CRFB Breaks Down the Newest CBO Budget Projections

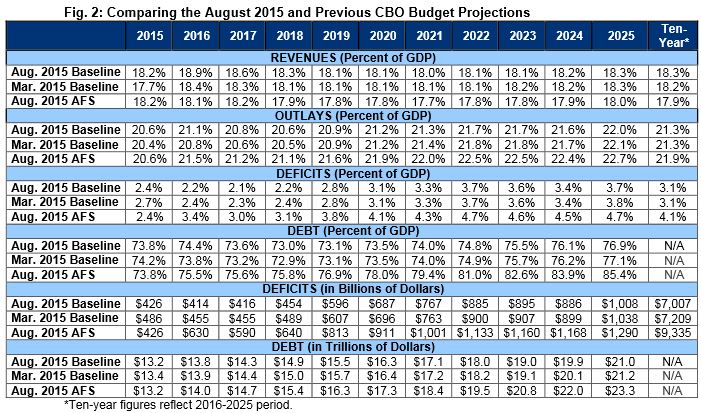

CRFB has released its analysis of CBO's latest ten-year budget projections, detailing the important facts from the report and how it has changed from previous estimates. As we noted earlier, the new baseline is very similar to the previous one released in March, showing a relatively subdued outlook for debt in the short term but growing deficits and debt for several years thereafter.

Click here to read our analysis.

Debt is projected to decline slightly in the near term from 74 percent of GDP in 2015 to 73 percent by 2018 before rising to 77 percent by 2025. Extrapolating further, we estimate that debt held by the public would exceed the size of the economy by 2040.

There is a similar story for deficits, which will fall to a low of 2.1 percent of GDP in 2017 before rising to 3.1 percent in 2020 and 3.7 percent in 2025, when the deficit will reach $1 trillion. These widening deficits in later years are the result of spending rising – driven by increases in health care, Social Security, and interest spending – while revenue stays largely flat.

The budget outlook is similar to the last projections from March, but deficits fell by $262 billion through 2025 as a result of changes to the economic forecast (more on that below). Most notably, lower interest rates reduced interest spending by $332 billion through 2025. Other changes include lower Social Security spending from lower inflation, increased revenue from income and payroll taxes as well as Federal Reserve remittances, and $135 billion of lower spending spread across several programs. Offsetting these changes are $165 billion of higher deficits from legislative changes, mostly the April physician payment law, and $342 billion of higher deficits from technical changes in estimating methodology.

CBO has also updated its economic outlook for the first time since January, taking into account several important developments since then. It has revised down its 2015 economic growth projection, owing to the slower growth seen in the first half of the year, but has revised up economic growth in the four years after that, bolstered by consumer spending. The agency has also lowered its short-term inflation projections as to incorporate more of the drop in oil prices. It has also revised down projected unemployment and interest rates throughout the ten-year period, which is beneficial for the budget outlook.

Overall, the budget picture remains about the same as CBO projected it before: stable in the short term but growing deficits and debt in the medium term and beyond. Thus, it remains a sign that lawmakers should take the steps to rein in the long-term debt before it becomes much more difficult.

Click here to read our analysis.