CBO's "Options for Taxing Multinational Corporations"

Yesterday, CBO put out a new report on the system for taxing U.S. multinational corporations, a somewhat complex but important topic when it comes to corporate tax reform. The report both describes the current system and its shortcomings, while presenting options for reform.

In short, our current international tax system works as follows:

- Active Income: U.S. multinational corporations are taxed on their worldwide income, but much of their foreign income ("active income") is not taxed until it is repatriated back to the U.S.

- Passive Income: Other income, known as "passive income" (investment income or other easily mobile income), is generally taxed in the year it is earned regardless of where it is earned.

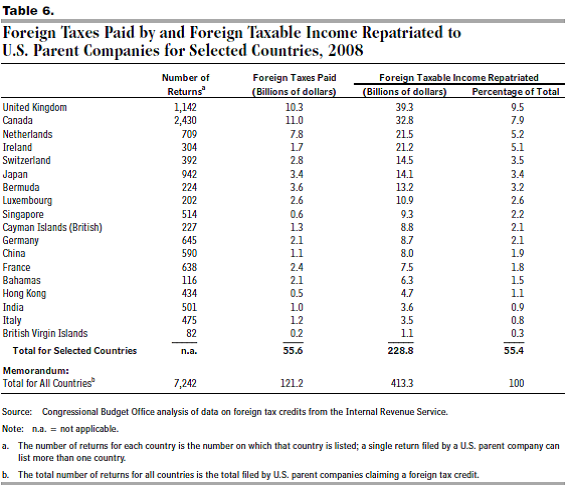

In both cases, any foreign income that is taxed by the U.S. government may also get a credit for taxes paid to foreign governments. This credit, though, cannot exceed the U.S. tax liability on that income. Prior to 1976, the foreign tax credit was individually calculated for each foreign country, limiting companies ability to "cross credit," or using the excess credits from foreign revenue earned from high tax countries to cover additional taxes owed to the U.S. government for revenue in low tax countries - thereby reducing a business's total tax liability.

The combination of deferral and cross crediting creates a number of problems. The report notes that deferral can lead to tax-motivated investment decisions and shifting of income, which detracts from economic efficiency. This may be further exacerbated by the way the foreign tax credit is calculated, which may further discourage investment in high-tax countries and shifting of income and/or production to low-tax countries.

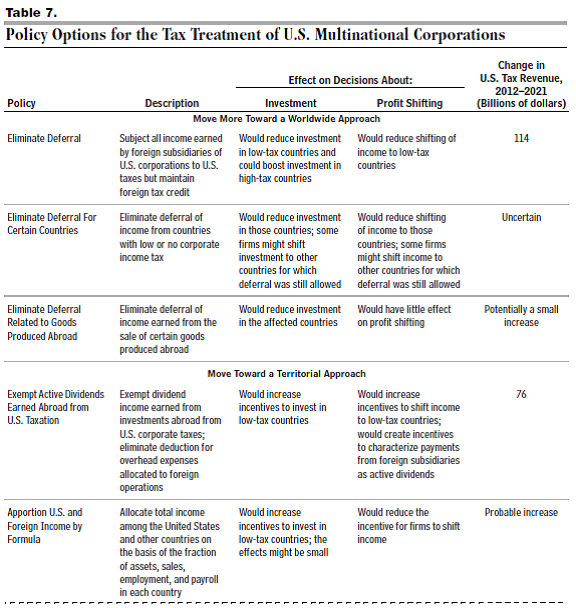

The two major ways to reform international taxes are to move towards either a pure worldwide system or a territorial system. Under a worldwide system, the U.S. would tax all income earned both domestically and overseas, but with the foreign tax credit to avoid double taxation. Under a territorial system, active income earned overseas would not be taxed. The choice of either system has implications revenue, but also incentives for investing abroad.

A "pure" worldwide system could be achieved by eliminating deferral but continuing to keep the foreign tax credit, which CBO says would raise $114 billion. However, this would dramatically reduce incentives to invest in foreign countries, especially those with lower corporate tax rates.

Moving toward a territorial system could gain or lose revenue, depending on the design. One option CBO puts forward would be to exempt active dividends earned overseas from U.S. taxes, which would raise $76 billion according to CBO over the next ten years. This option would raise revenue by restricting companies from deduction expenses from overseas operations and reduce foreign tax credits that were used to exempt other forms of taxable foreign income such as royalties. CBO cautions that countries with territorial systems tend to have lower foreign corporate tax revenues, however, whether it would lower or raise revenues depends how it is structured.

To prevent companies from moving profits to tax havens to escape corporate taxation, many other OECD countries that use a territorial system have also created anti-abuse rules like minimum taxation levels or the use of blacklists. House Ways and Mean's Chairman David Camp (R-MI) has proposed something to this effect, calling for a revenue neutral territorial system which pays for revenue losses through a combination of anti-abuse provisions and a temporary transition tax on foreign-earned income.

Alternatively, CBO also presents other ways to reform the corporate tax system including making changes to the foreign tax credit or changing the rules by which different entities are taxed. These reforms could reduce cross-crediting and profit shifting between high-tax and low-tax countries and raise a significant amount of revenue.

The CBO report shows that there are many ways to make the current system more effective with reform, but that there are no easy choices to be made with international taxation.

Click here to read the full report.