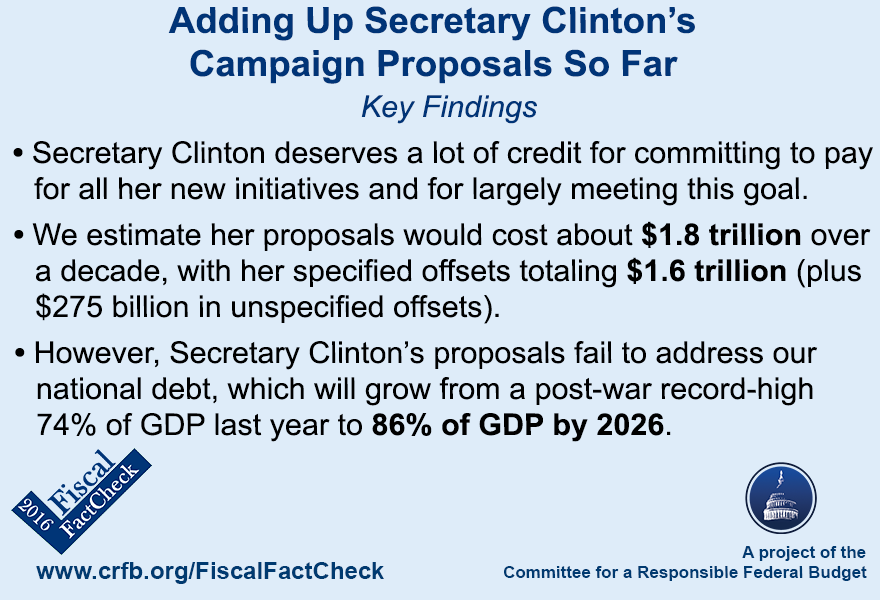

Adding Up Secretary Clinton's Campaign Proposals So Far

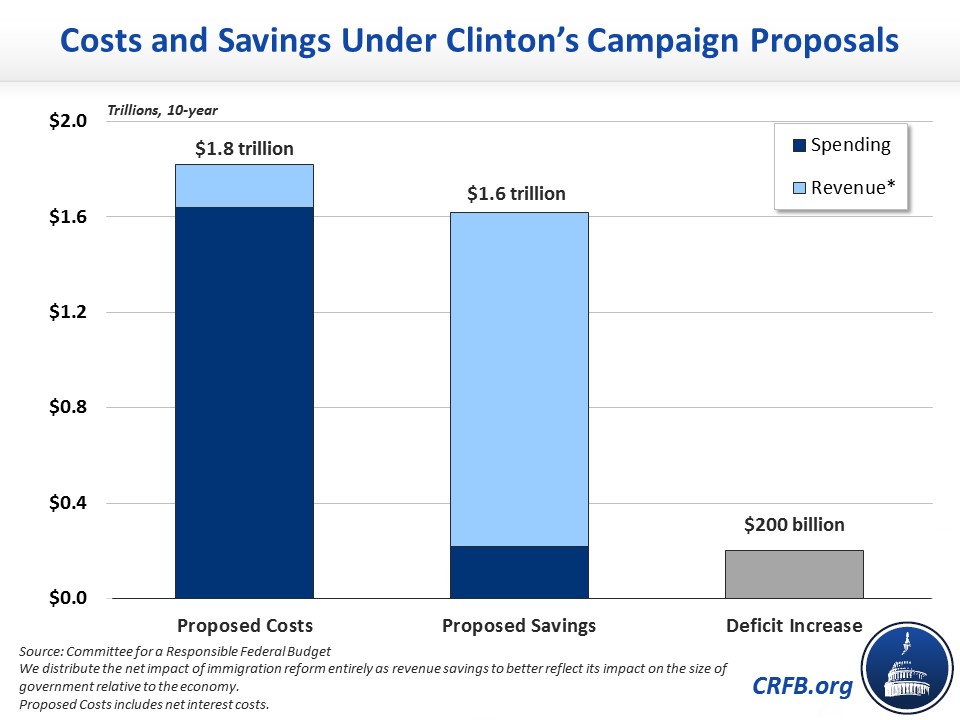

Using independent estimates from the Congressional Budget Office (CBO), the non-partisan Tax Policy Center (TPC), and others, we estimate that Secretary Clinton’s proposals would cost $1.80 trillion over a decade with interest, and they would be nearly fully paid for with $1.60 trillion of offsets – primarily from taxes on high earners. The $200 billion shortfall from Secretary Clinton’s proposals can be fully explained and would be more than fully covered by the $275 billion of corporate tax revenue that the Clinton campaign has called for but has not yet provided enough detail for us to credit.

