CBO's Estimate of Proposals in the President's FY 2021 Budget

The Congressional Budget Office (CBO) has released its estimate of the President's Fiscal Year (FY) 2021 budget using its own assumptions to evaluate the budget's policies. CBO's estimate shows that while the President's budget proposes significant deficit reduction, its savings are too small to put debt and deficits on a downward path, especially when combined with the additional tax cuts and spending increases outlined in the budget. Nevertheless, CBO finds the policies in the budget would slow the growth of debt and deficits relative to current law.

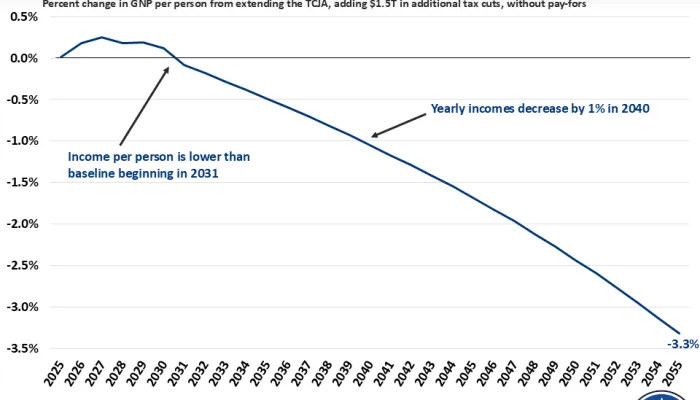

CBO estimates the budget would reduce deficits by $2.1 trillion relative to current law, compared to $3.2 trillion in the Office of Management and Budget's (OMB) estimate. That $2.1 trillion is the net effect of $3.3 trillion of gross deficit reduction, a $1.2 trillion cost for extending the Tax Cuts and Jobs Act (TCJA), $265 billion in costs for new initiatives, and $235 billion in interest savings. The new initiative costs come mostly from providing a tax credit for paid parental leave ($20 billion), establishing an Education Freedom Scholarship tax credit ($45 billion), and enacting highway and infrastructure spending ($185 billion). OMB's presentation of the budget hid the cost of extending TCJA in its baseline, which would result in claimed deficit reduction relative to that baseline of $3.4 trillion in CBO's estimate and $4.6 trillion in OMB's estimate.

The largest category of savings – $2.1 trillion – comes from reductions to both defense and nondefense discretionary spending. The budget would reduce nondefense spending by 5 percent between 2020 and 2021 and by an additional 2 percent annually thereafter (“two-penny plan”), which CBO estimates would save $1.3 trillion over ten years. In addition, the budget would fold Overseas Contingency Operations (OCO) spending into the base defense budget, grow spending with inflation through 2025, and then freeze spending thereafter. CBO estimates the defense changes would save $415 billion, which is $15 billion higher than OMB's $400 billion projection. CBO estimates the nondefense spending reductions, including the unspecified future cuts, would save $1.7 trillion, which is $150 billion more than OMB projects.

Policy Changes Through 2030 as Estimated by CBO and OMB

| Policy | CBO Estimate | OMB Estimate |

|---|---|---|

| Extend the Tax Cuts and Jobs Act (assumed in OMB's baseline) | $1,235 billion | $1,370 billion |

| Enact New Iniatives | $265 billion | $355 billion |

| Enact highway and other infrastructure spending | $185 billion | $275 billion |

| Establish Education Freedom Scholarship | $45 billion | $45 billion |

| Provide paid parental leave | $20 billion | $20 billion |

| Increase other spending | $15 billion | $15 billion |

| Reduce Discretionary Spending | -$2,115 billion | -$1,950 billion |

| Enact specific nondefense reductions | -$370 billion | -$370 billion |

| Assume further nondefense savings through "two-penny" plan | -$1,330 billion | -$1,180 billion |

| Freeze defense spending after 2025 and reduce OCO spending* | -$415 billion | -$400 billion |

| Support the President's Vision for Health Reform (Placeholder) | No Estimate | -$845 billion |

| Reduce Medicare and Medicaid Costs | -$635 billion | -$785 billion |

| Equalize hospital and physician payments for similar services | -$140 billion | -$165 billion |

| Enact Comprehensive Drug Pricing Reform | No Estimate | -$135 billion |

| Move GME and DSH spending out of Medicare and cap their growth | -$180 billion | -$140 billion |

| Reduce and reform Medicare post-acute care payments | -$90 billion | -$115 billion |

