CBPP Takes a Look at the President's Chained CPI Proposal

Previously on The Bottom Line, we have shown how the chained CPI could be a 6 percent benefit cut or a 25 percent benefit increase, depending on how you measure it, and we have looked at the low-income and old-age protections in the President's budget.

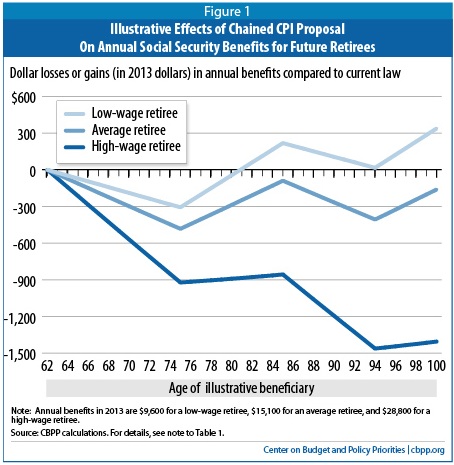

The Center on Budget and Policy Priorities today analyzed the effects of the President's chained CPI proposal on Social Security benefits in particular, finding that the average benefit cut relative to current law would be one percent. For old-age beneficiaries , the President's budget would have a bump-up in benefits for people reaching age 76 equal to 5 percent of the average benefit, phased in over ten years, with a second bump-up at age 95.

CBPP summarizes their findings as follows:

- Future beneficiaries receiving an average benefit would experience a benefit reduction averaging 1 percent to 2 percent over the course of their retirement. The benefit reduction would average 1.1 percent if they draw benefits through age 71, 1.8 percent if they draw benefits through age 81 (which is more common), and 1.6 percent if they draw benefits through age 91.

- For future beneficiaries receiving smaller-than-average benefits, the reduction would be smaller, likely in the 0.5 percent to 1.5 percent range — except for beneficiaries poor enough to qualify also for Supplemental Security Income (SSI), who would be held harmless.

- For future beneficiaries receiving higher-than-average benefits, the reduction would be larger, averaging 2 percent or slightly more.

One clear takeaway is that having an old-age benefit bump-up combined with the chained CPI makes the change progressive overall, blunting the impact much more for lower-income beneficiaries (or at least those that receive smaller benefits). CBPP explains why:

The special benefit increase (or "bump") would provide more help to seniors and people with disabilities who receive smaller-than-average Social Security benefits. All eligible retirees and disability beneficiaries would receive the same basic dollar increase, so those with smaller benefits would receive a larger percentage increase.

In addition, since the proposal calls for the chained CPI to take effect in 2015 and the 5-percent benefit adjustment to begin to take effect in 2020 (and to be phased in through 2029), people who are 69 or older today would begin to receive the 5-percent benefit increase after being subject to the chained CPI for only five years.

The graph below from CBPP's analysis makes this point clear. For an illustrative low-wage retiree, benefits are equal to or higher than current law from about age 80 on. An average retiree would have their benefits return close to current law levels after the first bump-up fully phases in. The bump-up, though, would make less of a difference for the high-wage retiree.

Source: CBPP

Note that this analysis assumes that the low-wage retiree is not on Supplemental Security Income (SSI), which the President exempts from the chained CPI. As a result, those on SSI would face no benefit change since their benefit change in Social Security would be fully offset by SSI.

CBPP's analysis shows that adjustments like the old-age benefit bump-up are a much more targeted way to protect vulnerable beneficiaries than to continue overstating inflation for all beneficiaries.