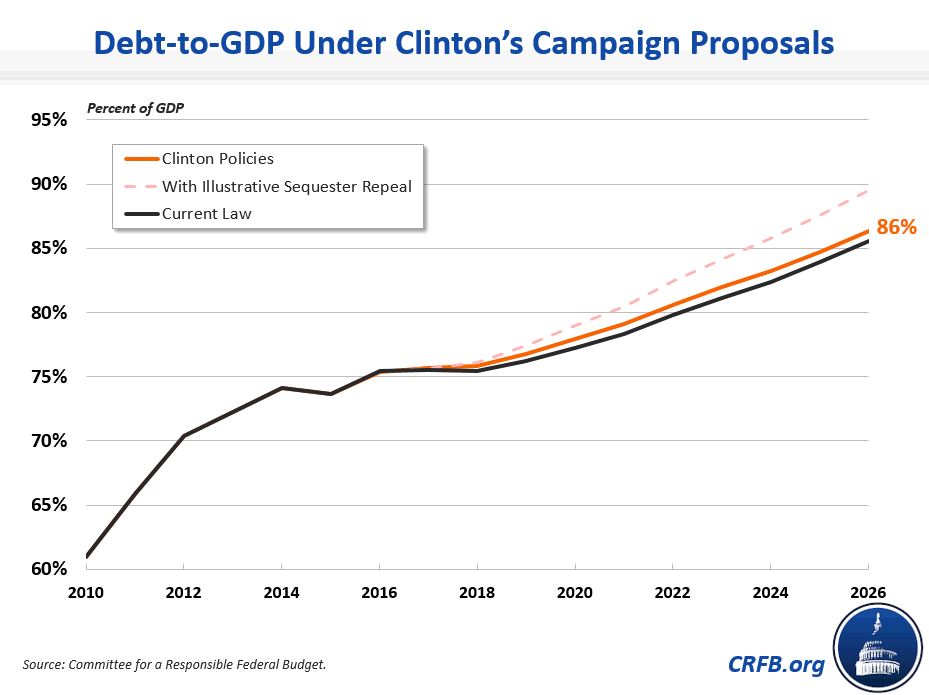

Though Secretary Clinton’s policies would not substantially add to current law debt levels, it would keep debt at post-war record-high and rapidly growing levels. Under Secretary Clinton’s proposals, debt held by the public would climb from 74 percent of Gross Domestic Product (GDP) at the end of last year to 86 percent of GDP by 2026.

Since the 2016 presidential campaign began, the Committee for a Responsible Federal Budget has analyzed several campaign proposals through our Fiscal FactCheck project. This analysis of Secretary Clinton’s policies is our fourth full assessment of a candidate’s proposals available on their campaign’s website (Read our analysis of the policies put forth by Senator Ted Cruz, Donald Trump, and Senator Bernie Sanders). We aimed to assess all major policy proposals on www.HillaryClinton.com as of May 2, 2016, incorporating comments and details provided by representatives of the campaign. We excluded smaller initiatives and those with too little detail to assess. Secretary Clinton may support additional policy changes that are not listed on her website or have only been alluded to but not specified. We intend to follow up with further analyses of the candidates’ plans, including updates to our analysis of Secretary Clinton’s proposals, as more details are added to their websites. Estimates provided in this analysis are both rough and rounded.

It is quite encouraging that Secretary Clinton has outlined specific offsets for her new proposals. By our estimates, these savings would cover nearly all the new costs (and may more than fully cover the costs once the campaign releases specifics for corporate tax reform). Paying for new initiatives is an important and necessary step to ensuring the nation’s fiscal health does not further deteriorate.

While Secretary Clinton would not worsen the fiscal situation, she also unfortunately does not offer concrete proposals for improving it. As under current law, under Secretary Clinton’s proposals the national debt would ascend from 74 percent of GDP at the end of last year – already a record high other than the period around World War II – to 86 percent of GDP by 2026. Secretary Clinton also has not set aside money for sequester relief, even though the campaign has put forward the goal of reversing the automatic defense and non-defense cuts, known as “sequester.” If full discretionary sequester relief were enacted without offsetting the cost, the debt would climb even higher to about 90 percent of GDP.

In order to pay for sequester relief and put debt on a more sustainable path, Secretary Clinton would need to put forward significant additional tax increases and/or spending cuts. By ruling out many changes to Social Security as well as tax increases on those making less than $250,000, Secretary Clinton has made this task far more difficult. Even so, given that her proposals are largely paid for, it remains possible for Secretary Clinton to offer a viable deficit reduction plan, and we encourage her to do so.

The Budgetary Impact of Secretary Clinton’s Proposals

Secretary Clinton’s campaign website includes a long list of new policy proposals, factsheets, briefings, and backgrounders. The recommendations with significant costs or revenue loss include:

- Enact “New College Compact.” Read more about this proposal.

