Factchecking the Senate Budget Committee Hearing with CBO

At least two claims in Wednesday's Senate Budget Committee hearing with Congressional Budget Office (CBO) Director Keith Hall merit fact checking.

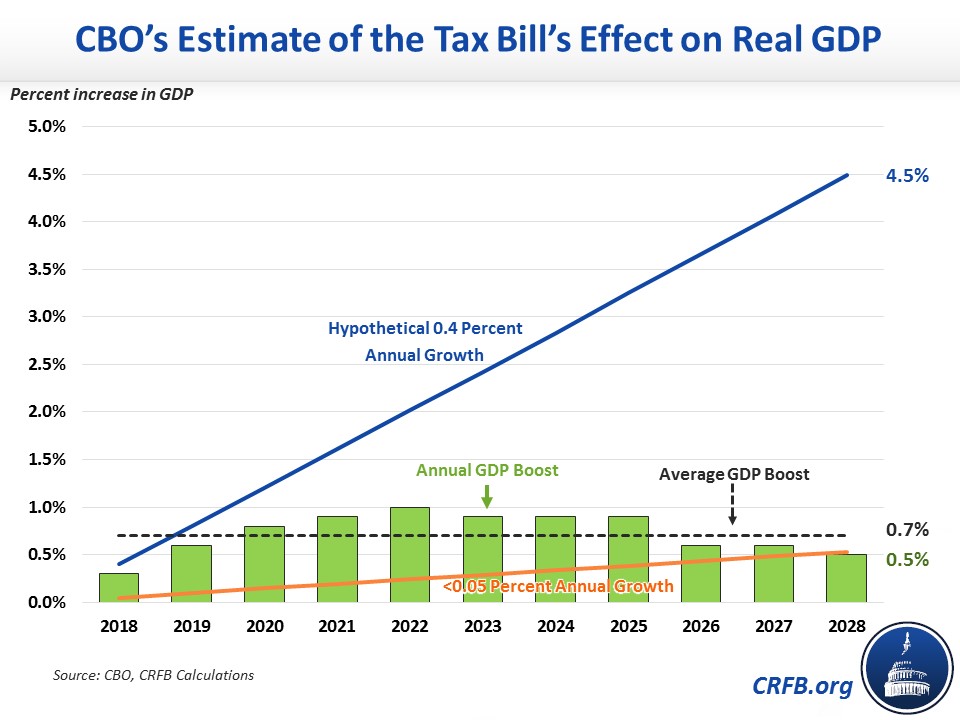

First, one Senator suggested that CBO's latest projections show the 2017 tax bill will do more to grow the economy than advocates had claimed. This statement is false. Tax reform advocates had claimed the bill could improve Gross Domestic Product (GDP) growth by 0.4 percent per year over the next decade. CBO estimates it will increase the average level of GDP by 0.7 percent and only improve the annual growth rate by close to 0.05 percent – a small fraction of what was claimed.

Second, another Senator claimed the recent spending deal would ultimately add about the same amount to the debt as the 2017 tax cuts, if both were extended. This claim is true. If the Bipartisan Budget Act of 2018 and the 2017 tax bill are both extended in the manner assumed in CBO's Alternative Fiscal Scenario, they will both end up costing between $2 trillion and $3 trillion through 2028, including interest.

Below, we explain both claims in more detail.

- Is growth exceeding the hopes of tax cut advocates?

- Are the tax and spending bills roughly the same size if extended?

Is growth exceeding the hopes of tax cut advocates?

In response to learning of CBO's estimate that the 2017 tax bill would boost average GDP by 0.7 percent over a decade, Senate Budget Committee Chairman Mike Enzi (R-WY) proclaimed "we were hoping for 0.4 so 0.7 is good news” – suggesting that CBO's estimate significantly exceeded the hopes (and claims) of many who supported the tax bill.

However, this comment confuses a change in growth rate with a change in level of GDP. Advocates of tax reform claimed it could produce a 0.4 percentage point increase in the annual growth rate "per year, on average, for ten years," whereas Hall was communicating CBO's estimate of the "average boost to GDP over the ten-year period."