| Reform other Medicare provider payments and other changes (net) | -$40 billion | -$60 billion |

| Enact medical malpractice reform | -$35 billion | -$40 billion |

| Enact Medicaid and other health changes | -$150 billion | -$130 billion |

| Reform Welfare Programs | -$95 billion | -$220 billion |

| Reduce and reform SNAP (“food stamps”) | -$60 billion | -$180 billion |

| Reduce and reform other means-tested programs | -$35 billion | -$40 billion |

| Reduce Other Mandatory Spending | -$260 billion | -$520 billion |

| Reform higher education loans and spending | -$110 billion | -$170 billion |

| Modify federal employee health and retirement benefits | -$75 billion | -$90 billion |

| Reform the Postal Service | -$10 billion | -$90 billion |

| Reduce farm subsidies | -$20 billion | -$50 billion |

| Promote return-to-work for workers with disabilities | $0 | -$45 billion^ |

| Reform disability payments and reduce Social Security improper payments | -$25 billion | -$35 billion |

| Enact other savings | -$20 billion | -$35 billion |

| Increase Revenue and Receipts | -$230 billion | -$285 billion |

| Reduce the "tax gap" and certain other taxes | -$70 billion* | -$80 billion* |

| Require Social Security Number for most tax credits | -$35 billion | -$75 billion |

| Raise PBGC, GSE, and other premiums | -$30 billion | -$60 billion |

| Increase various user fees and sell government assets | -$45 billion | -$45 billion |

| Raise other revenue | -$50 billion | -$25 billion |

| Net Interest | -$235 billion | -$290 billion |

| Total Policy Savings in Budget | -$2,070 billion | -$3,170 billion |

| Include cost of TCJA extension in OMB baseline (including interest) | -$1,310 billion | -$1,455 billion |

| Claimed deficit reduction | -$3,380 billion | -$4,625 billion |

Source: CBO, OMB, and CRFB calculations. Numbers may not sum due to rounding. *Includes discretionary effects of proposals. ^Savings are significantly overstated.

Remaining savings come from a variety of health care reforms focused on reducing excessive provider payments and drug costs ($635 billion), changes to the Supplemental Nutrition Assistance Program (SNAP) and other welfare benefits ($95 billion), reforms to the federal student loan program ($110 billion), reductions in the generosity of federal retirement benefits ($75 billion), improvements and reductions to disability programs ($25 billion), and a variety of other changes. The budget also includes a number of program integrity measures and about $230 billion in additional revenue from premiums, taxes, and user fees.

CBO estimates $2.1 trillion in policy savings under the President's budget, which is about $1.1 trillion less than OMB's estimate of $3.2 trillion.

Some of the discrepancy between CBO’s and OMB’s estimates is attributable to CBO disregarding unspecified savings. OMB estimates $845 billion in savings from a placeholder for a future health reform plan (“Support the President’s Vision for Health Reform”) that CBO was unable to estimate due to lack of specificity. CBO also did not estimate savings from a drug reform allowance that saved $135 billion in OMB's estimate. Unlike other proposals for which CBO did not provide an estimate, the proposal to enact comprehensive drug pricing reform appears to be similar to the Senate Finance Committee's Prescription Drug Pricing Reduction Act, which CBO estimates would save $95 billion over ten years. Other policies that CBO disregarded include transforming SNAP benefits into a USDA “Harvest Box” and piloting remain-at-work and return-to-work initiatives for Social Security Disability Insurance and Supplemental Security Income. OMB estimated these policies would save about $225 billion over ten years, but CBO does not score them due to lack of specificity.

In addition, CBO estimates lower savings from Medicare provider payment changes ($70 billion lower than OMB), reforms to higher education loans and spending ($60 billion less than OMB), reforms to the Postal Service ($80 billion less than OMB), and farm subsidy changes ($30 billion less than OMB). On the other hand, CBO finds $135 billion lower costs for extending the TCJA and $90 billion lower costs from the budget’s proposal to enact highway and infrastructure spending.

The President's budget offers a number of thoughtful proposals to reduce health care costs and spend more efficiently. While policymakers must now focus all of their attention on the current economic and public health crisis brought on by the outbreak of COVID-19, at some point they will need to turn their efforts to taming what will be a much higher federal debt and deficits. The policies outlined in the budget could serve as a good starting point when policymakers think about enacting significant deficit reduction and placing debt on a long-term downward path.