The Danger of a Fiscal Cliff Dive

As the President, Congress, business, labor, and other civic leaders meet this week to discuss a "Grand Bargain" on the fiscal cliff and our unsustainable fiscal path, some commentators have been advising their sides not to compromise. In fact, a group of "fiscal cliff divers" have suggested that it may be best to first go over the cliff and then use the additional leverage to secure an agreement. After all, they argue that the U.S. would not go into a recession immediately after January 1, and some policies might not have an impact for months.

However, going over the fiscal cliff would send a strong signal to the public and the markets that Washington would rather risk the health of the US economy and play political games than come together on a agreement even if the intent was to negotiate afterwards. As Wonkblog's Neil Irwin explains:

Markets don’t like risk. And for the world’s largest economy to adopt a yo-yo approach to fiscal policy — steep tax increases and spending cuts one month, a reversal the next — would be an extra layer of risk for already jittery markets. A falling stock market hammers both households’ wealth and confidence and businesses’ willingness to invest.

Who knows if a few weeks of austerity would cause a recession or merely a soft patch in growth. But with unemployment at 7.9 percent, neither is particularly welcome.

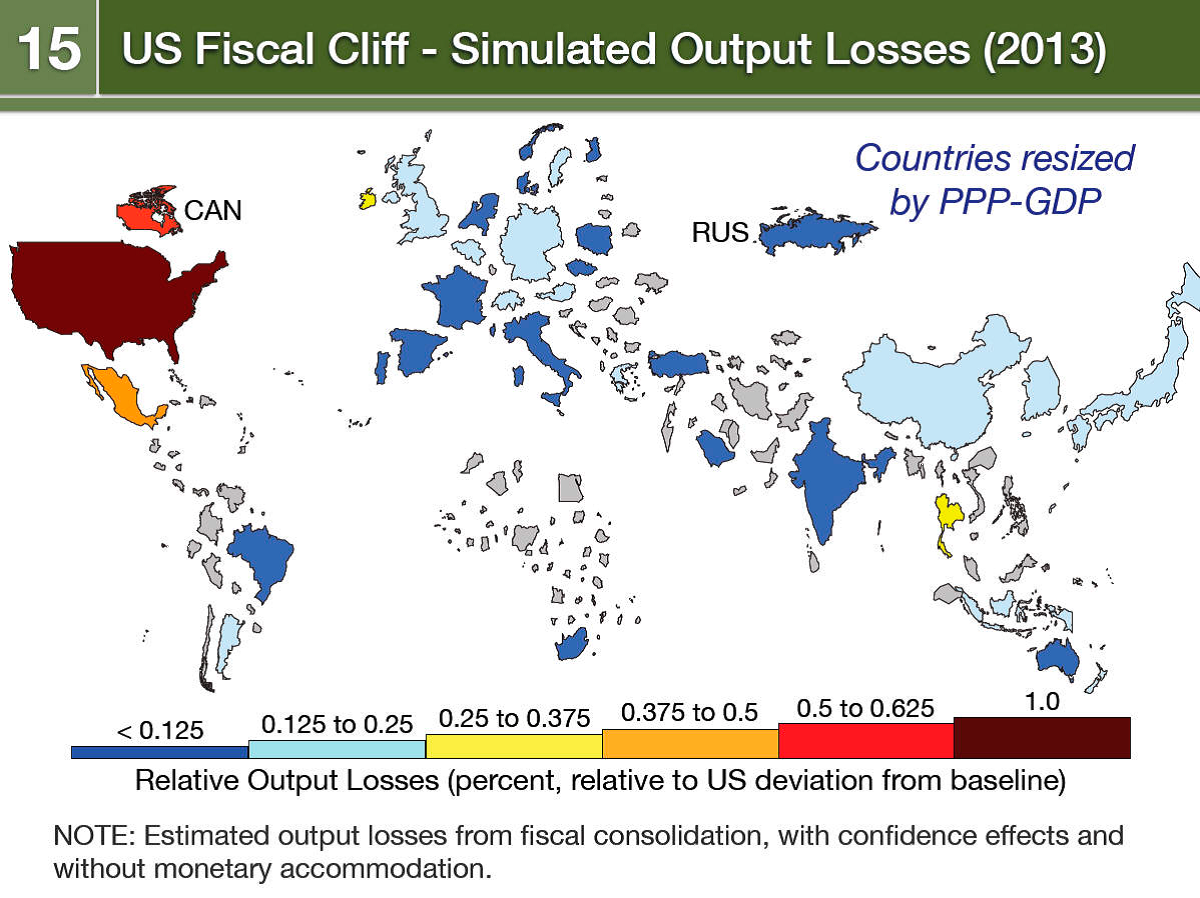

Ultimately, the economic effect may be much larger than just the domestic consequences--there could also be a great impact among major trading partners. Menzie Chinn notes that in a weak global economic climate, the fiscal cliff could have a large contagion effect. Should the U.S. business climate turn south, the effect may spread to other weak economies particularly with our major trading partners in Europe, China, Canada, and Mexico. The IMF released a simulation of the global effect should the U.S. go off the fiscal cliff, shown below. The chart shows the multiplier effect of US output loss in other countries.

Coming to an agreement that both sides can support will be difficult, which is why many have proposed enacting a framework that would waive the fiscal cliff temporarily while giving lawmakers enough time to reach a deal. But threatening to dive over the cliff as a means for political leverage is reckless and won't help us resolve our economic problems.