Drivers of Spending Growth in the Long Term

The Congressional Budget Office’s (CBO) latest Long-Term Budget Outlook projects that federal debt held by the public will exceed the size of the economy by 2033 and reach 150 percent of Gross Domestic Product (GDP) by 2047. This dramatic growth in debt is the result of large and growing deficits. With an aging population, rising interest rates, and growing health care costs, federal spending will increase much faster than revenue.

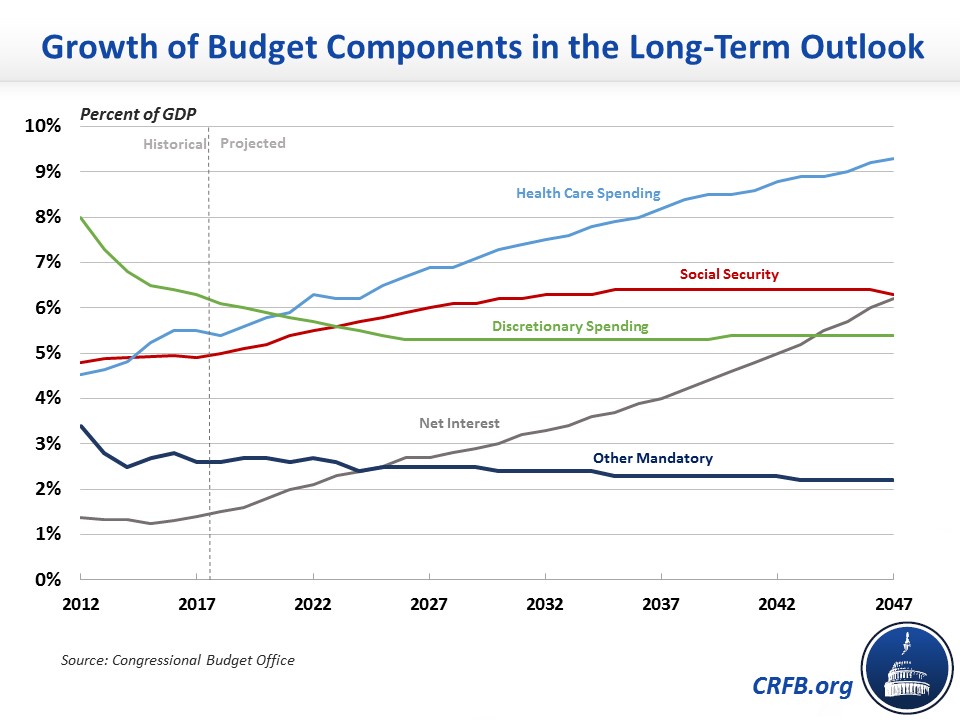

Spending is projected to grow from 20.7 percent of GDP in 2017 to 29.4 percent in 2047, while revenue is estimated to grow from 17.8 percent of GDP to 19.6 percent over the same period. The rapid rise in total spending is driven by growing Social Security, health care, and interest costs. In nominal dollars, total spending will grow by about $14 trillion in the next three decades, with Social Security, health care, and interest on the debt accounting for about 80 percent of that spending growth. In contrast, discretionary spending – which includes defense, education, and infrastructure – accounts for just 15 percent of spending growth.

As a share of the economy, Social Security, health care, and interest on the debt are responsible for more than all the total spending growth – rising from 11.8 to 21.8 percent of GDP, while discretionary and other mandatory spending will fall as a share of GDP, from 8.9 to 7.6 percent.

Currently, defense and non-defense discretionary spending combine to be the largest total category of spending. But according to CBO, total health care spending will exceed discretionary by 2021, Social Security spending will surpass it by 2024, and net interest spending will be higher than discretionary spending by 2044. As a result, Social Security, health care, and interest costs will make up almost three-quarters of the budget by 2047.

Net interest spending represents the fastest growing area of the budget. CBO projects interest costs as a share of the economy will double by 2028 and more than quadruple after three decades. It will exceed discretionary defense spending by 2027, all non-health non-Social Security mandatory spending by 2026, Medicare spending by 2047, and it will likely exceed total spending on Social Security by around 2050.

Of course, rising interest costs are largely a symptom of rising debt levels, which themselves are mainly driven by the growth of Social Security and federal health spending.

The rise in spending on these two areas is driven entirely by the aging of the population and rising per-person health care cost growth. Overall, “excess cost growth” in health care – the amount by which per person health spending exceeds per person economic growth – is responsible for about 45 percent of projected entitlement spending growth over the next three decades, while population aging is responsible for about 55 percent.

Rising Social Security, health care, and debt service costs are major contributors to the unsustainable fiscal situation. Policymakers need to address these sources of spending growth to prevent federal debt from reaching record levels and federal spending on other areas like defense, infrastructure, and education from being crowded out. Luckily, numerous options exist for controlling the cost of these programs, and we encourage them to act sooner rather than later.