Congressional Progressive Caucus Releases Alternative to House Budget

The Congressional Progressive Caucus (CPC) released their “People’s Budget,” an alternative to the House budget released last week. The budget offers a more liberal alternative than that proposed by the President and puts debt on a downward path. Major changes in the People’s Budget include dramatic increases in infrastructure and education spending, and a wide range of tax increases focused on high earners.

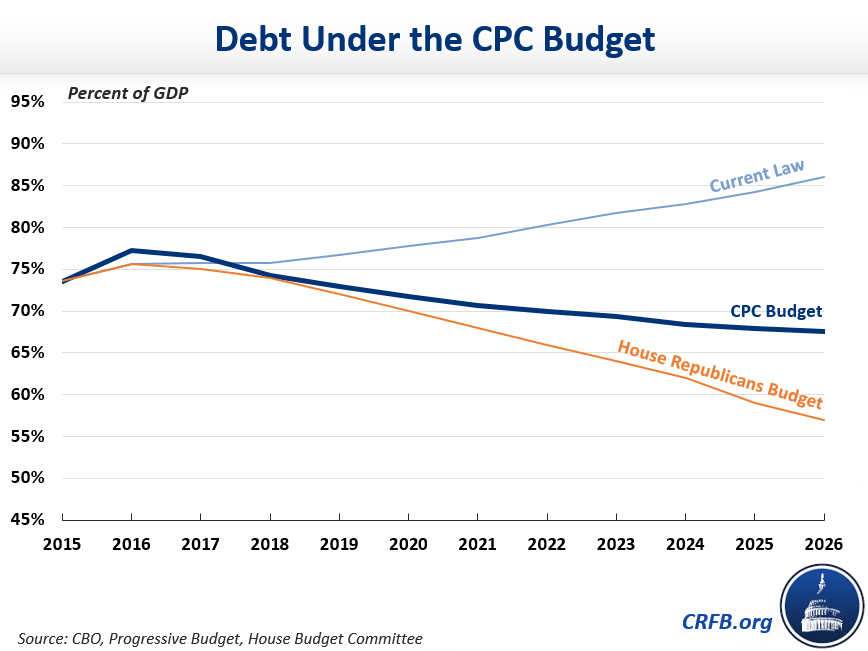

The CPC's budget proposes both higher taxes and higher spending in most areas. It calls for $9.2 trillion of gross savings and $5 trillion in investments and other costs over ten years, resulting in $5.1 trillion of deficit reduction over the next decade, including interest savings. This deficit reduction would put debt on a downward path from 77 percent of Gross Domestic Product (GDP) in 2016 to 68 percent of GDP in 2026. By contrast, the Congressional Budget Office (CBO) baseline projects that debt will rise to 86 percent by 2026.

