Understanding Joe Biden's 2020 Health Care Plan

Democratic presidential nominee and former Vice President Joe Biden has proposed a significant agenda to address health care coverage and costs. He proposes to expand the Affordable Care Act (ACA) by increasing marketplace subsidies, adopting auto-enrollment, and offering a new public option available to those in the individual market or with employer coverage. The plan would also reduce the Medicare age from 65 to 60, establish a new long-term care tax credit, and increase funding for rural health and mental health services.

To finance the cost of his plan, Vice President Biden would enact reforms to reduce prescription drug prices, lower other health care costs, and raise taxes on capital gains and ordinary income for high earners and heirs.

We previously analyzed and explained Biden’s health proposal as part of our Primary Care paper, which also analyzed proposals from candidates Sanders, Warren, and Buttigieg. This paper updates that analysis for Biden’s proposal based on new policies and new estimates. We find:

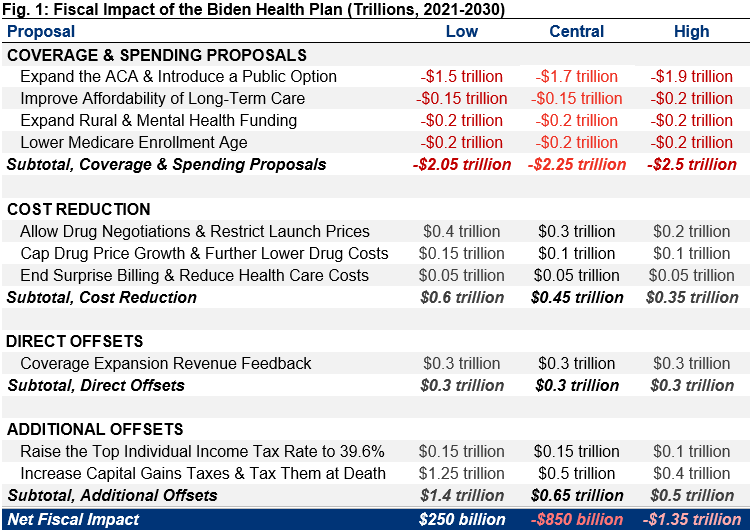

- Vice President Biden’s health plan and dedicated offsets would, on net, add $850 billion to deficits over the 2021-2030 budget window under our central estimate. It would save $250 billion under our low-cost estimate and add $1.35 trillion to deficits under our high-cost estimate. This assumes immediate implementation.

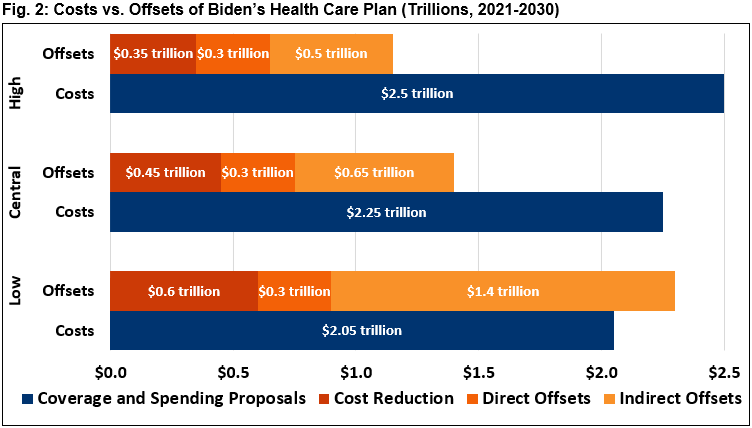

- Coverage expansion and other spending provisions in Biden’s plan would cost $2.25 trillion over ten years under our central estimate, while cost reduction provisions would save $450 billion, and new revenue would raise $950 billion.

- Biden’s plan would extend health care coverage to an additional 15 to 20 million people, out of 30 to 35 million who are currently uninsured.

- Biden’s plan would reduce national health expenditures by as much as 3 percent or increase them by as much as 1 percent. Under our central estimate, we find total costs will fall by 1 percent, with premiums and out-of-pocket costs declining slightly more than public costs increase.

This paper is part of US Budget Watch 2020, a project covering the 2020 presidential election. In the coming weeks and months, we will continue to publish analyses of candidate proposals that are having the greatest impact on the debate over our nation’s future. You can read more of our policy explainers and factchecks here. US Budget Watch 2020 is designed to inform the public and is not intended to express a view for or against any candidate or any specific policy proposal. Candidates’ proposals should be evaluated on a broad array of policy perspectives, including but certainly not limited to their approaches on deficits and debt.