- Expand the Affordable Care Act (“Obamacare”).

- Repeal the Cadillac Tax on high-cost health insurance plans.

- Expand early childhood education.

- Increase infrastructure spending. Read more about this proposal.

- Expand paid family leave and enact related policies.

- Invest in energy and research.

- Support economic revitalization and increase funding for veterans.

Meanwhile, the recommendations with significant savings or revenue include:

- Limit the value of tax breaks to the 28 percent bracket.

- Reform capital gains taxation.

- Enact a minimum tax, surtax, and other tax increases on high earners. Read more about this proposal.

- Increase various business taxes.

- Impose a fee on financial institutions.

- Reduce prescription drug costs and allow for a “public option.” Read more about this proposal.

- Enact immigration reform.

Each of these policies is described in detail in Appendix I.

In addition to these policies, Secretary Clinton has called for ending the automatic spending reductions known as the discretionary sequester in conjunction with “smart reforms in both defense and non-defense spending.” She has also called for expanding Social Security benefits for “those who need it most and who are treated unfairly by the current system,” including widows and caretakers, while extending the program’s solvency through tax increases on higher earners. Neither recommendation includes policy detail. In our assessment based on the campaign website and discussions with campaign representatives, these represent goals rather than proposals, and full proposals may be released at some future time, at which point we will assess their net fiscal impact.

| Secretary Hillary Clinton’s Campaign Proposals, As Featured on Her Campaign Website | |

|---|---|

| Major Initiative | 10-Year |

| Cost / Savings (-) | |

| Enact “New College Compact” | $0.35 trillion |

| Expand the Affordable Care Act (“Obamacare”) | $0.30 trillion |

| Repeal the Cadillac Tax on high-cost health insurance plans | $0.10 trillion |

| Expand early childhood education | $0.10 trillion |

| Increase infrastructure spending | $0.30 trillion |

| Expand paid family leave and enact related policies | $0.35 trillion |

| Invest in energy and research | $0.10 trillion |

| Support economic revitalization and increase funding for veterans | $0.15 trillion |

| Other proposals† | * |

| Subtotal, Costs | $1.75 trillion |

| Limit the value of tax breaks to the 28 percent bracket | -$0.40 trillion |

| Reform capital gains taxation | -$0.10 trillion |

| Enact a minimum tax, surtax, and other tax increases on high earners | -$0.40 trillion |

| Increase various business taxes | -$0.15 trillion |

| Impose a fee on financial institutions | -$0.10 trillion |

| Reduce prescription drug costs and allow for a “public option” | -$0.25 trillion |

| Enact immigration reform | -$0.10 trillion |

| Subtotal, Savings | -$1.60 trillion |

| Net Interest | $0.05 trillion |

| Budgetary Impact of Secretary Clinton’s Major Proposals | $0.20 trillion |

| Memo: Impact with claimed revenue from unspecified business tax reform | -$0.15 trillion |

†This category includes smaller proposals that do not individually cost or save more than $50 billion. For the purposes of this analysis, we have excluded these proposals, but they could have additional costs or savings.

By our estimate, Secretary Clinton’s specific new costs will total roughly $1.8 trillion over a decade – including nearly $1.55 trillion of new spending, less than $0.2 trillion of tax breaks, and $0.05 trillion in interest. These costs would be largely offset by about $1.3 trillion of tax increases, $0.2 trillion of spending reforms, and $0.1 trillion of savings from immigration reform. In total, this would increase the debt by about $200 billion over the next decade, an increase that would be more than offset by the $275 billion of revenue the campaign has called for generated from business tax reform but not yet specified enough details to count.

A full explanation of our cost estimates, including a discussion of several of the policies we were unable to incorporate into our analysis, is available in Appendix II.

Attaining Fiscal Sustainability under Secretary Clinton’s Plans

Secretary Clinton deserves a lot of credit for not only committing to pay for all new initiatives, but largely meeting this goal. However, by not setting aside any substantial savings for deficit reduction, Secretary Clinton would still allow debt to grow significantly as a share of the economy, from about 74 percent of GDP at the end of last year – already the highest in U.S. history other than around World War II – to 86 percent of GDP by 2026. In only a few years, under Secretary Clinton’s policies and under current law, debt would grow to twice its average over the last half-century of roughly 40 percent of GDP; and it would continue to grow unsustainably after that.

Were Secretary Clinton to repeal the discretionary spending sequester without offsets (she has set forth the goal of repealing sequester but not yet identified offsets), debt would grow even higher – to about 90 percent of GDP by 2026.

