Comparing the Unpaid-For Tax Cut Extensions

The Senate is set to vote in the coming days on dueling one-year extensions of the 2001/2003/2010 tax cuts and Alternative Minimum Tax patch, with neither likely to go anywhere for now. Nonetheless, the Tax Policy Center has provided a helpful analysis of both plans in terms of both the distribution of tax cuts and a detailed breakdown of the Joint Committee on Taxation revenue estimates.

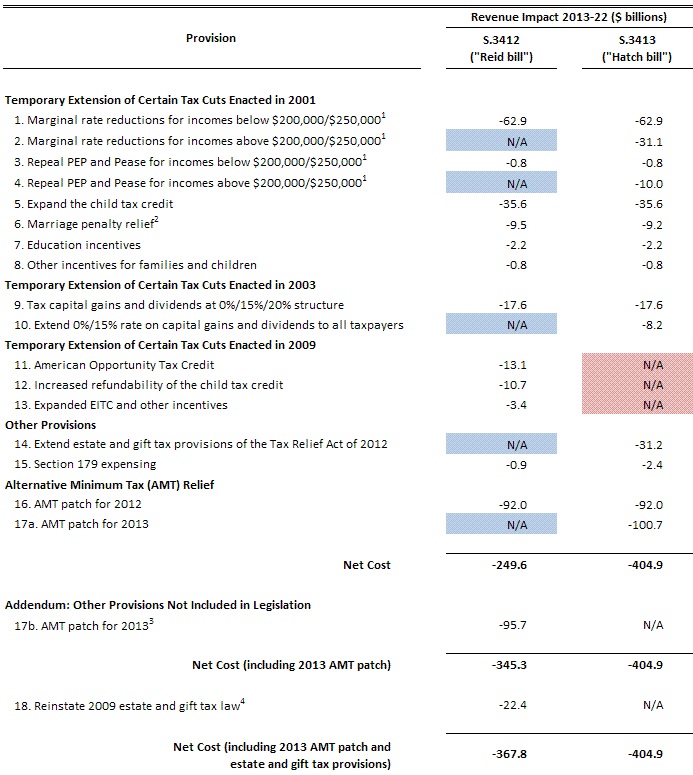

The breakdown is very helpful, showing side-by-side the cost of many of the provisions of each bill. On a comparable basis, the Republicans' plan costs about $40 billion more than the Democrats' plan ($405 billion vs. $368 billion), the differences stemming from extensions of the upper-income tax cuts, refundable tax credit expansions, and the estate tax parameters for next year.

Source: Tax Policy Center via JCT

The distributional tables show the distribution of the tax cuts for each proposal by income quintile. As expected, everyone gets a tax cut relative to current law, although the distribution differs and the narrative changes if you talk about a "tax-cuts-extended" current policy baseline.

Not surprisingly, the analysis shows that both of these plans would add hundreds of billions to the deficit -- and that is just a one-year extension. Most of the debate so far has focused on the differences between the two bills, but maybe they should devote more of their energy towards finding ways to offset these proposals. Better yet, our elected leaders could begin negotiating a way to replace the fiscal cliff with smarter and more gradual debt reduction.