CBO Scores the Limit, Save, Grow Act

Update (4/26/2023): The Congressional Budget Office released an estimate of the House Rules Committee amendments to the bill, reducing the savings of the bill by a net $30 billion. The analysis below has been updated to reflect those changes.

The Congressional Budget Office (CBO) just released its official score of House Republicans' Limit, Save, Grow Act of 2023 – a bill to address the debt ceiling and reduce federal spending. The bill would suspend the debt ceiling through either March 31, 2024 or a $1.5 trillion increase from the current $31.4 trillion ceiling - whichever comes first. CBO finds the bill would save $4.8 trillion through FY 2033, with about $4.2 trillion of policy savings and $543 billion of interest savings.

The below analysis is an update to our prior piece, What's In the Limit, Save, Grow Act?, incorporating CBO's new score. We had originally estimated $4.5 trillion of total savings.

The Limit, Save, Grow Act would return total discretionary spending to the Fiscal Year (FY) 2022 level in FY 2024 and cap annual growth at 1 percent for a decade thereafter; rescind unspent COVID relief funds; repeal most of the Inflation Reduction Act's (IRA) energy and climate tax credit expansions; rescind the IRA's increased Internal Revenue Service (IRS) funding; make changes to energy, regulatory, and permitting policies; impose or expand work requirements in several federal safety net programs; and prevent implementation of President Biden's student debt cancellation and Income-Driven Repayment (IDR) expansion.

What's in the Limit, Save, Grow Act of 2023?

| Policy | Ten-Year Savings |

|---|---|

| Return discretionary spending to FY 2022 level in FY 2024, then grow 1 percent annually for a decade | $3.2 trillion |

| Repeal energy tax credits and spending | $540 billion |

| Prevent student debt cancellation and IDR expansion | $460 billion |

| Expand work requirements in Medicaid, SNAP, and TANF | $120 billion |

| Rescind unused COVID relief funds | $30 billion |

| Enact reforms related to energy regulations and permitting | $3 billion |

| Repeal mandatory IRS funding for enforcement, operations, and customer service | -$120 billion |

| Require Congressional approval of major rules and regulations | unknown |

| Total Policy Savings | $4.2 trillion |

| Interest | $543 billion |

| Total Savings | $4.8 trillion |

Sources: Congressional Budget Office, CBO score of Rules Committee amendment, and Committee for a Responsible Federal Budget.

Most of these savings would come from limits on discretionary spending. The FY 2023 omnibus appropriations package set total discretionary budget authority (BA) at $1.65 trillion, about 8 percent above the FY 2022 level and 37 percent above the FY 2017 level. The Limit, Save, Grow Act would set ordinary discretionary budget authority at $1.47 trillion in FY 2024 – consistent with the FY 2022 level inclusive of changes in mandatory program spending (CHIMPS) – and then grow appropriations by 1 percent per year through FY 2033. After accounting for various adjustments the legislation makes for spending on program integrity and disaster relief, we estimate the bill would spend about $1.5 trillion in FY 2024 and then grow slightly faster than 1 percent annually thereafter.

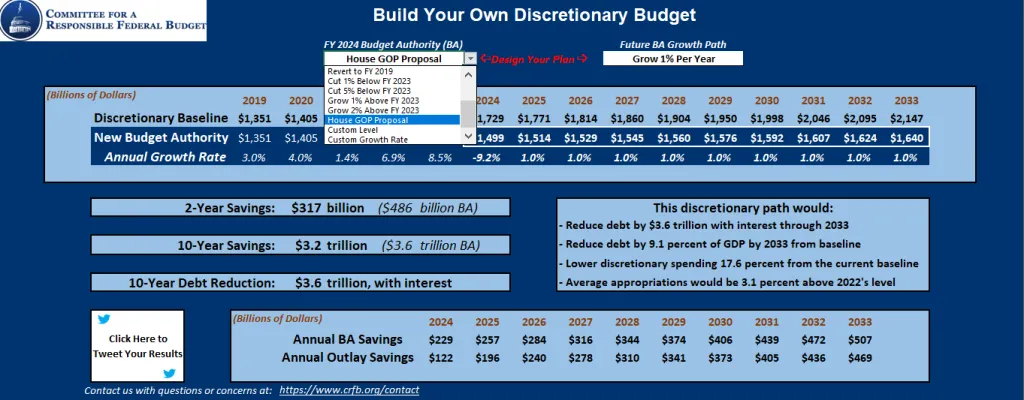

Using our Build Your Own Discretionary Budget tool, we estimate the Limit, Save, Grow Act would reduce discretionary budget authority by nearly $500 billion over two years and by $3.6 trillion over ten years relative to the CBO baseline. Since this money takes time to spend out, outlay savings would total $3.2 trillion. Total discretionary spending under this proposal would be about 17.6 percent below the baseline but an average of 3.1 percent above the nominal FY 2022 level. CBO's official score estimates the same amount of outlay savings.

Source: Committee for a Responsible Federal Budget: Build Your Own Discretionary Budget.

About $460 billion of additional savings would be achieved by rolling back President Biden's student debt cancellation and IDR program expansions. The bill would prohibit the President's plan to cancel up to $10,000 of debt for federal student loan holders and up to $20,000 of debt for all federal student loan borrowers. It would also prohibit the President's expansion of the IDR program, which proposes to raise the amount of income excluded from IDR payment calculations, to forgive unpaid interest each month for borrowers whose monthly payments do not cover interest payments, and to forgive the entire balance after a decade of repayment for those who borrowed less than $12,000.