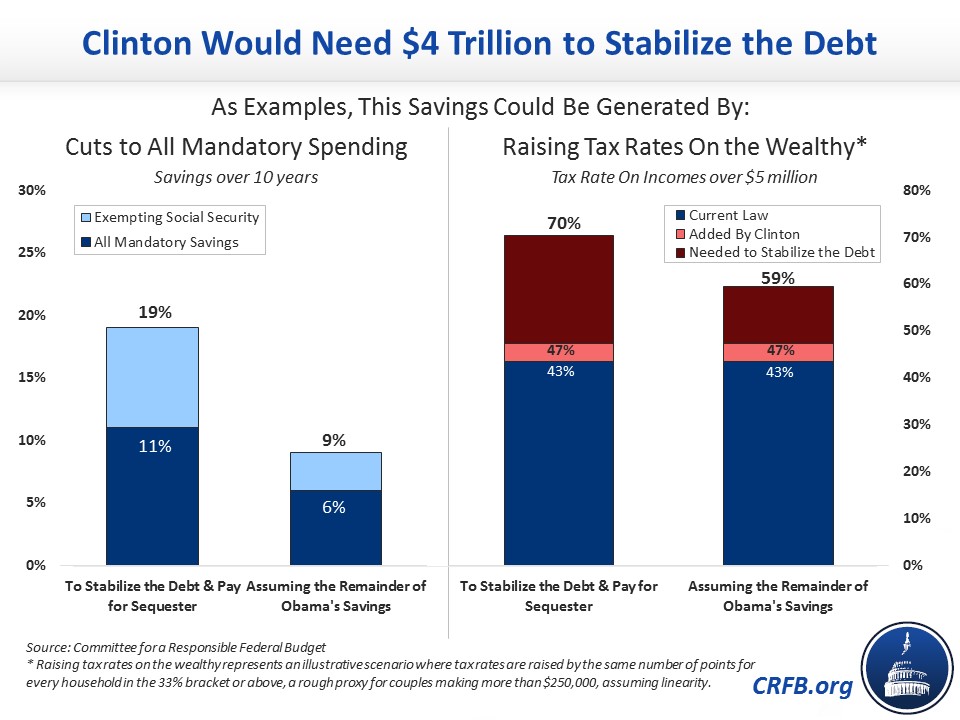

In order to meet her goal of fully reversing the discretionary sequester while also stabilizing the debt-to-GDP ratio, Secretary Clinton would need to identify over $4 trillion in additional budget savings (including interest) over 10 years. Achieving this level of savings on top of the offsets Secretary Clinton has already proposed would require aggressive tax increases or spending cuts, particularly since she has ruled out increasing taxes on households making less than $250,000 as well as a variety of potential Social Security changes. For example, to stabilize the debt and repeal the sequester, Secretary Clinton could:

- Increase tax rates on households above $250,000 by about 23 percentage points, pushing the top combined federal tax rate to 70 percent on incomes above $5 million (which would be close to or above the revenue maximizing level).

- Adopt all the tax increases and mandatory savings in President Obama’s budget1 (including those like oil and cigarette taxes that impact households making less than $250,000 per year), while raising tax rates by 12 percentage points on households making more than $250,000, which would move the top rate to 59 percent on incomes above $5 million.

- Apply an across-the-board 5 point tax increase on all households, including households making less than $250,000.

- Reduce mandatory spending on programs such as Social Security, Medicare, Medicaid, and food stamps with an 11 percent across-the-board cut.

- Reduce mandatory spending while exempting Social Security with a 19 percent across-the-board cut.

- Adopt all the tax increases and mandatory savings in President Obama’s budget and then reduce mandatory spending other than Social Security by 9 percent across the board.

Faster economic growth could also make it easier for Secretary Clinton to stabilize the debt and pay for the sequester. Based on CBO’s estimates of the effect of the 2013 Senate-passed immigration bill and the macroeconomic feedback analysis from the Tax Foundation that estimates Secretary Clinton’s tax increases would reduce the size of the economy by 1 percent over a decade, we determined that annual real economic growth of about 3.1 percent would be sufficient to pay for sequester repeal and stabilize the debt at last year’s level (74 percent of GDP). This is significantly higher than the 2.1 percent growth projected under current law, and would be unlikely to materialize given historical precedent, productivity trends, the aging population, and the impact Secretary Clinton’s tax increases would have on long-term economic growth.

***

Secretary Clinton should be commended for not only committing to pay for her new initiatives but also for offering serious and specific proposals that would more or less achieve this goal. However, with debt at post-war record-high levels and projected to grow unsustainably, simply remaining on our current course is not enough. Secretary Clinton would need over $4 trillion of deficit reduction to simply replace the sequester and stabilize the debt at its current high levels. So far she has proposed over $1.5 trillion of savings, and yet does not dedicate even a fraction of it to putting the debt on a more sustainable path.