Summarizing the Biden Health Care Plan

Vice President Biden has proposed to expand the Affordable Care Act, establish a new public insurance option, lower the Medicare enrollment age, increase the affordability of long-term care, and increase other health care spending. He would offset the costs of these proposals by containing and reducing spending on prescription drugs and ending surprise billing, through the revenue feedback from expanding coverage, and by increasing taxes on high-income households and heirs.

On net, we estimate these policies would add $850 billion to deficits over ten years under our central estimate. We estimate they would save $250 billion under our low-cost estimate and add $1.35 trillion to deficits under our high-cost estimate.

We generated low-, central, and high-cost estimates for Biden’s plan to capture the likely cost range. Each scenario relies on different policy and estimating assumptions to present estimates that are rough, rounded, subject to change, and reflect our best understanding of the plan, given the information currently available on Biden’s campaign website and related material. The low- and high-cost estimates are not absolute bounds. Our estimates are “steady state” estimates that assume the plan is enacted immediately and ignore the effects of the COVID-19 pandemic and the subsequent economic crisis. Estimates are from Fiscal Year (FY) 2021 through FY 2030.

Changes to Our Estimate of the Biden Health Care Plan

In our Primary Care paper – originally published in January and updated in February – we estimated that Vice President Biden’s health care plan would add $800 billion to deficits over the next ten years under our central estimate. Under our low-cost estimate, we found the plan would reduce deficits by $300 billion, and under our high-cost estimate, we found it would increase deficits by $1.3 trillion. We now estimate each scenario will be roughly $50 billion more costly over a decade.

While our overall estimates remain similar in this new analysis, we now believe some elements of the plan will cost more and others less than previously estimated. Specifically:

- We now estimate Biden’s long-term care provisions will cost $150 to $200 billion ($150 billion under our central estimate), down from $300 to $400 billion ($350 billion under central estimate). Our original estimates were largely adjusted from estimates of tax credits for informal caregivers proposed by Melissa Favreault and Brenda Spillman of the Urban Institute.1 Our new estimate is mostly based on a score of the major proposal from the Tax Policy Center.2

- We no longer estimate significant revenue from eliminating advertising deductibility for drug manufacturers. We originally estimated revenue would round to $50 billion over a decade. However, more recent estimates suggest revenue closer to $15 billion. We now include these savings within provisions to reduce drug costs.3

- We now estimate that increasing the top individual income tax rate to 39.6 percent will raise $150 billion, as opposed to $100 billion, in our central and low-cost scenarios. This is based on four modeled estimates of the Biden tax plan.4

- We now estimate that increasing the capital gains tax rate and taxing capital gains at death will raise $500 billion under our central estimate, as opposed to $550 billion. This is based on four modeled estimates of the Biden tax plan. We continue to assume the campaign-provided figure of $1.25 trillion under our low-cost estimate. However, we view this figure as well outside the range of likely outcomes.

- We incorporate the cost of a new proposal to lower the Medicare eligibility age. In April, Biden announced that, as President, he would lower the Medicare eligibility age from 65 to 60. Though the cost of this could vary depending on specific details, we assume it would involve reducing existing eligibility criteria for all parts of Medicare and estimate it would cost approximately $200 billion over a decade.

Details of the Biden Health Care Plan

Coverage Expansion and Other Spending

Vice President Biden has proposed expanding health care coverage by increasing the size of ACA subsidies, implementing a public option to compete with private insurance, lowering the Medicare enrollment age, increasing access to and affordability of long-term care and insurance, and expanding health funding for rural communities and mental health care. We estimate these policies would have a gross cost between $2.05 trillion and $2.5 trillion, with a central estimate of $2.25 trillion.

| Expand the ACA & Introduce a Public Option | -$1.5 trillion | -$1.7 trillion | -$1.9 trillion |

Biden’s plan would build on the Affordable Care Act by expanding current subsides, establishing a new public insurance option, and automatically enrolling low-income individuals into premium-free coverage.

His plan would increase the generosity of ACA premium subsidies in several ways. Currently, subsidies are determined based on the cost of a “silver” plan with a 70 percent actuarial value.5 Biden proposes basing subsidies on the cost of a “gold” plan with an 80 percent actuarial value. He would further increase subsidies by reducing the share of income that subsidized households would be expected to pay for their insurance and capping that share at 8.5 percent of income for all Americans (currently, those below 400 percent of the federal poverty level are capped at 9.8 percent, and those above that threshold have no cap).6

Biden would also establish a new Medicare-like public option that could be purchased with ACA subsidies. Because Medicare rates are generally lower than private insurance, the public option would be cheaper than alternatives in many cases – though competition from the public option could reduce the cost of private insurance as well. The public option would be available to those who lack insurance, those who purchase insurance through the exchanges, and low-income people in states that have not expanded Medicaid under the ACA (these individuals would receive premium-free coverage).7 The public option and subsidized coverage in the exchanges would also be made available to those with employer coverage (which implies a repeal of the ACA’s employer mandate). Biden would automatically enroll low-income beneficiaries into the public option when they interact with public institutions and programs such as public schools or the Supplemental Nutrition Assistance Program (SNAP, or “food stamps”).

