Drivers of the Debt: Aging in the Medium Term, Health Costs Over the Long Term

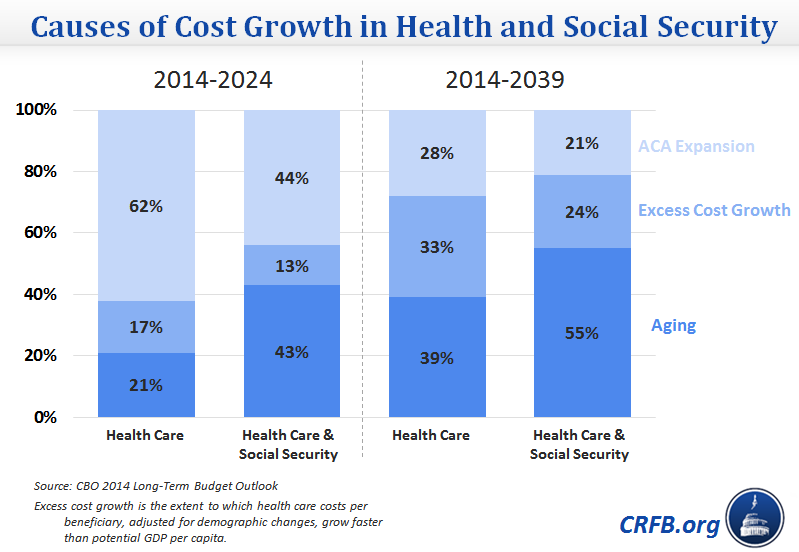

The recent CBO Long-Term Budget Outlook confirmed that our long-term debt problems remain far from solved, with debt projected to exceed the size of the economy within 25 years. Federal spending, especially the mandatory portion of the budget, will continue to outpace revenue collected, running up debt and interest payments on that debt. Spending on Social Security and health care programs will grow by almost half from 9.8 percent of GDP today to 14.3 percent of GDP by 2039. Two factors are reponsible for major portions of the increase in mandatory spending: an aging population and "excess cost growth," when health care costs are growing faster than the rest of the economy.

Of the 4.5 percent increase in the major entitlement programs over the next 25 years, about one-fifth – 0.9 percentage points – comes from the gross cost of the coverage expansions in the Affordable Care Act. Of the remaining 3.6 percent of GDP increase, 70 percent is projected to be the result of population aging, and about 30 percent will come from excess health care cost growth.

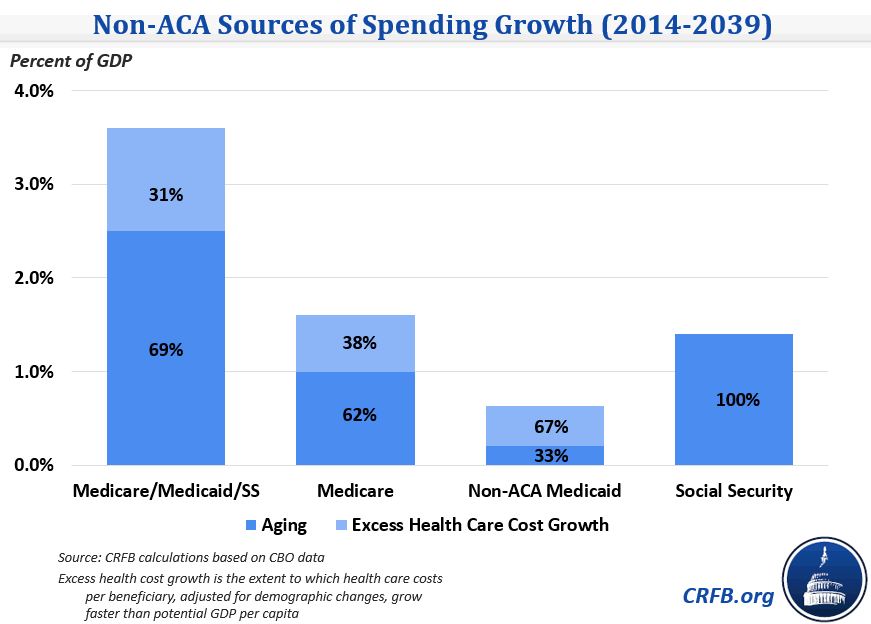

Population aging will have a substantial effect on entitlement spending over the next quarter century, as the baby boom generation retires, and life expectancy continues to grow. It is of course the driving factor in the growth of projected Social Security payments from 4.9 percent of GDP this year to 6.3 percent of GDP in 2039. But it also accounts for a little over half of the growth of Medicare and non-ACA Medicaid over the same time period. This is true both because more individuals will become eligible for those programs, and because an older Medicare/Medicaid population will likely mean higher per beneficiary costs.

Meanwhile, excess cost growth is projected to play a significant role in the rise of Medicare and Medicaid. According to CBO’s projections, per beneficiary costs in those programs will exceed GDP by about 1 percent on average over the next quarter century. Between 2014 and 2039, by our calculations, about two-fifths of Medicare growth will be the result of excess cost growth, and more than one-tenth would be the result of an aging Medicare population leading to higher average health costs. For Medicaid, the ratios are reversed: two-thirds of the increase can be explained by excess cost growth with the rest coming from aging.

After 2039, however, the ACA will have been fully phased in for decades, and "the age profile of the population is expected to change less rapidly," according to CBO. At that point, excess cost growth would become the primary driver of debt. As we pointed out last week, "controlling health care cost growth over the long term remains arguably the most critical challenge facing the federal budget." Its importance would only increase once aging slows down.

Understanding the drivers of debt is important for lawmakers to understand. As our graphs show, both aging and health care cost growth will play a significant role in the growth of spending and debt over the long term. Ultimately, policymakers will need to address these sources of growth in mandatory spending, compensate for them with other program changes, and/or raise revenue. Luckily, numerous options exist to put debt on a downward path.