Ultimately, a mixture of spending cuts, tax increases, and entitlement reform is likely to be necessary in order to grow the economy and fix the debt for future generations. We hope Secretary Clinton will pursue these policies going forward, putting new ideas on the table rather than simply taking ideas off. Paying for new initiatives is a good start, but much more must be done.

1 Note this excludes the policies already put forward by Secretary Clinton.

Appendix I: Summary of the Clinton Campaign’s Policy Proposals that have Fiscal Implications

Secretary Clinton has put forward numerous policies on her campaign website. As of May 2, 2016, we have identified eight sets of initiatives with substantial budgetary costs and seven sets of initiatives with substantial budgetary savings, defined as costing or saving at least $50 billion over ten years. Note that some offsets have been explicitly paired with new initiatives, while others have not.

Costs

- Enact “New College Compact” – Secretary Clinton would reduce the cost of college and student debt by providing states with grants to support two years of tuition-free community college and/or four years of “debt-free” education at public universities – tuition that could be funded through a mixture of a “realistic family contribution” and part-time work rather than student loans. Secretary Clinton would also lighten the burden of college debt by reducing interest rates and allowing borrowers to refinance existing student loans at lower rates while simplifying and expanding income-based repayment programs. Additionally, she would increase funding for AmeriCorps, increase institutions’ accountability for tuition rates, and make numerous other changes. The campaign estimates the $350 billion plan would be fully offset by capping the value of tax preferences to the 28 percent bracket. Read more about Clinton’s higher education plan.

- Expand the Affordable Care Act (“Obamacare”) – Secretary Clinton would expand the Affordable Care Act in a number of ways. First, she would offer federal support to states that expand Medicaid in order to cover the full costs of newly eligible Medicaid enrollees during the first three years of expansion, regardless of when the state chooses to expand. (This is the same funding that states that have already expanded Medicaid have received.) She would also spend $500 million per year on outreach efforts to enroll the 16 million people who are eligible for Medicaid or exchange subsidies but are not yet enrolled. Additionally, Secretary Clinton’s plan would expand existing insurance subsidies by limiting any out-of-pocket premium costs to 8.5 percent of income, fixing the so-called “family glitch” to calculate affordable health care plans for families rather than individuals, and increasing premium subsidies more broadly. Finally, Secretary Clinton would establish a new refundable tax credit to cover a portion of out-of-pocket health and premium costs above 5 percent of income for up to $5,000 per family.

- Repeal the Cadillac Tax on high-cost health insurance plans – Secretary Clinton supports repealing the “Cadillac Tax,” a 40-percent excise tax on a portion of high-cost employer-sponsored health insurance plans. The tax was originally part of the Affordable Care Act and is currently scheduled to take effect in 2020.

- Expand early childhood education – Secretary Clinton would expand early childhood education by funding universal preschool and doubling spending on Early Head Start, which promotes comprehensive child development and family support for children under three years old.

- Increase infrastructure spending – Secretary Clinton has proposed to substantially increase national infrastructure spending in a number of ways. First, she would establish a $25 billion National Infrastructure Bank that would issue loans and loan guarantees with the goal of generating about $250 billion of infrastructure investment. At the same time, Secretary Clinton would allocate $250 billion to improve highways, public transit, rail, sea, air, and broadband access while reviving the Build America Bonds program to subsidize state and local infrastructure investment. Read more about her infrastructure plan. Additionally, she would make a $25 billion housing investment to revitalize communities and make housing more affordable.

- Expand paid family leave and enact related policies – Secretary Clinton would guarantee up to 12 weeks of paid family and medical leave with a plan that ensures workers have at least two-thirds of their wages replaced up to a ceiling, similar to the FAMILY Act sponsored by Senator Kirsten Gillibrand (D-NY). Unlike the FAMILY Act, however, Secretary Clinton does not support an across-the-board payroll tax increase to pay for the plan (nor an employer mandate) and instead would pay for it with a portion of her proposed taxes on the wealthy. Secretary Clinton has also made several small proposals to support caregiving, including a 20 percent tax credit of up to $1,200 per year ($6,000 of expenses) to help alleviate the cost of caring for elderly family members.

- Invest in energy and research – To support clean energy, Secretary Clinton would create a $60 billion Clean Energy Challenge to help states and local communities cut carbon consumption by incentivizing faster clean energy adoption, awarding Solar X-Prizes to promote the use of solar panels, upgrading electrical grids, and working with existing Department of Agriculture programs to expand rural access to clean energy. She would also invest $30 billion to revitalize coal communities. On the research side, she would expand research investment across-the-board, including by investing $20 billion to cure Alzheimer’s, and additional funds for research in autism, HIV/AIDS, and many other areas, medical and non-medical alike.