Though not all details of Biden’s plan have been made public, the plan appears to be very similar to Variation #2 of the Healthy America Program proposed by Blumberg, Holahan, Buettgens, and Zuckerman of the Urban Institute (Healthy America) – which is cited on Biden’s campaign website.8 The most significant difference is that Biden would maintain the existing Medicaid program in roughly its current form, unlike Healthy America. Accounting for these and other differences, we estimate the proposal would cost about $1.7 trillion over a decade under our central estimate.9 Given uncertainty about both the estimates and plan details, we assume a cost of $1.5 trillion and $1.9 trillion under our low- and high-cost estimates, respectively.10

| Improve Affordability of Long-Term Care | -$150 billion | -$150 billion | -$200 billion |

Under current law, many Americans lack access to long-term services and support and instead rely on family caretakers. Those who do use long-term care facilities often pay out of pocket until they exhaust their assets, at which point Medicaid covers the cost. Biden would expand access to and defray the cost of long-term care in two primary ways. First, he would establish a $5,000 tax credit for informal or family caregivers to cover out-of-pocket expenses based on the Credit for Caring Act.11 Second, he would increase the generosity of current tax benefits for purchasing long-term care insurance (including insurance paid for out of retirement savings). Based largely on estimates from the Tax Policy Center,12 we find this would cost $150 billion over a decade under our central and low-cost estimates, and $200 billion under our high-cost estimate.13

| Expand Rural Health & Mental Health Funding | -$200 billion |

Biden would increase federal health care spending in several other areas – most significantly rural health care and mental health funding. For instance, he would double federal funding for Community Health Centers – more than half of which are located in rural communities. He would also increase funding for the USDA Community Facilities Direct Loan and Grant Program to build new health clinics and deploy telehealth services, reverse scheduled cuts to Disproportionate Share Hospital (DSH) payments for hospitals serving those without insurance, and adopt several other provisions included in the Save Rural Hospitals Act to support rural hospitals and expand care in rural communities.14 Separately, Biden would improve enforcement of mental health parity laws and expand funding for mental health services. We estimate these provisions would cost approximately $200 billion over a decade under our low-, central, and high-cost estimates.

| Lower Medicare Enrollment Age | -$200 billion |

In April, as part of his proposed response to the COVID-19 pandemic and subsequent economic crisis, Biden proposed lowering the Medicare eligibility age from 65 to 60. This would allow seniors to leave their employer-provided plan, or any other plan accessed through the Affordable Care Act or the new public option, before they reach retirement age although those who prefer to remain on their current plan may do so. Any potential costs would be financed out of general revenues to avoid negatively affecting the Medicare Trust Fund. We estimate this would cost $200 billion over a decade under our low-, central, and high-cost estimates.

| Subtotal, Coverage & Spending Proposals | -$2.05 trillion | -$2.25 trillion | -$2.5 trillion |

Cost Reduction

While Vice President Biden would increase overall health care spending, he proposes several measures to reduce both private and public health care costs. He would reduce prescription drug prices in a number of ways – most directly by restricting the launch price of new drugs based on an international average – and reduce other costs as well. We estimate these proposals would save between $350 billion and $600 billion over a decade, with a central estimate of $450 billion.

| Allow Drug Negotiations & Restrict Launch Prices | $400 billion | $300 billion | $200 billion |

To reduce prescription drug spending for both individuals and the federal government, Biden would use the federal government’s market and regulatory power to limit prices. Specifically, he would repeal the law that bans Medicare from negotiating drug prices directly.15 For new drugs and biologics sold without competition, Biden would establish an independent board to set reasonable prices based on the average price in other countries (when available). This price would be used in Medicare and the public option and would also be available for private plans on the individual market. Assuming the board relies on a proxy price when there is no international average (as many drugs are introduced first in the U.S.),16 we estimate these proposals would save about $300 billion over a decade under our central estimate, with savings of $400 billion under our low-cost estimate and $200 billion under our high-cost estimate.17

| Cap Drug Price Growth & Further Lower Drug Costs | $150 billion | $100 billion | $100 billion |

