"A Bipartisan Path Forward" and the Long Term

Erskine Bowles and Alan Simpson's new plan, "A Bipartisan Path Forward to Securing America's Future," saves $2.5 trillion to $2.85 trillion over the next decade, exceeding the $2.4 trillion we identified as the minimum savings needed to put the debt on a clear downward path relative to the economy. Importantly, though, policymakers must be looking to put the debt on a clear downward path over the long term, not just temporarily. Fortunately, Simpson and Bowles's new plan succeeds at that goal.

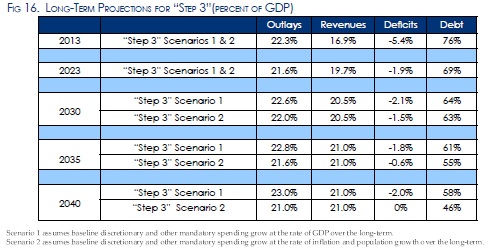

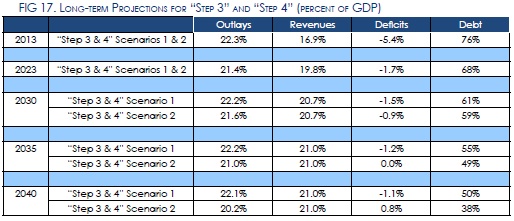

In Appendix G of the report, the Moment of Truth Project staff analyze the effects of the proposal through 2040. They do so both by looking at "Step 3" -- the $2.5 trillion of specific deficit reduction for this decade -- and the additional long-term Social Security, health, and transportation savings in "Step 4." They also evaluate the steps under two different scenarios. In Scenario 1, other mandatory and discretionary spending are assumed to grow with GDP after 2023 (2025 for discretionary), consistent with how CBO extrapolates the long-term. In Scenario 2, other mandatory and discretionary spending are assumed to grow with inflation plus population growth -- a somewhat slower growth rate -- consistent with how OMB extrapolates the impact of the President's budget over the long-term.

As you can see below, the plan puts debt on a downward path over the long term under all sets of assumptions put forward, though at different rates depending on what is assumed about the growth of discretionary and mandatory spending and depending on what policies are incorporated. Importantly, these estimates are quite rough and should be treated as such.

Sources: CBO, CRFB, MOT

In either scenario, the plan succeeds in continuing to put debt on a downward path as a share of the economy. By just taking "Step 3," the debt would fall to 64 percent of GDP by 2030, 61 percent by 2035, and 58 percent by 2040 in Scenario 1. Under this scenario, deficits remain at about two percent or below. Under Scenario 2, whereby discretionary and other mandatory spending grow more slowly, debt would fall to 63 percent in 2030, 55 percent in 2035, and 46 percent in 2040. Under this scenario, the budget would balance by about 2040.

Enacting the "Step 4" from the proposal, which includes measures to make the Highway and Social Security trust funds solvent plus a cap on the growth of the federal government's budgetary commitment to health care, would put additional downward pressure on deficits and debt over the long-term. In Scenario 1, debt would fall to 61 percent of GDP in 2030, 55 percent in 2035, and 50 percent in 2040, while reducing the deficit to one percent by 2040. Under Scenario 2 of estimating the effects of "Step 4," debt would fall to 59 percent of GDP in 2030, 49 percent in 2035, and 38 percent in 2040, while balancing the budget by 2035.

There is some question about whether some long-term assumptions may be reasonable, particularly on revenue. Over the long term, the plan assumes that revenue increases as a share of GDP until it reaches 21 percent, where it is frozen. This treatment is more generous than CBO's Alternative Fiscal Scenario, which freezes revenue after 2022, but it is less generous than either CBO current law or the CRFB Realistic baseline, which assume that revenue continues to grow. One could see arguments either way for why this assumption may be less reasonable than an alternative.

While Bowles and Simpson's new proposal is just one way to go about fixing the budget, it is clear looking at the projections that the plan would put debt on a sustainable path over the next ten years and beyond. Any budget plan that policymakers ultimately support should accomplish that goal.