Event Recap: Challenges Facing Social Security

Update: The video has now been posted.

Today, the Committee for a Responsible Federal Budget, the Mercatus Center, and Third Way held an event entitled "Challenges Facing Social Security," discussing the future of the program given the latest Trustees' report. The event featured Social Security Trustee Charles Blahous and a panel discussion moderated by CNNMoney writer Jeanne Sahadi.

Blahous started the event by breaking down the latest Trustees' report and the pressures on Social Security's financing in the future. He noted that the combined old-age and disability portions of the program were projected to go insolvent by 2033, at which point benefits would be cut by 23 percent. He then described the three factors that were driving the shortfall: demographics, growth in per-capita benefits, and pay-as-you-go financing. These three issues interact to create the financing problem that Social Security is facing. The aging of the population both increases beneficiaries and decreases the amount of workers paying into the system to finance their benefits, a fact exacerbated by the lack of a linkage between the retirement ages and life expectancy. The growth in per-capita benefits built into the system's benefit calculation also puts upward pressure on program cost. And pay-as-you-go financing enables more "excess" benefits than one in which contributions are specifically put away and saved for retirement.

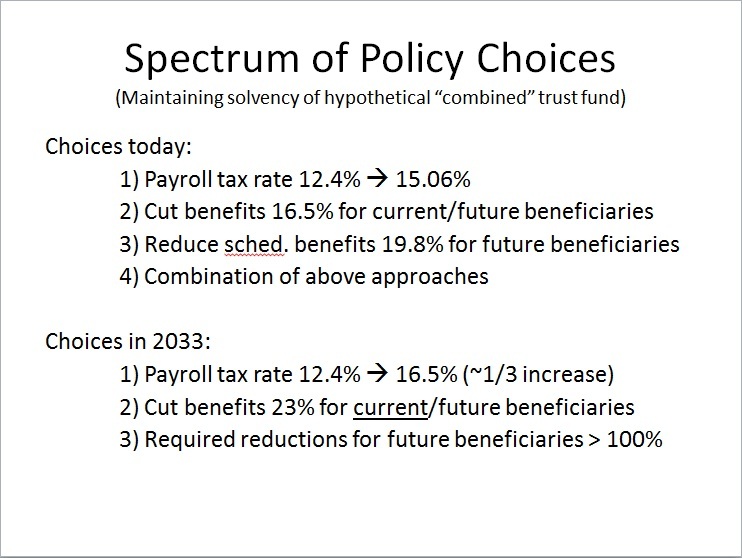

Blahous used the Trustees' numbers to lay out the choices we face. In order to keep the system solvent over 75 years, lawmakers would either need to raise the payroll tax rate from 12.4 percent to 15.06 percent or cut benefits by 16.5 percent immediately. If they exempted current beneficiaries from cuts, the cut would rise to nearly 20 percent. Blahous noted that a combination of the two approaches was, of course, possible.

These numbers only get worse when looking at what would need to happen if we wait until 2033 when the trust fund becomes insolvent. In that case, the payroll tax rate would have to rise by nearly one-third (16.5 percent) and benefits would have to be cut by 23 percent. Since the trust fund would become insolvent immediately, it would be impossible to exempt current beneficiaries from cuts in order to keep the trust fund from being exhausted -- the required cut in that case would be greater than 100 percent.

Click here to see full presentation.

Blahous then broke the numbers down by each component of the program. While the disability insurance portion faces insolvency sooner -- its trust fund will run out in 2016 -- the old-age portion has a larger shortfall, both in absolute terms and in relation to the size of the component's revenue. For the old-age program, the shortfall will reach nearly 40 percent of dedicated revenue by the end of the 75-year projection period. Blahous also noted that the shortfall Social Security faces is much bigger than it was when reforms were made in 1983, particularly in the relative near term.

After Blahous's remarks, he joined a panel discussion with Third Way's Jim Kessler, the National Academy for Social Insurance's Virginia Reno, and The Can Kicks Back's Nick Troiano. The three made opening remarks before the question and answer session began.

Kessler emphasized the long-term fiscal sustainability of Social Security and expressed concern that increased spending on programs for the elderly -- and more broadly on consumption in the federal budget -- would crowd out investment programs like education. Troiano echoed this point from a Millennial's perspective, noting that investments for younger people in the budget had been less prioritized with the continued rise in entitlement spending. He also said it was important to ensure the long-term solvency of Social Security so that it would be secure for people his age or younger. Reno made the case that Social Security benefits were modest and a bedrock for the retirement security of most Americans. She also pointed out that in polling, majorities of those polled had favored fixing Social Security through tax increases and even included select benefit increases.

The panelists differed on some topics, particularly on the chained CPI. Both Blahous and Kessler supported using the measure for cost-of-living adjustments since it was a more accurate measure of inflation. Reno argued that for Social Security, it would make more sense to use the CPI-E, an experimental price index for the elderly, to better capture the purchasing habits of Social Security beneficiaries. Blahous responded that a significant portion of the program's beneficiaries are not elderly and also argued that having a specific price index for a subset of beneficiaries was a poor precedent to set.

Overall, the event was very lively and informative, featuring diverse perspectives on the program and an informed discussion of its future. It also prominently featured "The Reformer," a new CRFB interactive tool which allows users to make their own Social Security reform plan.

To view CRFB's Social Security Trustees' report paper, click here.

To play "The Reformer: An Interactive Tool to Fix Social Security," click here.

To view Charles Blahous's PowerPoint presentation from the event, click here.

To read Third Way's paper "It’s Time for a National Commission on Social Security," click here.

To read Virginia Reno's paper, click here.