A 0.4 percentage point increase in the growth rate would imply a 4.5 percent boost to the economy by 2028. CBO, by contrast, estimates the economy will be only 0.5 percent larger by then as a result of the tax bill. In other words, CBO estimates the average growth rate will only be about 0.05 percentage points higher as a result of the tax bill. Because this growth is not linear, CBO estimates that on average – in a given year – the economy will be about 0.7 percent larger than it otherwise would be.

To be sure, this 0.05 percentage point increase in average growth is higher than the Joint Committee on Taxation's initial estimate of 0.01 to 0.02 percentage points. But it is nowhere close to the 0.4 percentage points advocates claimed, let alone 0.7 percentage points.

Ruling: False

Are the tax and spending bills roughly the same size if extended?

Much of the discussion at the hearing focused on the cost of the recently enacted tax bill. Senator Bob Corker (R-TN) asked if – when extended – the recent budget deal would add about the same order of magnitude to the debt as the tax bill (Corker cited a prior CRFB analysis suggesting it could cost $2.1 trillion through 2027).

While Director Hall appeared to misunderstand the question and thus suggested the spending bill was significantly cheaper, the reality is that both pieces of legislation could end up being almost equally costly.

One important caveat – the 2017 tax legislation itself added significantly more to the debt. Based on CBO's estimate, the spending bill would cost about $435 billion through 2028 (including interest), while the tax bill will cost $1.9 trillion. However, this difference is not due to the magnitude of the changes, but rather the fact that the spending bill was a two-year bill (the tax bill mostly continues for eight years before expiring).

Corker referenced the "current policy" cost of the two bills – the full cost if each is extended beyond its expirations. Using CBO's definition of such extensions, the tax bill could ultimately lead to $2.7 trillion of additional debt through 2028, while the spending bill could lead to $2.4 trillion. Both cost about $2 trillion before interest.

The tax bill would add more to debt. The actual difference may yet be larger because only the tax bill is scored dynamically and because a different definition of current policy other than CBO's Alternative Fiscal Scenario could be more costly to extend.

But if extended, both pieces of legislation will cost similar amounts, at least in order of magnitude, under any approach.

| Bill That Was Passed | If Extended | Total | |

|---|---|---|---|

| December tax bill | $1.27 trillion | $770 billion | $2.05 trillion |

| Debt Service | $580 billion | $40 billion | $620 billion |

| Total, December tax bill | $1.9 trillion | $810 billion | $2.7 trillion |

| Bipartisan Budget Act of 2018 | $320 billion* | $1.70 trillion | $2.02 trillion |

| Debt service | $115 billion | $250 billion | $350 billion |

| Total, Bipartisan Budget Act of 2018 | $435 billion | $1.95 trillion | $2.4 trillion |

Source: CBO estimates of the Bipartisan Budget Act of 2018 and April baseline projections. Tax bill reflects increased economic growth; no such estimate was provided for the spending bill. Figures rounded to the nearest $5 billion. With debt service, the tax bill is more expensive, but part of that effect is the inclusion of economic growth effects: faster economic growth raises interest rates and increases debt service for existing debt as well as new debt added because of the tax bill.

*Bipartisan Budget Act of 2018 primary savings scored through 2027, although nearly all costs took place in the short term.

Hall's answer to Corker appears to have been based on a misunderstanding of the question. Rather than describing the cost of the spending bill if extended, Hall discussed the total increase in CBO's current law discretionary baseline. That increase – which is approximately $650 billion through 2027 – is the sum of the discretionary portions of the budget deal as well as baseline changes due to higher disaster spending and lower overseas contingency spending relative to the prior baseline (for uncapped spending, CBO assumes current year levels continue to increase with inflation).

While Hall correctly identified the $650 billion increase in projected discretionary costs resulting from recent legislation, Corker was correct that if extended the recent budget deal will cost over $2 trillion and add roughly as much to the debt as the tax bill.

Taken together, these two pieces of legislation significantly worsened an already unsustainable fiscal situation.

Ruling: Largely True