The Analysis of the Analysis: CRFB's Take on CBO's Immigration Estimates

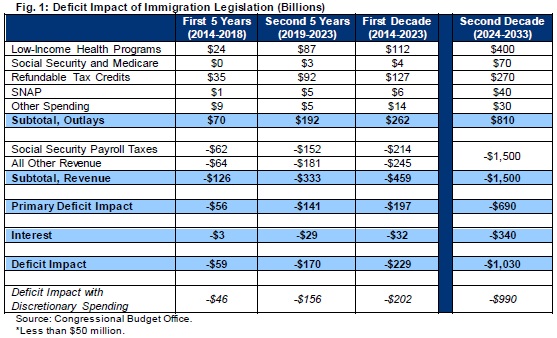

CBO's recent budgetary and economic analyses of the Senate immigration bill have been making waves in the political sphere as lawmakers rush to highlight or disavow the findings of $197 billion of total deficit reduction through 2023 and almost $700 billion in the 2024-2033 period. CRFB already summarized the analyses on the blog yesterday, but now we have a full length paper with further breakdown and additional analysis based off of CBO's findings. The paper discusses CBO's method of scoring, their findings for the budget, their findings for the economy, and how the budget would look like if those numbers were incorporated.

The paper first notes the atypical method by which CBO analyzes the bill in its primary cost estimate. Normally, CBO does not utilize "dynamic scoring" for macroeconomic variables like GDP or employment. However, considering the clear direct impact that the bill would have on certain variables, CBO relaxes this assumption for US population, employment, and taxable compensation. It still does not use dynamic scoring in its cost estimate for variables that are indirectly affected like GDP or wages; rather, the effect on these other variables is forecasted and described in the supplemental economic analysis.

Our paper stresses that CBO's estimate differs widely for the on-budget portion of the federal budget and the off-budget (Social Security) portion. In fact, the on-budget experiences a projected $14 billion deficit increase as a result of the bill, while the off-budget reduces the deficit by $211 billion. Social Security gets such large deficit reduction because immigrants pay into the system upfront but are generally younger than the average population and take many years to accumulate a sufficient work history to receive meaningful benefits.

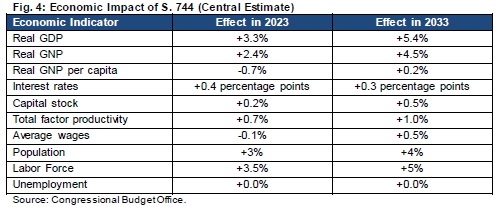

CBO's economic analysis is a very informative look at how they project the bill would affect a slew of economic indicators that are not done for the initial cost estimate. As mentioned before, CBO does include macrodynamic scoring for population, employment, and taxable compensation. But changes in variables like GDP, wages, productivity, and the capital stock are only analyzed in the supplemental analysis. The table below shows CBO's estimate of the changes in each of these metrics.

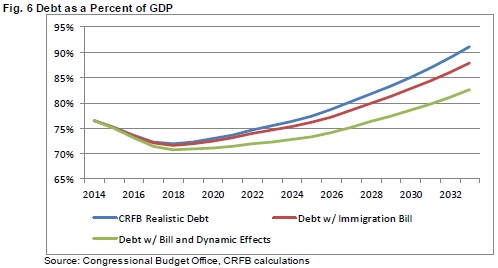

The budgetary feedback of these economic effects is deficit-neutral through the first ten years and an additional $300 billion of deficit reduction in the second decade. We used these numbers to show how the legislation itself and the dynamic effects would affect deficits and debt over the next twenty years. For debt as a percent of GDP, it would be reduced from 91 percent in 2033 in the CRFB Realistic baseline to 88 percent incorporating just the budgetary effects of the legislation and reduced further to 83 percent incorporating the dynamic effects (including the new GDP numbers).

Budgetary implications should not be the only driver behind what lawmakers do with immigration reform, but it is helpful for them to at least be cognizant of the impact. Lawmakers should make sure that immigration reform continues to be a net positive for the budget, and hopefully the final bill will be PAYGO-compliant (not increase the on-budget deficit). We will continue to provide further analysis of this and other immigration bills as analyses become available.

Click here to read the paper.