CTJ's Options for Raising Revenue

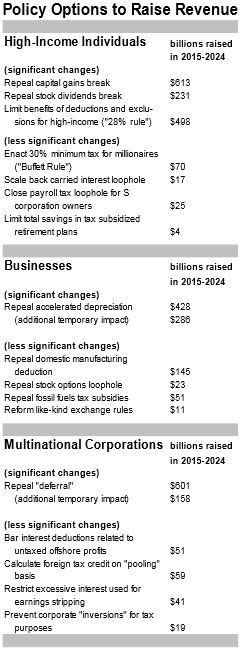

Citizens for Tax Justice released a new report detailing options to raise revenue, which could help lawmakers in their pursuit of tax reform to lower the debt. The revenue-raisers in the report are divided into three categories – those that raise money from high-income individuals, businesses, and multinational corporations. Within those categories, the report distinguishes between options that would only be considered in the context of tax reform and less significant changes that could be enacted on their own. Finally, the report helpfully separates the permanent and temporary impacts for provisions that raise greater revenue upfront.

For high-income individuals, the report includes many options that have been part of the tax debate in recent years, including repealing preferential rates for capital gains and dividends, limiting the value of tax deductions to 28 percent (below the current top value of 39.6 percent), and enacting the "Buffett Rule." Smaller options include closing the carried interest loophole and eliminating the reasonsable compensation (or John Edwards/Newt Gingrich) loophole.

For businesses, the one significant change is the repeal of accelerated depreciation. Since the policy would lengthen the period of time that businesses would take deductions for investments, getting rid of it increases tax payments now and reduces them later, meaning that some of the resulting revenue would be temporary. By CTJ's estimate, 40 percent of the policy's revenue would dissipate over time. It is important to separate out these temporary costs in tax reform. Otherwise, policymakers may offset the permanent cost of a corporate rate cut with temporary revenue, making the long-term deficit situation worse. Other smaller changes for businesses include repealing the domestic manufacturing deduction and closing the stock option loophole.

The report also provided a number of options for changing international taxation for U.S. multinational corporations. Currently, non-financial income earned abroad is generally only taxed when it is repatriated to the U.S. CTJ's main international change would eliminate deferral of taxation on income kept, which would end the incentive for companies to keep income abroad. However, this policy would be incongruous with how most other developed countries treat their multinationals. Smaller options are also taken from the President's budget, including limiting interest expense deductions and restricting inversions.

CTJ's report is a good contribution to the tax debate, providing updated estimates for many options that raise significant amounts of revenue from high-earners and businesses.