Biden would also reduce prescription drug prices in several other ways. Most significantly, he would limit price increases for name-brand drugs, biotech drugs, and “abusively priced” generic drugs to the rate of inflation. In order to participate in Medicare or the new public option, drug manufacturers would be required to adhere to this limit, which would be enforced with a tax penalty. In addition, Biden would allow the purchase of safe prescription drugs from other countries and would eliminate the current deduction for prescription drug advertising, as proposed by the End Taxpayer Subsidies for Drug Ads Act.18 Finally, the plan supports “numerous proposals” to encourage the accelerated development and introduction of generic drugs to increase competition. We estimate these proposals would save about $100 billion under our central and high-cost estimates. Our low-cost estimate of $150 billion assumes additional unspecified policies to encourage generics.19

| End Surprise Billing & Reduce Health Care Costs | $50 billion |

Under his plan, Biden would enact several other provisions designed to reduce non-drug health care costs. He would end the practice of “surprise medical billing” – which occurs when a person goes to an in-network facility but receives care from an out-of-network clinician at an additional out-of-network cost – by requiring that providers at an in-network facility be paid in-network rates when the patient has little control over which provider he or she sees. Biden would also address the issue of increasing market concentration among hospitals and health care providers by using existing antitrust authority to block health care industry mergers and acquisitions that would result in more expensive, lower quality, or less accessible care. Finally, he would partner with the health care workforce to deploy innovations designed to improve outcomes and lower costs. We estimate these provisions would save approximately $50 billion over ten years under our low, central, and high-cost estimates.20

| Subtotal, Cost Reduction | $0.6 trillion | $0.45 trillion | $0.35 trillion |

Direct Offsets

Vice President Biden’s health spending proposals would be partially offset by changes in health-related revenue. Expanding subsidized coverage would reduce employer-provided health coverage and thus reduce the cost of tax breaks associated with that coverage. We estimate this would save about $300 billion over a decade.

| Coverage Expansion Revenue Feedback | $300 billion |

By expanding coverage in the exchanges and creating a public option, Biden would reduce the number of Americans who receive health insurance benefits through their employer’s plan, could also reduce the per-person cost of employer-provided health insurance, and would lower out-of-pocket costs for many Americans. As a result, wages would be higher, and existing income and payroll tax breaks related to health care – especially the tax exclusion for employer-provided health insurance – would become less valuable. We estimate this would lead to roughly $300 billion of additional income and payroll tax revenue over a decade.21

| Subtotal, Direct Offsets | $0.3 trillion | $0.3 trillion | $0.3 trillion |

Additional Offsets

Vice President Biden proposes financing his health care plan by increasing taxes on high earners. Specifically, he would increase the top individual income tax rate, tax capital gains as ordinary income for high earners, and eliminate the stepped-up basis of capital gains at death. We estimate these proposals would likely generate between $500 billion and $1.4 trillion of new revenue for the federal government over a decade, with a central estimate of $650 billion.

Methodological note: Our low-cost estimates are based on numbers provided by the Biden campaign and reported by Jennifer Epstein of Bloomberg News.22 Our central and high-cost estimates are based on modeled estimates of the Biden tax plan published by four independent estimators, as featured in our paper, Understanding Joe Biden’s 2020 Tax Plan. Future estimates may change as Biden’s tax policies are modeled by other independent estimators.

| Raise the Top Individual Income Tax Rate to 39.6% | $150 billion | $150 billion | $100 billion |

Under current law, individuals making over $207,000 and couples making over $415,000 face a marginal income tax rate of 35 percent; individuals making over $518,000 and couples making over $622,000 pay a 37 percent top rate. Between 2013 and 2018, and starting in 2026 under current law, the top tax rate was and will be 39.6 percent. To help pay for his health care plan, Biden has proposed an immediate increase in the top rate to 39.6 percent. This would generate between $100 billion and $150 billion of new revenue over ten years (all by 2026).23

| Increase Capital Gains Taxes & Tax Them at Death | $1.25 trillion | $500 billion | $400 billion |

Under current law, net income from the sale of assets held longer than a year and related dividends is taxed at a top rate of 20 percent (plus a 3.8 percent surtax), whereas earned income is taxed at a top rate of 37 percent (plus a 3.8 percent payroll tax). Furthermore, when one generation inherits an asset from another, the cost basis of that asset gets “stepped-up” from the cost at the time of purchase to the cost at the time of transfer, meaning that the asset’s appreciated value escapes taxation permanently.

Biden would eliminate the preferential treatment of capital gains and dividends for high earners. First, capital gains and dividends would be taxed as ordinary income at a rate of 39.6 percent for individuals and couples earning more than $1 million. In addition, Biden would eliminate the stepped-up basis for capital gains at death. The campaign does not specify whether capital gains would be “carried over” – meaning the original basis would still apply – or taxed at death, nor what exceptions or exemptions would apply. However, in our paper on Biden’s tax plan, we assumed his plan would resemble an Obama-era proposal to tax capital gains at death with exclusions based on size and type of assets – though the campaign has said the plan would not apply below $400,000.

