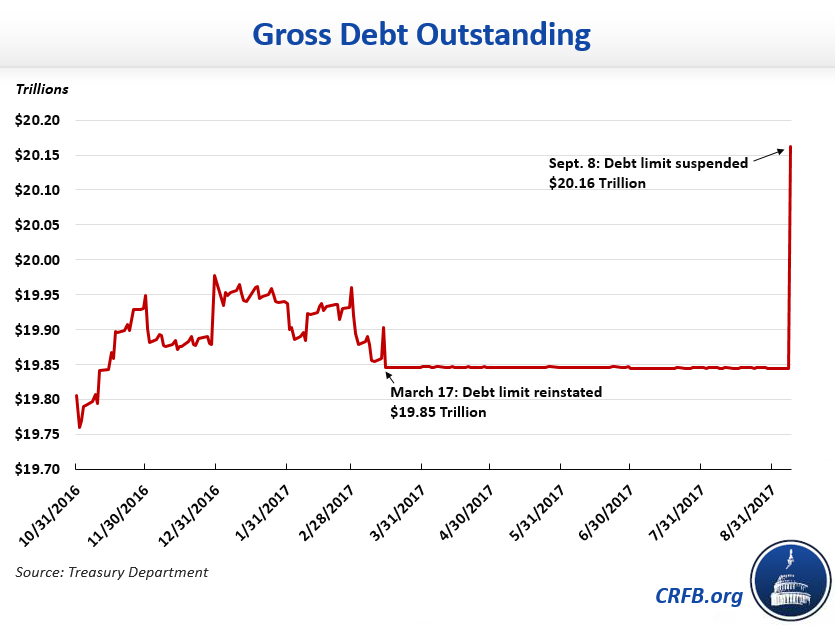

Why Did Debt Jump $318 Billion in One Day?

On September 8, 2017, gross U.S. debt increased almost $318 billion after President Trump signed legislation temporarily suspending the debt limit as part of a deal to fund the government and the emergency response to Hurricane Harvey. However, the large spike in debt is not particularly noteworthy: debt is largely catching up to what it would have been under normal operating procedures if the Treasury Department was not taking special actions to avoid hitting the debt limit.

For the last century, the debt ceiling has limited the total amount of money the government can borrow. After being suspended in November 2015, the debt limit was reinstated on March 16, 2017 at $19.809 trillion, at which point the government could not issue new debt (gross debt was higher than the limit because about $36 billion was not subject to the limit). As such, gross debt stayed flat at around $19.845 trillion between March 16 and September 7.

The federal government continued to run sizeable deficits, but the Treasury Department used a series of “extraordinary measures,” such as suspending payments to certain federal pension funds, to keep the debt from breaching the limit. These measures can only be used for a limited amount of time, and according to Treasury Secretary Steven Mnuchin it was critical that Congress raise the debt limit by the end of September to avoid defaulting on the government's obligations.

Once the suspension was signed, Treasury immediately started unwinding its extraordinary measures and repaid most of the money it borrowed from different government accounts. Debt will likely rise even further in the next few days and weeks as Treasury restores its cash balance.

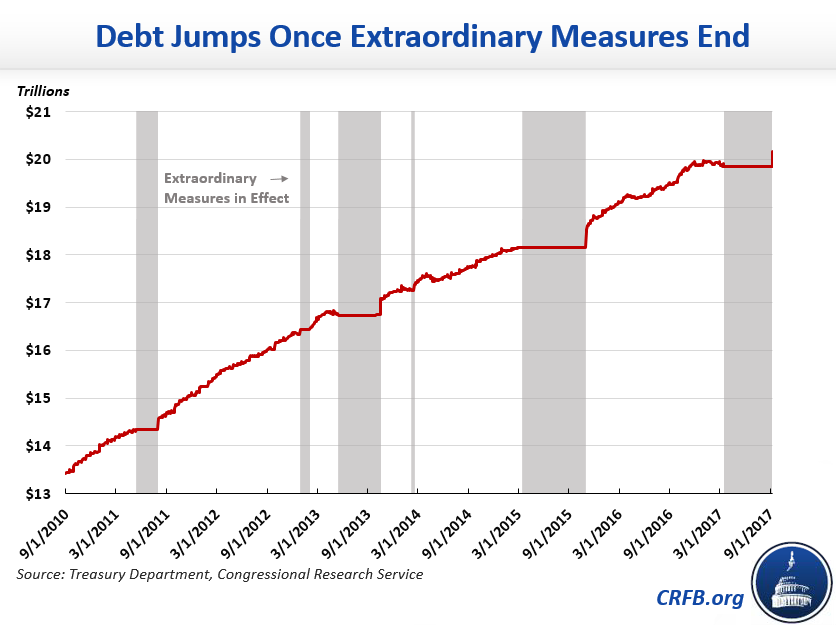

These spikes in overall debt regularly occur once the debt ceiling is raised or suspended after a long period of extraordinary measures. There was an even larger jump on November 2, 2015 after the Bipartisan Budget Act of 2015 temporarily suspended the debt limit following six months of extraordinary measures. The limit is currently set to return on December 9, 2017 at whatever level gross debt is at that point, which will likely be followed by a similar plateauing of debt until lawmakers raise the debt limit to avoid default.

As we have noted several times, the debt limit is one of the only fiscal constraints we have, but its current structure makes it a flawed check on federal borrowing. It should be reformed to better encourage fiscal discipline while removing the threat of defaulting on the debt. But even if the debt ceiling were modified, debt will continue to rise both in nominal terms and as a share of the economy without meaningful changes that address the key drivers of our fiscal imbalance.