- Support economic revitalization and increase funding for veterans –To support job creation, Secretary Clinton would invest $20 billion in youth jobs and invest in programs that help previously incarcerated citizens renter the workforce. She would also expand the New Markets Tax Credit and create a Manufacturing Renaissance Tax Credit to encourage investors to make credit more available in low-income areas. For veterans, she would make permanent the Work Opportunity Tax Credit for companies that hire veterans and expand child care, spousal employment opportunities, and mental and women’s health benefits. Secretary Clinton has also proposed to support entrepreneurship and small businesses in underserved communities; provide $10 billion for a Make it in America program that encourages domestic manufacturing; offer a two-year tax credit for businesses that share profits with their employees; and provide funding for farmers, ranchers, and local food markets, among many other initiatives.

Savings

- Limit the value of tax breaks to the 28 percent bracket – By reducing the amount of income subject to taxes, tax deductions effectively provide a larger subsidy to those in higher brackets. For example, $1 of mortgage interest results in 39.6 cents of tax savings for someone in the top tax bracket but only 10 cents of savings for someone in the bottom bracket. Secretary Clinton would limit the value of most itemized deductions and tax exclusions to the 28 percent tax bracket, meaning those in higher brackets would receive no more than a 28-cent subsidy per dollar. The charitable deduction would be exempt from this limit, though the employer-provided health insurance tax exclusion would be included.

- Reform capital gains taxation – Currently, capital gains held less than a year are generally taxed as ordinary income (with a top rate of 43.4 percent, the top individual rate of 39.6 percent plus a 3.8 percent surtax), and those held longer than a year are taxed at a preferential rate (15 or 20 percent plus a 3.8 percent surtax in some cases). Secretary Clinton would increase capital gains rates on only the highest bracket of earners by offering the full preferential rate only to assets held for longer than six years, phasing down the rate between the second and sixth year. She would also tax carried interest as ordinary income.

- Enact a minimum tax, surtax, and other tax increases on high earners – Secretary Clinton has proposed a number of tax increases targeted at higher earners. Most significantly, she supports a 30 percent minimum tax (“Buffett Rule”) on taxpayers with income above $2 million (phased in starting at $1 million) and a 4 percent surtax on income above $5 million. Secretary Clinton would also increase estate taxes on very large inheritances by lowering the threshold for the tax from $5.45 million to $3.5 million, increasing the rate from 40 percent to 45 percent, and making other changes. In addition, she would work to close the tax gap (including by increasing IRS enforcement), limit tax-preferred contributions to retirement accounts that have large balances, and close the tax advantage known as the Bermuda reinsurance loophole, which allows investment managers to avoid taxation by channeling investments through insurance companies in lower-tax nations like Bermuda. Read more about her taxes on higher earners.

- Increase various business taxes – Secretary Clinton has proposed several new or increased taxes on businesses. To start with, she would aim to discourage businesses from moving overseas by imposing an exit tax on earnings held abroad, increasing the threshold for foreign ownership in inversions transactions, deterring earnings stripping, and implementing a “clawback” proposal to rescind tax breaks for companies that outsource jobs. She would also reform performance-based tax deductions for highly-paid executives and eliminate several tax breaks for fossil fuel, including targeted tax breaks like expensing for intangible drilling and more broadly available breaks such as the domestic production activities deduction. Secretary Clinton has also called for broad business tax reform, though has yet to offer any details other than a revenue target of $275 billion.

- Impose a fee on financial institutions – Secretary Clinton would impose a risk fee on banks with more than $50 billion in assets as well as other financial institutions that regulators designate for additional oversight. The fee would be assessed on a sliding scale and would increase as an institution grows in size and as it accumulates riskier, short-term debt.

- Reduce prescription drug costs and allow for a “public option” – Secretary Clinton would enact changes designed to reduce prescription drug prices in Medicare Part D and elsewhere. She would require drug manufacturers to lower certain prices in Medicare Part D plans by imposing minimum rebates in order to participate in Medicare, lower barriers to importing drugs from abroad, prohibit pay-for-delay agreements between generic and brand-name drug makers, lower the patent exclusivity period for specialty biologics, and eliminate the tax-deductibility of prescription drug advertising. Read more about her prescription drug plan. Secretary Clinton would also reduce federal health costs by allowing and encouraging states to offer a “public option” in health insurance exchanges and by pursuing payment reforms and anti-fraud measures in the Medicare program.

