CRFB Releases Analysis of CBO's February Baseline

CBO's release of its annual Budget and Economic Outlook is a treasure trove of information, sometimes not easily digestible.

To help put all that information in a more accessible form, CRFB released a brief 6 page analysis of CBO's new economic and budget projections, which are first official look at future budget projections in light of the fiscal cliff deal and other developments.

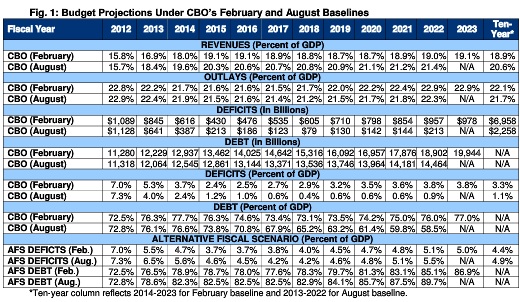

The biggest change in the current law baseline comes from revenue, a result of the full extension of the 2001/2003/2010 tax cuts and the Alternative Minimum Tax patches. Revenues will now average only 18.9 percent of GDP over the next ten years, instead of the previously projected 20.6 percent. CBO is now saying that over the following ten years, spending will average 22.1 percent of GDP, compared to 21.7 percent last August. CBO's current law deficit numbers are significantly worse than in the August projections, totaling $7 trillion (3.3 percent of GDP) over ten years, and they now have debt as a percentage of GDP on an upward path at the end of the new ten year window of 2014-2023. It will now rise from under 73 percent in 2012 to 77 percent by 2023.

CBO's Alternative Fiscal Scenario, which already had most of the parts of the fiscal cliff deal included in its baseline, shows slight improvement, mostly due to the expiration of some of the tax cuts for higher income households. Deficits will fall from 7 percent of GDP in 2012, but they will not fall below 3.7 percent, meaning that debt will rise as a share of GDP in the latter part of the projection window. Ultimately, AFS projections show debt reaching 85 percent in 2022, compared to 90 percent in the previous projections.

Source: CBO

Our paper goes into much more detail over the projections that CBO has put together, including the many changes that have occurred since the August projections. The main takeaway from all of these numbers is that there is still much work to be done in controlling future debt. As we say in the paper:

Ideally, lawmakers should replace the sequester with an intelligent and gradual deficit reduction plan that controlled the debt over the long-term. Doing so would result in both short and long-term economic gains, and could avoid painful and disruptive austerity later. Lawmakers cannot continue to put off dealing with the nation’s fiscal challenges. With several budget “speed bumps” approaching in the coming weeks and months, lawmakers will have ample opportunities to forge a bipartisan deficit reduction plan.

Click here to read the paper.