CBO Releases 2014 Long-term Outlook

Earlier today, the Congressional Budget Office (CBO) released its latest Long-Term Budget Outlook. Although CBO normally makes ten-year projections, it also occasionally shows 25- and 75-year projections that highlight our long-term fiscal challenges. As the report states clearly, the fiscal situation is unsustainable, and within the next quarter century, growing debt levels will "push federal debt held by the public to a percentage of GDP seen only once before in U.S. history."

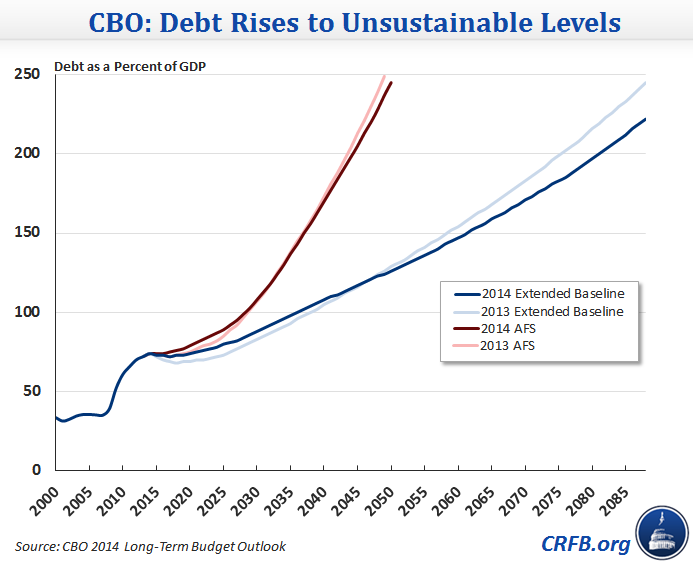

Under CBO's projections, debt will rise from 74 percent of GDP in 2014 (a post-war record high), to 80 percent of GDP by 2025, 108 percent by 2040, 147 percent by 2060, and 212 percent by 2085. The projections are modestly higher than last year's over the next three decades but somewhat lower over the very long term. As expected, the growing debt is largely the result of the rapidly growing costs of Medicare, Medicaid, and Social Security – and the failure of revenue to keep up.

Importantly, those projections assume that Congress follows current law, letting several provisions (such as the tax extenders and doc fix) expire, allowing revenue to grow far above historical levels, and allowing discretionary spending to fall far below historical levels. Under CBO's more pessimistic Alternative Fiscal Scenario (AFS), debt will reach nearly 90 percent of GDP by 2025, 170 percent by 2040, and exceed 250 percent beyond 2050.

These estimates and the CBO report make clear the significant economic consequences of failing to address our debt, the real cost of waiting, and the ultimate need to slow the growth of our entitlement programs and bring revenue and spending in line. As CBO explains:

Beyond the next 25 years, the pressures caused by rising budget deficits and debt would become even greater unless laws governing taxes and spending were changed. With deficits as big as the ones that CBO projects, federal debt would be growing faster than GDP, a path that would ultimately be unsustainable.

In the coming hours and days, CRFB will have additional analysis on the report which can be read here.

CBO's report can be read here.