Discussing the Uncertainty of Long-Term Budget Projections

An old saying goes, "Nothing is certain but death and taxes." But in budget projections, neither of those things -- mortality rates nor revenue levels -- nor a host of other economic and technical variables can be predicted with perfect precision. This simple fact has led many commentators to question the usefulness of long-term forecasts that go out as far as 75 years, but also prompted suggestions about how to reduce uncertainty or at least tailor policies to account for it. On Monday, the Brookings Institution's Hutchins Center on Fiscal and Monetary Policy released three working papers and held an event shedding light on both of these questions.

The first paper "The Economics and Politics of Long-Term Budget Projections" by Brookings Senior Fellow Henry Aaron discussed the usefulness of various long-term projections. He argued that 75-year projections for the overall budget -- performed by CBO -- and for Medicare -- performed by their Trustees -- are not all that helpful and should be limited to 25 years. He argued that requiring 75-year numbers forces forecasters to make unrealistic assumptions or otherwise make arbitrary determinations about very uncertain variables like health care cost growth. He did see a use in 75-year projections for Social Security because of lawmakers' tendency to make very gradual benefit cuts, so that lengthy projection period is necessary to fully measure the financial impact of legislation and see how much of a shortfall they have to close.

While Aaron suggested that long-term projections other than Social Security are not useful, University of California, Berkeley's Alan Auerbach takes the opposite conclusion: the uncertainty makes it all the more important to reduce deficits since things could be worse.

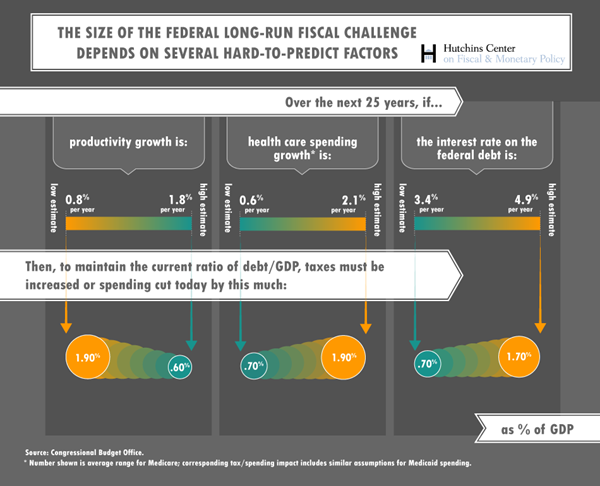

His paper entitled "Fiscal Uncertainty and How to Deal With It" started by acknowledging the many different changes in economic variables that can affect the budget. Of course, the uncertainty also compounds the longer projections go for, as more variables factor in and the chance of error increases. But he did not see this as a reason to disregard the projections all together.

Source: Brookings Institution

His central solution to uncertainty was "precautionary saving," or reducing debt significantly to accommodate adverse changes in budget projections (CBO also mentioned this as a way to reduce uncertainty). He argued that as individuals and businesses set more money aside when faced with uncertainty, so should government. He found it far more preferable to have the government save more than necessary than to have it ignore long-term projections due to their uncertainty and have to scramble to make it up later. In other words, uncertainty about budget projections provided a greater impetus to reduce deficits and debt, not less. We completely agree on this point and raised the issue when it was mentioned by CBO in their long-term outlook.

The paper "In Good Times and Bad: Designing Legislation That Responds to Fiscal Uncertainty" from New York University's David Kamin showed automatic adjustments that lawmakers could set to address the uncertainty about long-term projections without going as far as requiring precautionary savings. He discussed these in the context of "policy drift," or when government policies do not respond to changes in circumstances. The four tools he focused on are delegation of legislative authority (like the Independent Payment Advisory Board), triggers to change policy or force action, expirations (or "cliffs"), and indexing policies to changes in conditions.

Kamin recommended three different types of adjustments. The first was an expanded use of triggers for countercyclical policy in a recession, like tying higher infrastructure spending to state unemployment rates. The second was the use of automatic benefit and tax adjustments to Social Security to maintain solvency in the context of a deal that targeted 75-year solvency. Finally, he suggested linking Medicare payroll tax or income tax rates to health care cost growth so that revenue would rise to match accelerated health care growth. Overall, Kamin argued that automatic-adjustment triggers, which change policy as conditions warrant, are more attractive than other kinds of adjustment tools in putting government policy back on track.