- Enact immigration reform – Secretary Clinton supports immigration reform that would bring undocumented immigrants into the economy, end family detention, and allow immigrants to use health insurance exchanges. She would push for immigration reform that includes a path to citizenship, defend President Obama’s executive action on immigration (and likely expand it to include families of those receiving deferred action), end the 3- and 10-year wait period for reentry to the United States for obtaining a green card, shutter private detention centers for immigrants, and expand upon work to naturalize immigrants.

This is not an exhaustive list of Secretary Clinton’s proposals – there are many others – but it does represent the legislative policy proposals that would most likely have significant fiscal impact.

The Committee for a Responsible Federal Budget does not endorse any candidate or any candidate’s policies.

Appendix II: Explaining Our Cost Estimates

Our estimates of Secretary Clinton’s policy proposals come from a variety of respected sources that are explained below, and occasionally include our own estimates. We excluded policies or policy areas that would not cost or save at least $50 billion over 10 years.

For many of Secretary Clinton’s new initiatives, we relied on the campaign’s estimates as long as we viewed such estimates as consistent with the policy provided. When the campaign provided per-year costs or savings, we assumed the value would be 10 times greater over the decade. When no campaign estimate was available or when such estimates did not conform to the policy, we relied on outside estimates from respected and independent sources. When no estimate was available, we generated our own based on the available evidence.

For Secretary Clinton’s college education plan, we relied on the campaign’s estimated cost of $350 billion over 10 years. This estimate is consistent with our own rough analysis which found her plan to support tuition-free community college and “debt-free” public college would cost about $200 billion, while other initiatives included in the plan would cost $100 to $200 billion more.

For Secretary Clinton’s plan to expand the Affordable Care Act (“Obamacare”), we relied on a number of sources and made adjustments as necessary. Like Secretary Clinton, Linda Blumberg and John Holahan of the Urban Institute have proposed to limit premiums on the health care exchanges to no more than 8.5 percent of income, increase premium subsidies for those currently on the exchanges, fix the so-called “family glitch,” and expand support for cost-sharing. The Urban Institute estimates these four changes would cost about $340 billion over a decade. Based on Secretary Clinton’s campaign website as well as discussions with the campaign, we believe her policies would be more modest and cheaper than Urban’s; for simplicity we assume her expansion of premium subsidies would cost about half of the Urban plan, while her other policies would cost a similar amount – bringing the total to roughly $230 billion. On top of this, we believe Secretary Clinton’s policy to extend full federal Medicaid support to states that have not yet adopted the Obamacare expansion would be virtually identical to President Obama’s proposal, which CBO has estimated would cost about $30 billion. Finally, we estimate Secretary Clinton’s plan to spend $500 million per year on Medicaid and exchange outreach would not only require $5 billion of direct spending but would lead to $25 to $50 billion more in Medicaid and exchange subsidy costs for new enrollees.

We estimate Secretary Clinton’s plan to repeal the Cadillac tax based on estimates provided by CBO. Actual costs could be somewhat higher due to interactions with Secretary Clinton’s other health policies.

For Secretary Clinton’s early education plans, we assume her universal preschool proposal is the same as President Obama’s, which CBO estimates will cost $66 billion over a decade. To estimate the cost of doubling Early Head Start funding, we calculated the current projected cost based on numbers from the Department of Health and Human Services.

The spending for Secretary Clinton’s infrastructure and economic revitalization plans is primarily from the campaign. She proposes to spend $275 billion on infrastructure and $25 billion for housing revitalization projects.

For Secretary Clinton’s paid family and medical leave proposal, we assume costs will likely match the plan put forward by Senator Sanders or at least be similar to the $35 billion per year proposal from the Center for American Progress, although at least one outside estimate suggests costs could be much higher. In estimating Secretary Clinton’s proposed caregivers credit, we relied on a press report putting the cost at about $10 billion over a decade.

Our cost estimates related to energy and research come from a mixture of campaign numbers, TPC estimates, and our own projections. In terms of explicit costs, Secretary Clinton states she would invest $60 billion for the Clean Energy Challenge, $30 billion to revitalize coal communities, and $20 billion on Alzheimer’s research. Further, TPC estimated that expanding the New Markets Tax Credit and creating a Manufacturing Renaissance Tax Credit would cost an additional $9 billion.

For estimates on her economic revitalization and veterans proposals, Secretary Clinton says she would invest $20 billion in youth jobs, $5 billion in reentry programs for the incarcerated, $25 billion to support small business entrepreneurs and underserved communities, $20 billion for a profit-sharing credit, and $10 billion for the Make It in American program. We believe additional costs on veterans, rural communities, and elsewhere will cost somewhere in the broad range of $50 and $100 billion over a decade.