Not only would taxing capital gains at death generate direct revenue, it would also magnify the revenue effect of raising the capital gains rate by reducing the incentive for taxpayers to hold assets until death.24 We find these provisions would raise about $500 billion over the next decade under our central estimate.25 Our low-cost scenario assumes $1.25 trillion of revenue, based on figures from the Biden campaign.26 Under our high-cost estimate, which assumes stronger behavioral responses, these provisions would generate $400 billion of revenue. These estimates are particularly sensitive to assumptions of how responsive asset sales are to capital gains rates.

| Subtotal, Additional Offsets | $1.4 trillion | $0.65 trillion | $0.5 trillion |

| Net Fiscal Impact | $250 billion | -$850 billion | -$1.35 trillion |

What is the Fiscal Impact of the Biden Health Care Plan?

Under our central estimate, we find Vice President Biden’s health plan would increase deficits by $850 billion over a decade. The plan would reduce deficits by $250 billion under our low-cost estimate and increase deficits by $1.35 trillion under our high-cost estimate.

Under our central estimate, gross costs of $2.25 trillion would be partially offset by $450 billion of cost reductions and $950 billion of revenue. Under our high-cost scenario, gross costs of $2.5 trillion would be partially offset by $1.15 trillion of savings and revenue. Our low-cost scenario shows $2.05 trillion of gross costs that are more-than-offset by $2.3 trillion of savings and revenue.

These figures represent the federal fiscal impact of the plan, not the effect on national health expenditures. And they only describe Biden’s health plan and related offsets; they do not account for other spending or revenue changes in his agenda.

Importantly, our analysis of the Biden health care plan is based on data from before the onset of the COVID-19 pandemic and subsequent economic crisis. Therefore, all estimates do not reflect recent changes in baseline federal spending and revenue, health care spending, employment levels, or other economic metrics that may have occurred since the onset of the crisis.

Given current rates of unemployment, we believe the Biden plan would cost somewhat more over the course of the current economic downturn than under our estimates, as it would subsidize and cover more Americans. Revenue collection under the plan might also be modestly lower to the extent income among high-income households is lower than it otherwise would have been.

What Are the Other Impacts of the Biden Health Care Plan?

While our analysis is focused on the fiscal impact of Vice President Biden’s health care plan, it is critical to also consider other implications. These include, but are not limited to, the plan’s impact on health insurance coverage, national health expenditures, distribution of spending, and economic performance, as well as its effect on quality of care, access to care, provider viability, medical and pharmaceutical innovation, federal tax capacity, and other factors.

Coverage

Prior to the COVID-19 pandemic and economic crisis, 30 to 35 million people were projected to lack comprehensive health insurance at some point in a given year over the next decade.

We estimate Biden’s plan would reduce the number of uninsured people by 15 to 20 million, mainly by improving the affordability of health coverage and auto-enrolling low-income Americans into coverage.

It is worth noting that our estimate for coverage expansion under the Biden plan has not changed since February, despite the fact that Biden has since added lowering the Medicare enrollment age from 65 to 60 to his plan. While we believe this policy would indeed further expand coverage, its effect would be relatively modest considering the small percentage of Americans in that age group who currently lack coverage and the fact that Biden’s other proposals would largely close the gap.

Importantly, our estimates do not incorporate the effects of the current pandemic and economic crisis. In light of the crisis, the number of uninsured Americans under current law and the number covered under the Biden plan are both likely to be higher than in our estimates.

National Health Expenditures

While Biden’s plan would increase federal health spending, its potential effects on total health spending – including spending by households and businesses – are more uncertain. Generally speaking, national health expenditures would grow as a result of expanding coverage to more individuals, covering more services, and reducing or eliminating cost sharing for many individuals. Conversely, expenditures would shrink due to lower drug costs, reduced reimbursements to providers, and administrative savings and efficiencies.

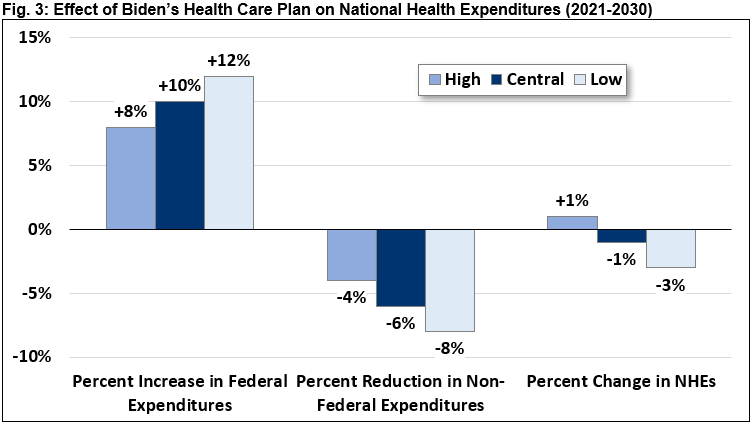

There remains significant uncertainty over how the Biden plan would affect overall health care spending, and especially the extent to which the public option would put downward pressure on overall costs. By our very rough estimate, federal spending would raise by 8 to 12 percent over the next decade while private, state, and local spending would decline by 4 to 8 percent.

