Comparing the Reconciliation Instructions in the Congressional Budgets

With news that the Senate Budget Committee has agreed to reconciliation instructions for a $1.5 trillion tax cut, policymakers seem poised to accelerate the unsustainable rise of our national debt. Instead of allowing for massive increases in debt, a more responsible (though still insufficient) approach would be to work from the House budget resolution, which calls for at least $203 billion of reconciliation savings spread out across 11 committees.

With the important caveat that the House and Senate rely on different scoring methods, a comparison of the two shows the rumored Senate instructions would be as much as $2 trillion worse for the debt than the House ones.

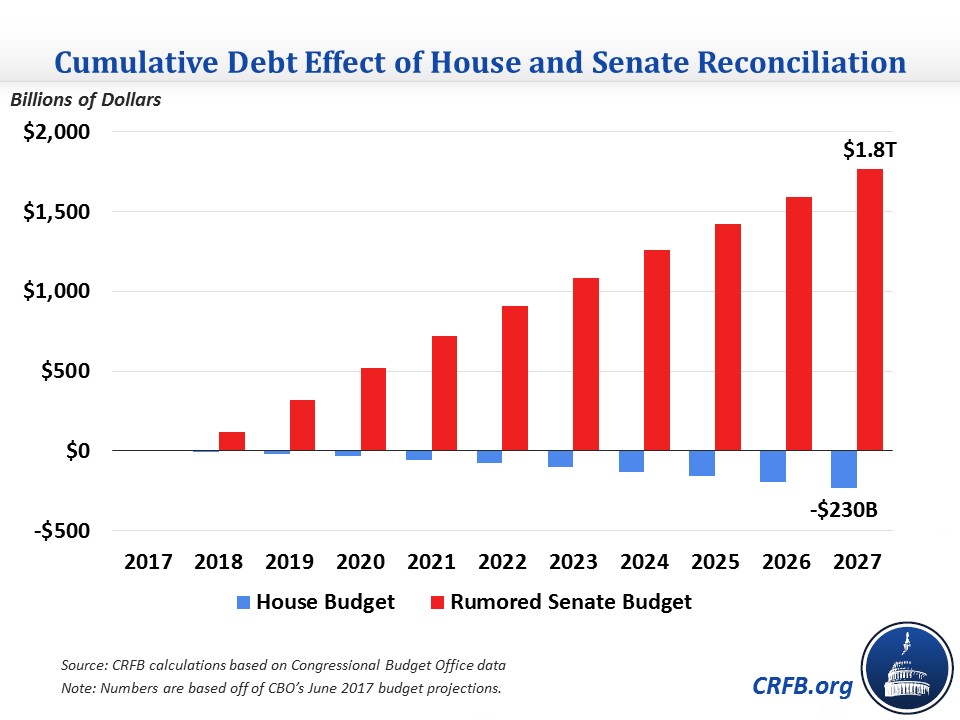

If the reconciliation bills exactly hit the targets laid out and don't incorporate dynamic effects (which would likely be small or negative with a $1.5 trillion tax cut), The House instructions would reduce debt by about $230 billion (including interest) over ten years, while the Senate instructions would increase debt by about $1.8 trillion.

As we previously showed, the Senate instructions would result in debt held by the public equaling the size of the economy by 2028, compared to 92 percent of GDP under the House instructions.

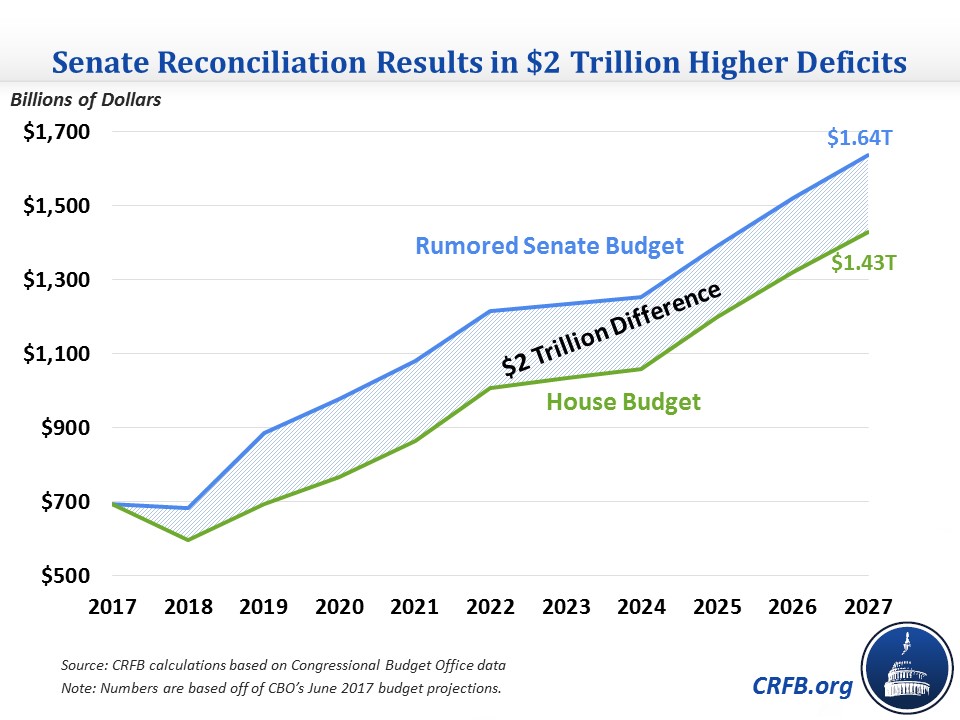

In terms of borrowing, deficits are projected to increase from $693 billion in 2017 to $1.46 trillion by 2027 under current law. Assuming reasonable phase-in paths, deficits under the House reconciliation proposal would reach about $1.43 trillion in 2027. Under the Senate proposal, the 2027 deficit would further increase to about $1.64 trillion. Over ten years, that means about $2 trillion in additional borrowing under the Senate reconciliation proposal.

To be sure, the House budget does not go far enough to prevent the rise in debt projected in the coming years – our mini-bargain would be a better (though again incomplete) approach. But the House approach of saving over $200 billion is much preferable to adding another $1.8 trillion to the debt as the rumored Senate budget might do. The budget conference should ensure that any instructions for tax reform are at a minimum deficit-neutral and include as much deficit reduction as possible. The federal government already needs trillions of dollars in budgetary savings just to stabilize the debt at its current high levels. Certainly, we can’t afford to make the debt worse.