CBO Releases Its Own Estimate of the President's FY 2020 Budget

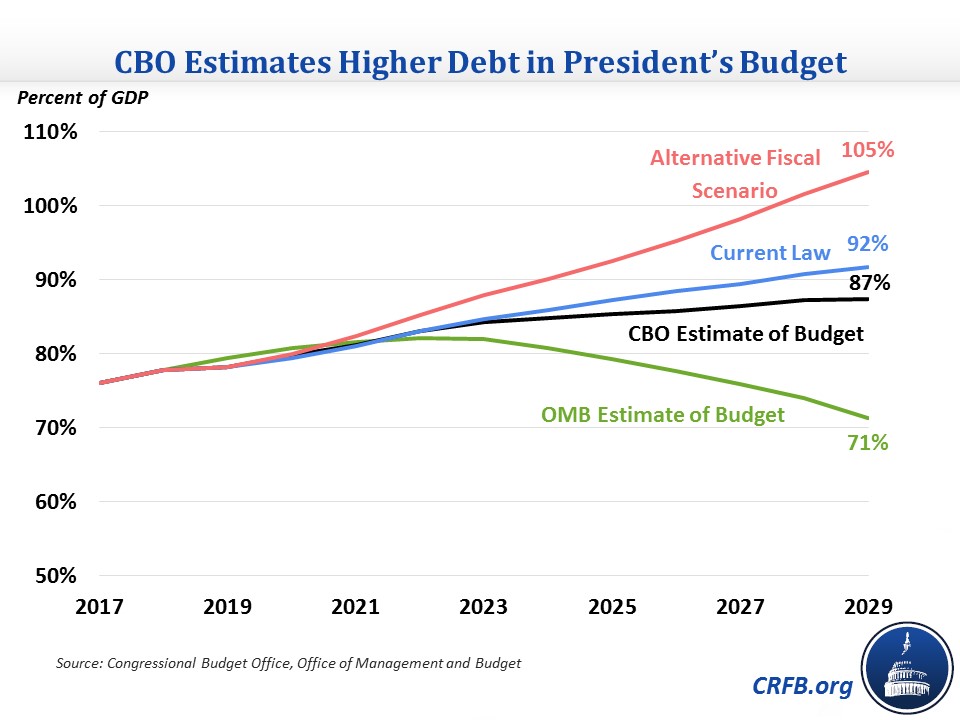

The Congressional Budget Office (CBO) has released its estimate of the President's FY 2020 budget. CBO finds that debt in the budget would be on an upward path over the next ten years in contrast to what the Administration's Office of Management and Budget (OMB) estimated.

CBO estimates that debt in the President's budget would rise from 78 percent of GDP in 2018 to 87 percent by 2029. By contrast, OMB estimated that debt would reach a peak of 82 percent of GDP in 2022 before declining to 71 percent by 2029. However, the budget would slow the growth of debt compared to current law, which has debt reaching 92 percent of GDP by 2029, and the Alternative Fiscal Scenario (AFS), which has debt reaching 105 percent that year.

Deficits in the budget total $9.9 trillion over the next ten years in CBO's estimate, $2.7 trillion higher than OMB's estimate. Deficits in CBO's estimate would increase from $779 billion to $1.1 trillion by 2022 before roughly stabilizing around $1 trillion after that. As a share of GDP, they would increase from 3.9 percent in 2018 to 4.5 percent by 2022 before declining to 3.3 percent by 2029. OMB had estimated that deficits would decline steadily from $1.1 trillion in 2020 to $202 billion by 2029, or from about 5 percent of GDP to 0.6 percent. Still, the budget is an improvement on current law, which has deficits totaling $11.4 trillion over ten years and reaching $1.3 trillion, or 4.3 percent of GDP, in 2029.

The main reason for the $2.7 trillion difference in the two estimates of the President's budget is OMB's very optimistic economic assumptions. OMB projects that real GDP growth will average 2.9 percent over the next decade compared to 1.8 percent in CBO's economic forecast. This economic difference is the main driver of $3.8 trillion of lower revenue in CBO's projection. Differences in spending projections, driven mainly by lower health inflation and higher expected health care savings, reduce the difference between the two projections by $1.1 trillion.

Differences Between CBO's and OMB's Estimates of the President's Budget

| Difference | 2020-2029 Deficit Effect |

|---|---|

| OMB Estimate | $7.259 trillion |

| Revenue | $3.823 trillion |

| Mandatory Spending | -$993 billion |

| Discretionary Spending | -$22 billion |

| Interest | -$131 billion |

| CBO Estimate | $9.936 trillion |

Source: Congressional Budget Office.

Positive numbers denote deficit increase and vice versa.

CBO estimates the budget would reduce deficits by $1.5 trillion compared to current law, the net result of $2.2 trillion of spending cuts, $882 billion of revenue decreases, and $175 billion of interest savings. Most of the spending cuts come from health care and non-defense discretionary (NDD) spending – while the budget would increase spending on defense (partially through an egregious gimmick), infrastructure, and private veterans' health care – and the tax cuts mainly come from extending expiring provisions in the 2017 tax law.

CBO's estimate of the President's budget shows that the budget would slow but not stop the rise of debt as a share of the economy, and even these numbers assume that very large unspecified NDD cuts go into effect. In addition, the budget uses a gimmick to get around the defense spending caps which sets the wrong tone for this year's appropriations process. Though the deficit reduction in the budget is a start, the Administration would have to go further to truly make debt sustainable.

Click here for our press release on CBO's estimate and check back later for a full analysis.