Overall, we estimate national health expenditures could increase by as much as 1 percent or fall by as much as 3 percent. Under our central estimate, Biden’s plan would reduce national health expenditures by 1 percent.

Importantly, these estimates are based on pre-COVID data, and therefore do not reflect any changes in national health expenditures that have occurred since the onset of the pandemic.

Economic and Distributional Effects

Overall, we expect the Biden health care plan to substantially increase the progressivity of overall fiscal policy. New spending would be relatively progressive, with additional subsidies going primarily to low- and middle-income families. At the same time, new taxes would be highly progressive, imposed almost entirely on those with more than $400,000 per year or more of annual income.

The macroeconomic effect of the Biden health care plan is more uncertain. Under traditional economic models such as those used by the Congressional Budget Office, we expect the combination of higher tax rates and higher deficits under the plan to modestly reduce gross domestic product by reducing labor and investment. We do not expect this effect to be large enough to materially change the estimated fiscal impact of the plan.

Conclusion

Vice President Biden has put forward a comprehensive health care plan that builds on the Affordable Care Act, a program he helped to shepherd into law as Vice President during the Obama Administration.

While the plan would most likely increase deficits over the next decade, it would also reduce out of pocket costs and premiums for most individuals and would extend health insurance coverage to between 15 and 20 million uninsured Americans. It might modestly reduce overall national health expenditures as well – though these effects are highly uncertain.

The COVID-19 pandemic and subsequent economic crisis have put an important spotlight on the issue of health care coverage, cost, and access. But they have also worsened an already unsustainable fiscal situation by further expanding deficits and debt.

It is important for the public to understand the fiscal impact of the health proposals candidates put forward and to weigh those implications against other important factors.

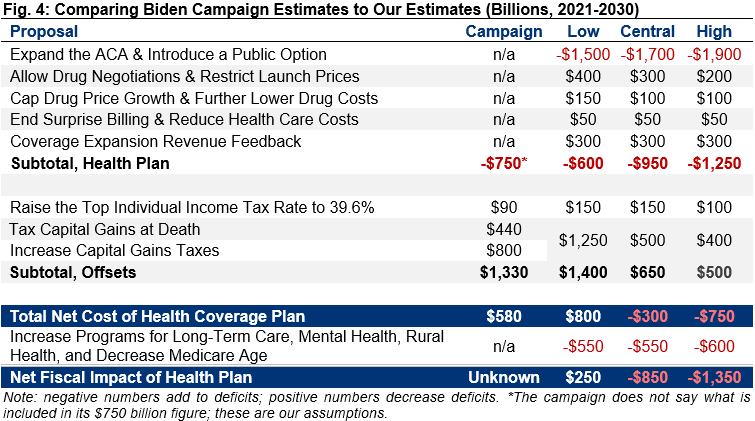

Appendix: Comparing Our Estimates to the Biden Campaign’s Estimates

Excluding the effects of lowering the Medicare age, Vice President Biden has said his health care plan would cost $750 billion and that his revenue offsets would raise over $1.3 trillion.27 The campaign has not clarified what is counted as its health plan or what budget window its estimates cover. A reasonable assumption would be that the campaign’s $750 billion estimate incorporates all direct spending and revenue effects of its health coverage plan, but not its plans to expand long-term care or funding for rural health or mental health services. If so, the campaign’s $750 billion cost estimate would fall between our low-cost estimate of $600 billion and our central estimate of $950 billion. The campaign’s revenue figures are similar to our low-cost estimate.

1 See Melissa M. Favreault and Brenda C. Spillman, “Tax Credits for Caregivers' Out-of-Pocket Expenses and Respite Care Benefits: Design Considerations and Cost and Distributional Analyses,” Urban Institute, January 2018, https://www.urban.org/research/publication/tax-credits-caregivers-out-pocket-expenses-and-respite-care-benefits-design-considerations-and-cost-and-distributional-analyses.