The bill proposes another $540 billion of savings through the repeal of most of the IRA's new and expanded climate tax credits, some of its spending, and any unused COVID relief funds. The IRA included changes to several existing credits as well as new credits aimed at encouraging the adoption of clean energy, including credits for the production of clean energy and electricity, the production of energy-efficient homes and buildings, clean vehicles, and clean fuel. It also included various spending programs for energy- and climate-related items. Policymakers approved about $6 trillion of COVID relief funds through legislative action, though there is likely significantly less than $100 billion of unobligated funds remaining. CBO estimates rescinding the remaining unspent COVID relief would save another $30 billion.

The Limit, Save, Grow Act also includes policy changes related to regulations, energy, and permitting, including the Regulations from the Executive In Need of Scrutiny (REINS) Act, which would require Congress to approve any federal rule or regulation that the Office of Management and Budget determines would have an economic impact of $100 million or more. It also includes the House-passed Lower Energy Costs Act, which would repeal some of the IRA's climate provisions and rescind the funding for them, allow for additional sales of oil and gas leases, and make changes to permitting regulations. CBO estimates the changes to energy regulations and permitting policies would save over $3 billion while it did not score the provision to require Congressional approval of major rules and regulations, though it did indicate that the REINS Act could significantly affect federal spending and revenue in the future.

In addition, the bill would impose stricter work requirements for Medicaid, the Supplemental Nutrition Assistance Program (SNAP), and Temporary Assistance for Needy Families (TANF) beneficiaries. For TANF, it would modify the baseline year for the Caseload Reduction Credit, which provides states with a credit for reducing the number of individuals on their TANF caseload, from 2005 to FY 2022. For Medicaid, the bill would apply work requirements to able-bodied adults without dependents in the Medicaid program between the ages of 19 to 55, requiring them to either work, engage in community service, or participate in a work training program for at least 80 hours per month to remain eligible for Medicaid benefits. The bill would increase the SNAP work requirements age range from 18-49 to 18-55 and eliminate the ability of states to carry forward their unused exemptions from federal work requirements. CBO estimates these changes would save $120 billion.

The Limit. Save, Grow Act would also rescind most of the $80 billion of increased IRS funding authorized in the IRA. CBO estimates this policy would worsen the deficit by $120 billion over the next decade by allowing more tax cheating and expanding the tax gap. Every President from Ronald Regan to Joe Biden has supported more IRS funding to reduce the tax gap, and it would be a mistake to reverse this policy. We strongly oppose including measures that would worsen the debt as part of this package.

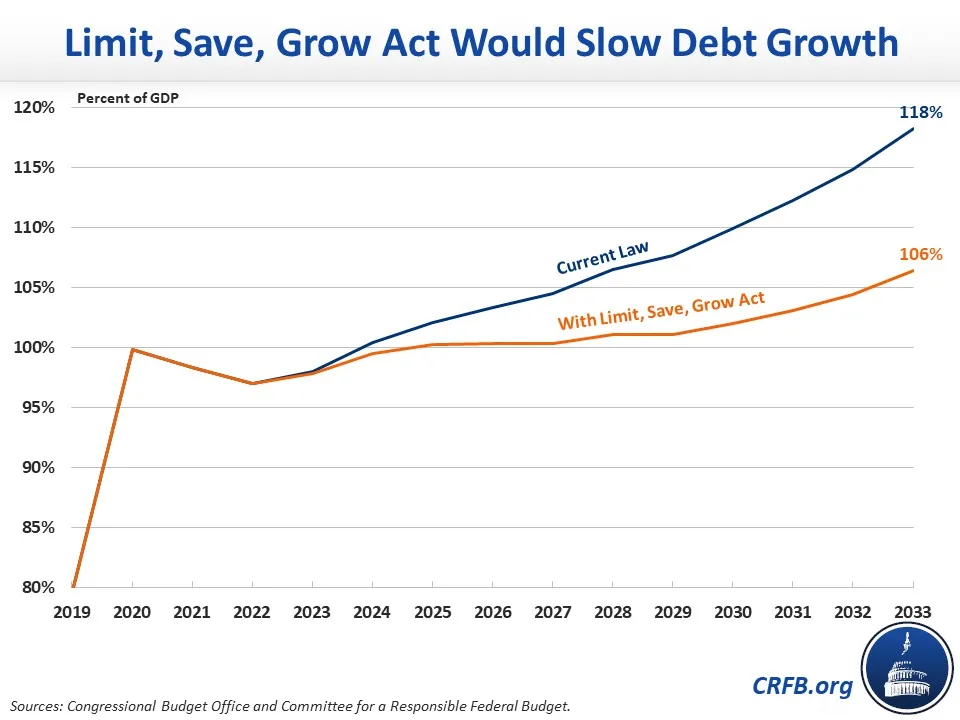

Altogether, the policies above would save about $4.2 trillion over the next decade, reducing projected debt by about $4.8 trillion after accounting for interest through FY 2033 – about 12 percentage points of Gross Domestic Product (GDP). As a result, debt as a share of GDP would rise less than half as fast as currently projected – from 98 percent of GDP to 106 percent by FY 2033, compared to 118 percent of GDP projected under current law.

The House deserves credit for putting forward a reasonable proposal that would help the Federal Reserve fight inflation in the near term and generate significant savings at a time when they're desperately needed. Additional changes would be needed to hold debt to manageable levels, including by addressing rising health care costs and trust fund solvency. We suggest including a fiscal commission to deal with the long-term drivers of the debt.

The Limit, Save, Grow Act is a welcome first step in the right direction. Any debt ceiling savings plan should aim to quickly lift the debt ceiling without drama or threat of default and should only include measures to reduce debt, not increase it. We encourage Congress and the President – who put forward $3 trillion of deficit reduction in his own budget – to negotiate a budget deal as soon as possible.