Absent from this analysis of costs are estimates for requiring health plans to cover three sick visits, capping individual drug costs at $250 per month, combatting drug and alcohol addiction, doubling funding for the U.S. Department of Justice’s Collaborative Reform program that supports police department reforms, offering matching federal funding to equip police forces with body cameras, and creating a $1,500 tax credit for every apprentice that a business hires. On net, these changes are likely to increase costs by a small amount.

In addition, Secretary Clinton has expressed some support for fully funding the Individuals with Disabilities Education Act (IDEA), expanding the child tax credit, expanding Social Security for certain populations, and repealing both the defense and non-defense sequester. Based on review of the campaign’s website and discussions with the campaign, we view these as goals that may be addressed by future policy proposals rather than developed policy proposals. However, if we did account for them, they would add more than $1 trillion to the cost of her new proposals.

In terms of offsets, the majority of Secretary Clinton’s proposals come in the form of tax increases that have been modeled and estimated by TPC in its comprehensive analysis of Secretary Clinton’s plans. We relied on TPC’s estimates even when they differed slightly from our own in order to provide consistency across estimates, though often we used our own estimates to divide and allocate TPC numbers as well as when no TPC estimate was available.

Our estimate of Secretary Clinton’s 28 percent limitation comes directly from TPC’s analysis, while our estimate of her capital gains reform combines TPC’s numbers for Secretary Clinton’s long-term holding period reform with our approximation of carried interest from TPC’s estimate for a larger set of proposals described in the following paragraph.

Our estimate of Clinton’s other taxes on higher earners combine our approximation of TPC’s estimate for marking derivatives to market and limiting the deferral in retirement accounts with TPC’s estimate for the 4 percent surtax above $5 billion, a Buffett rule, and estate tax changes, plus the Joint Committee on Taxation’s (JCT’s) estimate for closing the tax gap.

Similarly, our business tax estimates are based on TPC’s estimates of Secretary Clinton’s international tax reforms to prevent inversions and earnings stripping, and reductions in fossil fuel breaks for both individuals and businesses, plus JCT’s $1 billion estimate for the President’s proposal to impose an excise tax on certain crude oil and the campaign’s estimate for the proposal to clawback tax benefits from companies that move abroad, as well as JCT’s estimate of Congressman Dave Camp’s proposal to reform executive compensation.

TPC did not estimate Clinton’s proposed risk fee on financial institutions, but our estimates assume this fee is broadly similar to the one proposed by President Obama, which the JCT has estimated would raise $111 billion over a decade.

Our estimates of Secretary Clinton’s health offsets were based largely on CBO estimates of President Obama’s budget, which – like Secretary Clinton – would expand drug rebates and enact other drug savings. We also assume Secretary Clinton’s payment reform and anti-fraud efforts match those policies in the President’s budget that expand and reform accountable care organizations and bundled payments, and improve program integrity. To estimate the costs of allowing drug importation from other countries and repealing the deductibility of drug advertising, we rely on press reports of previous CBO scores. Finally, our estimate of Clinton’s “public option” is loosely based on CBO’s 2013 estimate of implementing a national “public option.” Although at the time CBO estimated savings of $160 billion through 2023, we predict Secretary Clinton’s plan would save less than one third of that – even against a new budget window – since it only allows states to establish a “public option,” rather than require them to do so.

Secretary Clinton’s immigration plan shares many components with the bill that passed the Senate in 2013. Although there are also many differences, we assume for simplicity that her immigration policy will save an amount similar to the Senate bill – about $100 billion on net due to a larger labor force paying nearly $400 billion more in taxes and receiving $300 billion more in government benefits, according to CBO’s most recent estimate of the President’s budget. In order to generate these savings, immigration reform would need to increase the size of the economy; consistent with CBO’s conventions, however, we assume no change in GDP. To avoid distorting information on the effect that immigration reform would have on the size of government as a share of GDP, we distributed all the (net) savings to the revenue side of the ledger rather than assuming both higher spending and revenue.

Absent from our offset estimates is any savings from business tax reform. Although Secretary Clinton has called for $275 billion of revenue from such reform, too little detail has been provided to assess the validity of this claim. In addition, our analysis was unable to estimate proposals to tax high frequency trading, cap individual drug costs at $250 per month, and strengthen the Volcker rule to prevent banks from making certain speculative investments in hedge funds though we suspect the impact of these policies will be generally small. Our analysis (as well as TPC’s) also does not estimate Secretary Clinton’s “exit” tax due to lack of detail.

Finally, we do not credit Secretary Clinton with any revenue from increasing Social Security taxes nor costs from increasing Social Security spending or enacting sequester relief. In our assessment, these changes represent goals but not concrete policy proposals.

Updated: An earlier version of this analysis mistakenly omitted a negative sign in the Memo line of the table above. This has now been corrected to indicate that Secretary Clinton’s unspecified business tax could result in $150 billion of deficit reduction.