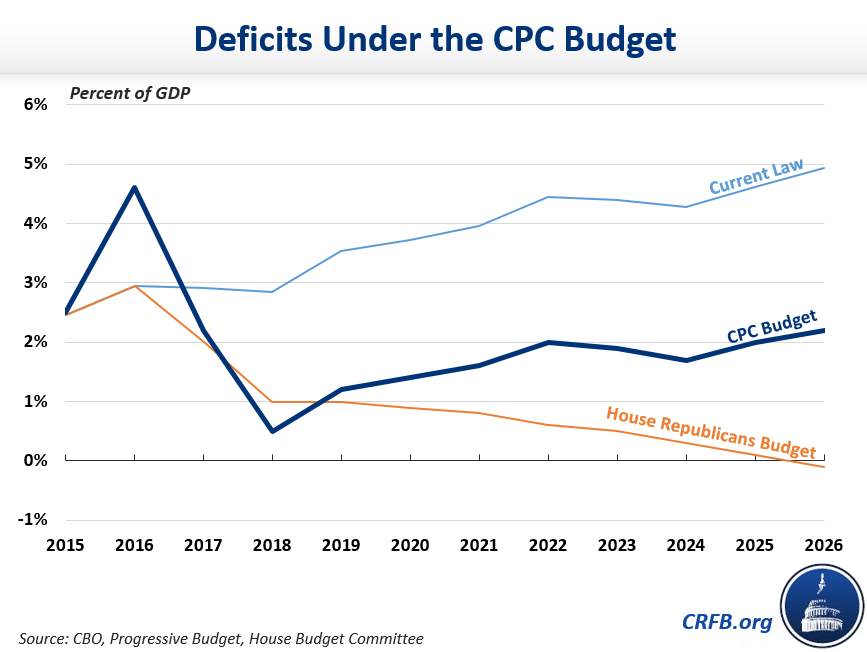

Under the People’s Budget, revenues would rise from 18.2 percent of GDP in 2015 to 22.3 percent by 2026, the latter number being about 4 percent of GDP higher than under current law. Outlays would increase from 20.7 percent of GDP in 2015 to reach 24.5 percent in 2026, or about 2 percent of GDP percent higher than under current law. Because of significant short-term stimulus, the 2016 deficit would shoot up to 4.6 percent of GDP, about 2 percent of GDP higher than current law. After that, deficits fall to a low of 0.5 percent of GDP in 2017 and end up at about 2 percent of GDP at the end of the ten-year period, well below the 4.9 percent deficit CBO expects. Deficits would be slightly increasing at the end of the ten-year window.

The budget includes sizeable spending increases in areas like infrastructure ($1.2 trillion through 2026) and higher education ($412 billion through 2026), with additional temporary stimulus going to a public works program ($114 billion), extended unemployment benefits ($33 billion), and funding to states ($30 billion). In addition, the plan would repeal both the sequester and the original spending caps on non-defense spending, returning this category to its historical average as a percentage of GDP by 2021. On the tax side, it would create a temporary refundable tax credit modeled after the Making Work Pay credit and would increase the Earned Income Tax Credit for childless workers.

The budget raises revenue by significantly changing tax rates. For very high earners, the budget raises top rates from 39.6 percent to a range of 45 and 49 percent for incomes over $1 million and over $1 billion, respectively, and taxes capital gains and dividends as ordinary income. It lowers the estate tax exemption to $2.5 million with rates between 55 and 65 percent and eliminates step-up basis for capital gains at death. The budget also includes the President’s $10.25 per barrel tax on oil to eliminate the Highway Trust Fund shortfall, a carbon tax, a financial transactions tax, and would move to a worldwide tax system where all foreign-earned income of U.S. businesses is taxed in the year it is earned. Though the budget proposes substantial tax increases, it appears to be overestimating the revenue that could be gained for a few of the policies, particularly eliminating step-up basis (which the Office of Management and Budget estimates would raise much less, though the rate in the Progressive Budget is higher) and the financial transactions tax (which the Tax Policy Center estimates would max out around $75 billion per year).

The plan also makes some health care changes. The budget would accelerate the use of bundled payments and repeal the Cadillac tax and replace it with a public option in the health exchanges. The budget also gives the Department of Health and Human Services authority to negotiate prescription drug costs in Medicare Part D – apparently using the President’s Medicare drug rebate for savings since negotiation itself would save little – and would prohibit "pay-for-delay" agreements that delay the release of generic drugs.

| Major Proposals in CPC Budget | |

| Policy | 2016-2026 Savings/Costs (-) |

| Deficit Reduction Proposals | |

| Increases tax rates on income above $250K (inc. capital gains/dividends) | $1,553 billion |

| Enact carbon tax and repeal fossil fuel tax preferences | $1,456 billion |

| Repeal step-up basis and institute estate tax reform | $1,056 billion |

| Implement financial transactions and financial institution taxes | $1,035 billion |

| Enact worldwide taxation system | $983 billion |

| Cap the value of itemized deductions at 28% | $646 billion |

| Enact public option and prescription drug savings | $394 billion |

| Enact $10.25 per barrel oil tax | $319 billion |

| Close John Edwards/Newt Gingrich loophole | $272 billion |

| Enact immigration reform | $216 billion |

| Reduce defense spending | $164 billion |

| Other policies | $532 billion |

| Interest savings | $576 billion |

| Subtotal, Deficit Reduction | $9.2 trillion |

| New Investment Proposals/Other Costs | |

| Repeal sequester and spending caps | -$888 billion |

| Further increase non-defense spending | -$1,549 billion |

| Increase infrastructure spending | -$1,247 billion |

| Refinance student loans and other college cost proposals | -$412 billion |

| Enact temporary stimulus measures | -$252 billion |

| Enact or expand tax credits | -$115 billion |

| Repeal Cadillac tax | -$103 billion |

| Other investment proposals/costs | -$383 billion |

| Subtotal, New Investments | -$5 trillion |

| Subtotal, Policy Savings | $4.3 trillion |

| Draw down war spending starting in 2017* | $873 billion |

| Total Savings | $5.1 trillion |

Source: Congressional Progressive Caucus

Note: Totals may not add due to rounding.

*Includes interest savings

The budget certainly contains a lot of tax and spending increases, but we welcome budget alternatives and appreciate that the budget puts debt on a downward path. Lawmakers should keep this focus on deficit reduction throughout this year's budget debate.