CBO's Updated Economic and Budget Outlook

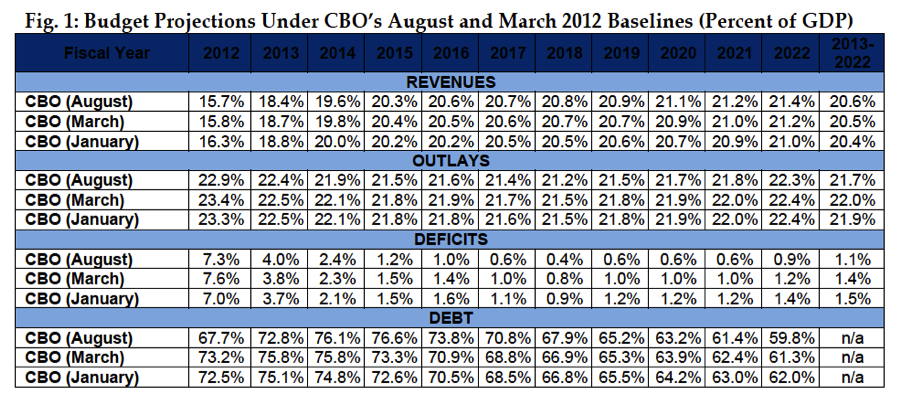

CRFB has just released a new analysis of CBO's updated Budget and Economic Outlook. The CBO updates its baseline every year in January, March, and August to account for changes in its forcasting of the Current Law and Alternate Fiscal Scenario (AFS) baselines. Below is the current law projection for each baseline that CBO has produced this year.

While much of the revisions in the projections were due to economic and technical reasons, CBO's baseline has also been affected by changes in policy. The Supreme Court ruling in particular had the effect of lowering the projected deficits by $78 billion over the 2013-2022 window. The ruling determined that the federal government could (as assumed in the March baseline). While this ruling lowers projected Medicaid spending by $288 billion due to less individuals being eligable, it also increases the projected spending on the insurance subsidies and exchanges by $164 billion and lowers tax revenues by $46 billion. Other adjustments to health spending include slowing growth rates for Medicare and Medicaid. Legislative revisions were $22 billion, the majority of which was due from Moving Ahead for Progress in the 21st Century Act, which reformed premiums paid to the Pension Benefit Guaranty Corporation for defined benefit pension plans.

| Changes From CBO's March Budget and Economic Outlook (in Billions) | |

| 2013-2022 | |

| March Projected Deficit | $2,887 |

| Legislative Changes | -$18 |

| Changes Resulting From Supreme Court Ruling | -$78 |

| Economic and Technical Health Care Revisions | -$35 |

| Economic and Technical Revenue Changes | -$205 |

| Economic and Technical Changes to Other Spending | $60 |

| Interest Changes | -$353 |

| Total Changes | -$629 |

| August Projected Deficit | $2,258 |

Source: CBO

Just as in March, the fiscal cliff is expected to have a damaging effect on the economy. Should the cliff happen, deficits would fall dramatically in the first part of the next decade falling from $1.13 trillion in 2012 to a low of $79 billion in 2018 before slowly rising again to $213 bllion by 2022. However, economic output would greatly contract in the first two quarters of 2013, by 3.9 percent and 1.9 percent respectively, with growth for the year totaling -0.3 percent.

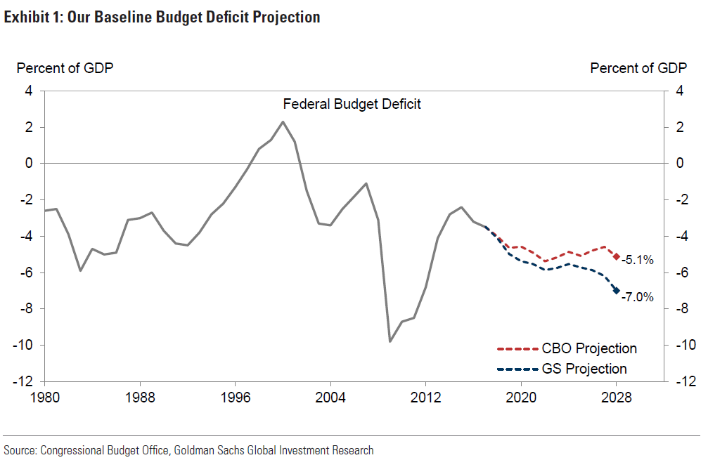

Yet the consequences of continuing down the current path will be even more damaging. Under CBO's Alternative Fiscal Scenario, in which much of the cliff is averted, debt as a share of GDP will grow from 73 percent in 2012 to nearly 90 percent by 2022. By the end of the ten-year window, CBO projects the increased debt burden will already be having a significant impact on the economy with growth rates under Alternative Fiscal Scenario 0.2 percent slower and interest rates 0.4 percent higher than under the current law scenario. And long-term projections look even worse.

These budget projections come as a reminder of how quickly our current decisions on deficit spending will have repercussions. The projected figure under Alternative Fiscal Scenario is already apporaching levels that economists have suggested may have a significant dampening effect on economic growth. A comprehensive debt reduction plan can address this issue and do it in a way to minimize any harmful effects on the economy in the short term. As we say in our paper:

The next several months present a challenge for lawmakers, but also offer an opportunity for them to work together on a sensible plan to both avoid the fiscal cliff while also controlling the debt. It is critical they move swiftly to enact a comprehensive plan to set our nation on a sustainable fiscal track. The strength of the American economy and standard of living will suffer if they do not.

Our full analysis of CBO Budget and Economic Outlook can be found here.