2 The Tax Policy Center estimates that Biden’s proposed tax credit for caregivers would cost approximately $100 billion over ten years. See Gordon B. Mermin, Surachai Khitatrakun, Chenxi Lu, Thornton Matheson, and Jeffrey Rohaly, “An Analysis of Former Vice President Biden’s Tax Proposals,” Tax Policy Center, March 2020, https://www.taxpolicycenter.org/publications/analysis-former-vice-president-bidens-tax-proposals/full

3 This estimate range is based on four modeled estimates shown in our recent paper, “Understanding Joe Biden’s 2020 Tax Plan”

4 This estimate range is based on four modeled estimates shown in our recent paper, “Understanding Joe Biden’s 2020 Tax Plan”

5 Actuarial value of 70 percent means that, on average, 70 percent of covered health costs would be paid by the insurer (financed with premiums) and 30 percent would be paid through deductibles, copayments, and coinsurance.

6 Those earning less than 400 percent of the Federal Poverty Level (FPL) are generally eligible for premium subsidies if they buy insurance on the insurance exchanges. Subsidies are calculated based on income and family size but do not generally vary based on the insurance package someone buys. Instead, subsidies are set based on the price of the second-lowest cost available silver plan – offering buyers a large enough subsidy to limit the cost of that plan to anywhere from 2.06 to 9.78 percent of income. For example, a family of four making $40,000 (about 150 percent of the FPL) would benefit from a cap of roughly 4 percent of income. If the second-lowest priced silver plan in their market costs $20,000, their subsidy would total $18,400 – allowing them to purchase a silver plan for $1,600 (4 percent of income). They could also choose to buy a cheaper “bronze” plan and use their subsidy to further reduce or eliminate costs, or for an additional price, they could purchase a gold or platinum plan (if a such a plan cost $30,000, the family would pay $11,600 – the cost of the plan minus the $18,400 subsidy). No subsidy is available for those making above 400 percent of the FPL or for those who would be able to buy the second-lowest cost silver plan for below the cap on their percentage of income.

7 States that have already expanded coverage could also transfer Medicaid beneficiaries to the public option with a “Maintenance of Effort” payment.

8 See Linda J. Blumberg, John Holahan, Matthew Buettgens, and Stephen Zuckerman, “The Healthy America Program, An Update and Additional Options,” Urban Institute, September 2019, https://www.urban.org/research/publication/healthy-america-program-update-and-additional-options.

9 See Ibid. Variation #2 of the Healthy America Program would cost the federal government about $141 billion in 2020 and roughly $1.5 trillion through 2029. To get $1.7 trillion, we removed the costs and savings associated with covering Medicaid acute care enrollees under the public option, removed Medicare Part D drug savings (counted elsewhere), and adjusted to the 2021-2030 budget window. Figures do not include income tax offsets, which are counted as part of “revenue feedback” later in the analysis.

10 The Biden campaign has estimated its core health care plan would cost $750 billion over ten years. Accounting for drug and health savings and revenue feedback, we estimate a net cost of $900 billion under our central estimate, savings of $550 billion under our low-cost estimate, and $1.2 trillion under our high-cost estimate – meaning the campaign’s numbers (if we understand them correctly) fall between our low and central estimates. See Appendix for more discussion.

11 S. 1443/H.R. 2730, the Credit for Caring Act, would offer a 30 percent credit, up to $3,000, on direct caregiving costs that exceed $2,000 in a taxable year.

12 The Tax Policy Center estimates that Biden’s proposed tax credit for caregivers would cost approximately $100 billion over ten years. See Gordon B. Mermin, Surachai Khitatrakun, Chenxi Lu, Thornton Matheson, and Jeffrey Rohaly, “An Analysis of Former Vice President Biden’s Tax Proposals,” Tax Policy Center, March 2020, https://www.taxpolicycenter.org/publications/analysis-former-vice-president-bidens-tax-proposals/full

13 The Biden campaign does not specify how it would make existing tax benefits for long-term care insurance more generous. For purposes of scoring this provision, we assume the cost is similar to that of a Bush-era proposal to move the long-term care insurance deduction from itemized to “above the line,” which would remove it from income before the standard or itemized deductions.

14 H.R. 2957, the Save Rural Hospitals Act, would also eliminate Medicare sequestration for rural hospitals, reverse cuts to the reimbursement of bad debt for Critical Access Hospitals (CAHs) and rural hospitals, extend payment levels for low-volume hospitals and Medicare Dependent Hospitals (MDHs), reinstate revised diagnosis-related group payments for MDHs and Sole Community Hospitals (SCHs), reinstate hold harmless treatment for hospital outpatient services for SCHs, delay application of penalties for failure to be a meaningful electronic health record user, make permanent increased Medicare payments for ground ambulance services in rural areas, extend Medicaid primary care payments, equalize beneficiary copayments for services furnished by CAHs, establish a “Community Outpatient Hospital” program, enhance grant funding for rural hospitals, and enact regulatory reforms. Although Biden does not say specifically which provisions he would seek to enact as part of his plan, we assume all of them would be enacted.

