should be done in a way that at least maintains, if not increases, the progressivity of the tax code. Tax expenditures are skewed toward the wealthy, and there are many proposals that could raise revenue from limiting the value of tax expenditures for wealthier taxpayers or otherwise reform the tax code in a progressive way. Trumka's statement also mischaracterizes the framework goals in its health care reforms. From the Moment of Truth Project:

On the health side, we’re calling for reductions in provider payments, reforms to cost-sharing rules, increases in premiums for higher earners, savings from lower drug costs, and adjustments to account for an aging population. Most importantly, we will be focused on the type of cost-bending reforms that realign incentives so that quality – no quantity – drives health care decision making.

The Heritage Foundation questions the need for additional revenue, given the revenue raised in the American Taxpayer Relief Act. But the negotiations to avert the fiscal cliff show that more revenue will be needed in a bipartisan compromise. Even Speaker Boehner was willing to put more revenue on the table in December than was raised by ATRA. From MOT's Q&A:

Speaker Boehner’s opening offer had more revenue than what we ultimately enacted on a bipartisan basis on New Years. We agree that the primary focus needs to be on entitlement reforms, and our proposal recommends aggressive entitlement reforms along with additional spending cuts. But we do not believe it will be possible to achieve the amount of savings necessary to put the debt on a downward path entirely on the spending side without jeopardizing our goals of protecting vulnerable populations and preserving funding for key investments.

Including additional revenues will also be necessary to reach bipartisan agreement on a plan to reform entitlements, and it represents the best chance for comprehensive tax reform. We have no interest in raising tax rates again; we want to lower them. There is so much wasteful spending in the tax code that there is room to lower those rates and reduce the deficit at the same time.

Of course, many other questions can also be answered by looking at the full report on the framework. The details may change in the coming weeks, as Simpson and Bowles recieve feedback from various policymakers, but it is a good step in shifting the conversation toward what we need to do next. Lawmakers need to go back to what was on the table in December, and then go a bit further if we are going to be able to put the debt on a sustainable path.

Click here to read answers to FAQ's from the Moment of Truth Project and here for the full interview from Ezra Klein.