The event included presentations by the papers' authors and subsequent panel discussions. It also included presentations by CBO Director Douglas Elmendorf and Robert Chote, Chairman of the Office for Budget Responsibility (OBR), the United Kingdom's newly-created CBO equivalent. Their talks revealed a number of similarities but also some differences in how the two agencies present uncertainty. Chote's OBR seemed to place a greater emphasis on uncertainty, which he attributed to the government having an explicit target of cyclically-adjusted budget balance five years out. Thus, policymakers were interested not just in the central estimate of budget deficits/surpluses but also in the probability they would achieve their goal; OBR's presentation of their budget forecast reflects that. OBR also pointed out the degree of uncertainty in scores of legislation by assigning an uncertainty rating based on the quality of data available, their modeling capabilities on the particular subject, and the degree of uncertainty about behavioral responses.

Source: OBR

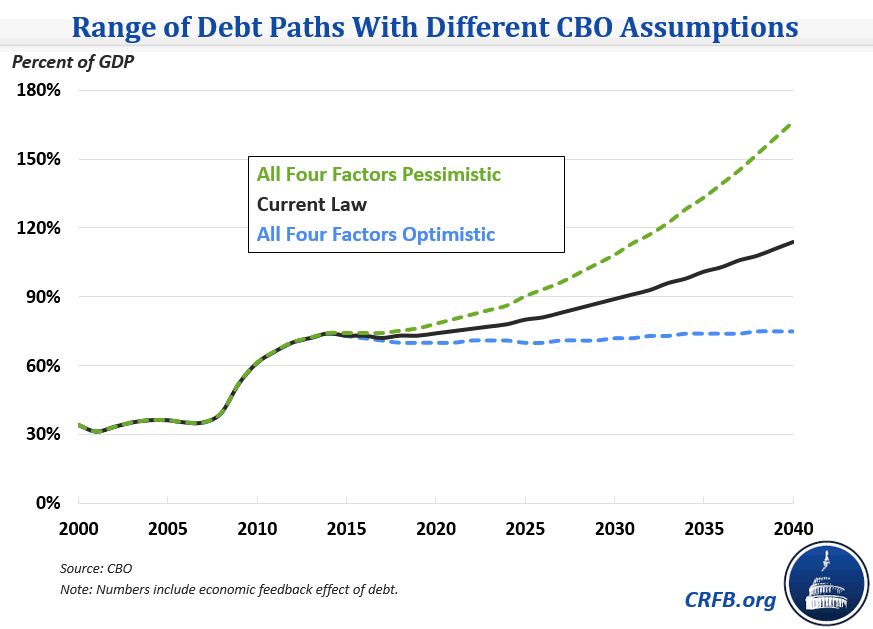

Elmendorf was perhaps less bullish on presenting ranges in CBO data. He noted many reasons why CBO provides point estimates in many instances rather than ranges: legislative requirements, a limited ability of some of their models to estimate uncertainty, limited information on certain topics, and a lack of time. He also pointed out that in certain instances, providing ranges could allow for lawmakers to cherry-pick the data that best supported their view. Nonetheless, he listed many instances where CBO has provided ranges or sensitivity analyses: macroeconomic effects of fiscal policy or policy changes like increasing the minimum wage, the effect of changes in economic variables on the ten-year outlook, and the effect of changes in economic or demographic variables on long-term debt. CBO, like OBR, also frequently takes a look at how its economic forecasts have erred in the past.

The papers and event were a lengthy but informative discussion of how to deal with uncertain long-term forecasts. It is a topic that will continue to come up because uncertainty provides a convenient excuse to focus on the relatively stable near-term picture and the wishful possibility of a protracted health care slowdown rather than the large rise in debt that current long-term projections show. We agree with Auerbach that it is better to be proactive and plan for projections to be as bad as or possibly worse than they are now to avoid having to make sudden cuts later. And there is some use in making the budget more responsive to changing circumstances. There is plenty that lawmakers can do to make the future budget picture less uncertain, but they can start by working on policies that put our debt on a sustainable downward path.