15 Under Medicare Part D, seniors purchase privately-run but publicly-funded prescription drug insurance, and each insurance company negotiates its own rates with drug companies. In theory, allowing the Medicare program (or the Secretary of Health and Human Services) to negotiate on behalf of all Part D insurance companies, as well as the new public option, could push down prices by taking advantage of the large monopsony market power the government would have. However, without any ability to restrict what drugs are covered or to regulate prices, the federal government would have little leverage and thus savings would be modest. See Committee for a Responsible Federal Budget, “Could Negotiating Medicare Drug Prices Save $300 Billion Per Year?” March 2016, https://www.crfb.org/blogs/negotiating-medicare-drug-prices-could-save-300-billion-year.

16 In the case of no available international reference price – which would be common for new drugs first introduced in the U.S. – we assume prices would be similar to the average manufacturer price (AMP) provision in H.R. 3, the Elijah E. Cummings Lower Drug Costs Now Act of 2019, which would limit prices to 85 percent of the AMP.

17 This estimate is largely based on CBO’s preliminary analysis of the drug price negotiation methods in H.R. 3, the Elijah E. Cummings Lower Drug Costs Now Act of 2019. The range reflects a number of factors, but most significantly depends where the reasonable price is set relative to the external reference price (under H.R. 3, it is capped at 120 percent of the average price with a floor at the lowest price in any country).

18 S. 73, the End Taxpayer Subsidies for Drug Ads Act, would prohibit tax deductions for expenses relating to “Direct-to-Consumer” (DTC) advertising of prescription drugs. DTC advertising refers to any dissemination, by or on behalf of a sponsor of a prescription drug product, of an advertisement in regards to the drug product and primarily targeted to the general public.

19 Savings estimates for many of these policies are featured in the health section of our Budget Offsets Bank. Note that savings estimates will differ somewhat from those in Biden’s plan due to interactions.

20 The Congressional Budget Office (CBO) scored one plan to ban surprise medical billing – H.R. 2328, the Reauthorizing and Extending America’s Community Health Act – as saving $20 billion from 2020 to 2029. Depending on the details, actual savings could be somewhat lower or somewhat higher. Absent more specifics, we expect Biden’s other proposals to generate modest additional savings for the federal government.

21 Blumberg, Holahan, Buettgens, and Zuckerman estimate Variation #2 of the Healthy America Program would raise about $16 billion from the income tax exclusion in 2020. We adjusted these figures to account for payroll taxes and other tax preferences, partially offset by reduced revenue from the lack of an employer mandate and higher Social Security benefits associated with higher wages. We then extrapolated it over the 2021-2030 period.

22 See Jennifer Epstein, “Biden to Target Tax-Avoiding Companies Like Amazon with Minimum Federal Levy,” Bloomberg News, December 4, 2019, https://www.bloomberg.com/news/articles/2019-12-04/biden-to-target-tax-avoiding-companies-with-minimum-federal-levy.

23 This estimate range is based on four modeled estimates shown in our recent paper, “Understanding Joe Biden’s 2020 Tax Plan” The Biden campaign estimated $90 billion of net revenue.

24 Though not specified on the campaign’s website, we assume qualified dividends would also be taxed as ordinary income for those earning over $1 million and that the $1 million threshold is the same for couples and individuals. We assume the proposal to tax capital gains at death is similar to the proposal put forward in President Obama’s FY 2017 budget, which included a $100,000 exemption along with special rules for real estate and other non-financial assets. See “General Explanations of the Administration’s Fiscal Year 2017 Revenue Proposals,” U.S. Treasury, February 2016, https://www.treasury.gov/resource-center/tax-policy/Documents/General-Explanations-FY2017.pdf#page=166.

25This estimate range is based on four modeled estimates shown in our recent paper, “Understanding Joe Biden’s 2020 Tax Plan”

26 The campaign estimates $800 billion of revenue from taxing capital gains as ordinary income and $440 billion from ending stepped-up basis at death.

27 See Stephanie Armour, “Biden’s New Plan for Health Care Is a Nod to the Past,” The Wall Street Journal, July 15, 2019, https://www.wsj.com/articles/bidens-new-plan-for-health-care-is-a-nod-to-the-past-11563184800; and Jennifer Epstein, “Biden to Target Tax-Avoiding Companies Like Amazon With Minimum Federal Levy,” Bloomberg News, December 4, 2019, https://www.bloomberg.com/news/articles/2019-12-04/biden-to-target-tax-avoiding-companies-with-minimum-federal-levy.