The Costs of Senator Mike Lee's Tax Reform

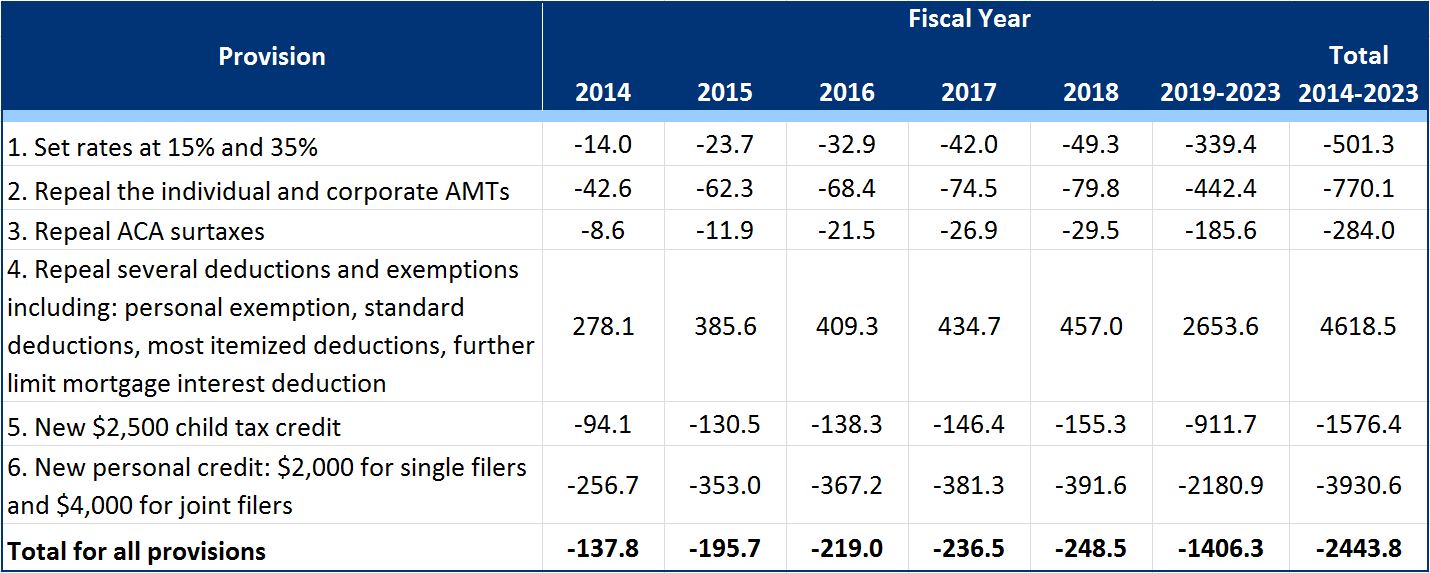

On Tuesday, the Tax Policy Center (TPC) released an estimate of Senator Mike Lee's Family Fairness and Opportunity Tax Reform Act. We first described the proposal last year, but did not know the plan's impact on the budget, aside from Senator Lee's expectation that it would represent a slight reduction in revenues. TPC's new estimate illuminates the true costs of his proposal: the proposal would cost $2.4 trillion over the next ten years (2014-2023).

Senator Lee's plan calls for substantially increasing the child tax credit, consolidating the tax schedule to just two rates of 15% and 35%, and repealing Affordable Care Act surtaxes. As the table below shows, there are considerable costs associated with these provisions. The Act partially offsets these costs with the elimination of many credits and deductions not related to children (with the exception of a reduced mortgage interest deduction and expanded charitable giving deduction). The savings would provide large tax credits for families. TPC estimates the reform would raise taxes for 12% of households, while lowering taxes for a majority of Americans. High income households with married couples and children would benefit most from the plan.

Revenue Effects of Lee Proposal (billions of dollars)

Source: Urban-Brookings Tax Policy Center

Acknowledging the high costs of the plan in its current form, TPC offers a suggestion for reforming the Act to achieve revenue neutrality:

The Lee proposal could maintain its general framework and become revenue neutral if its statutory tax rates were raised, the tax credits were scaled back, or the tax base were broadened more aggressively. For example, the Tax Policy Center estimates that the proposal would be approximately revenue neutral if the 35 percent tax bracket started at a taxable income of $50,000 for singles and $100,000 for married filers–substantially lower than the proposed $87,850 for singles and $175,500 for married filers.

While these changes could make the proposal revenue-neutral, many more taxpayers would face tax increases relative to current law. We applaud efforts to reform the nation's tax code, however as it currently stands, the Family Fairness and Opportunity Act would add substantially to our national debt.