Weakening the SALT Cap is Costly, Benefits High-Earners, & Increases Tax Complexity

The Tax Policy Center (TPC) recently published analyses of several options to raise the $10,000 State and Local Tax (SALT) deduction cap, which is set to expire at the end of 2025 but could be part of an extension of the rest of the 2017 Tax Cuts and Jobs Act (TCJA).

We recently showed that doubling the cap to $20,000 for married filers would be costly, regressive, and worsen complexity. TPC’s analysis also looks at other options, including raising the caps to $20,000 for single filers and $40,000 for married filers ($20,000/$40,000), to $30,000/$60,000, to $40,000/$80,000, and to $100,000/$200,000. Based on their analyses and another analysis from scholars at the American Enterprise Institute, we find that these expansions would:

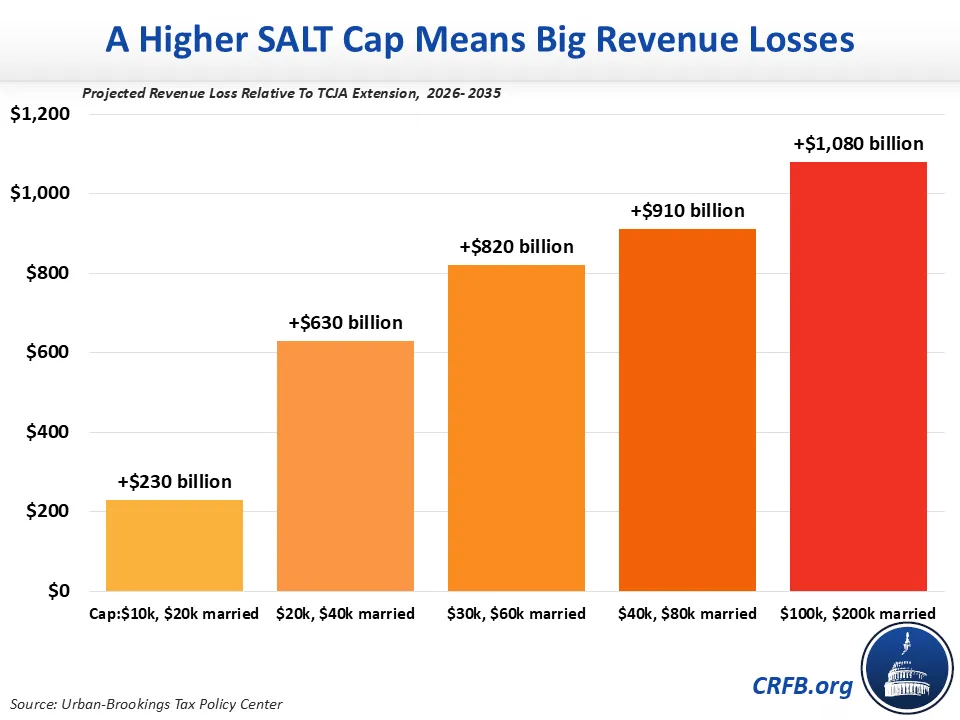

- Reduce revenue by $230 billion to nearly $1.1 trillion over a decade, relative to a full TCJA extension, potentially increasing the $3.9 trillion deficit impact of TCJA extension by more than a quarter.

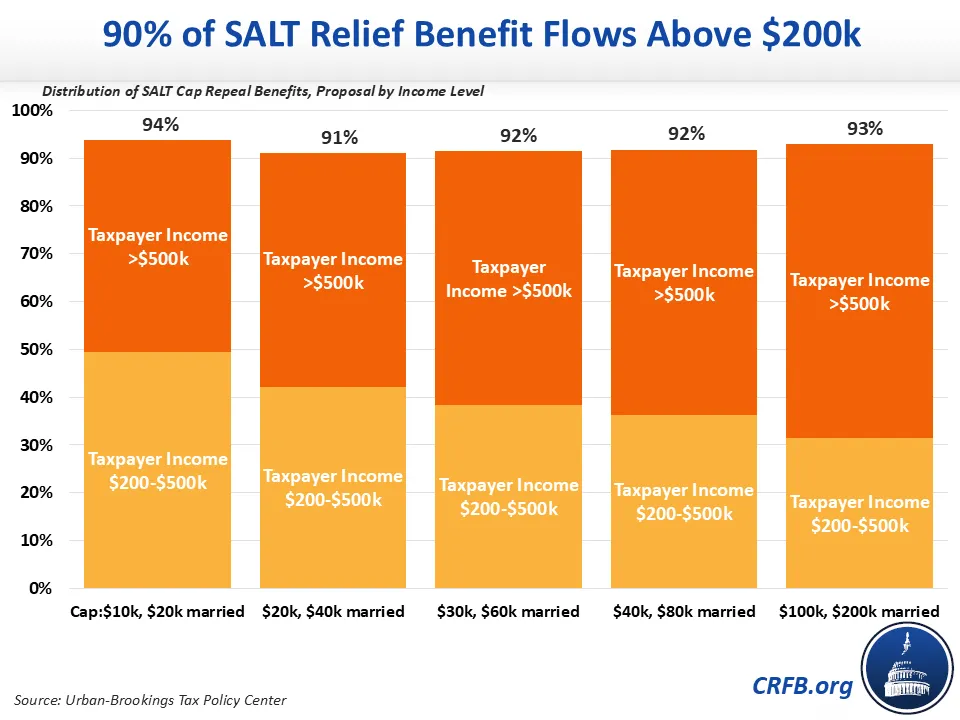

- Distribute more than 90 percent of the gains to those making over $200,000 per year, with up to 61 percent going to those making over $500,000.

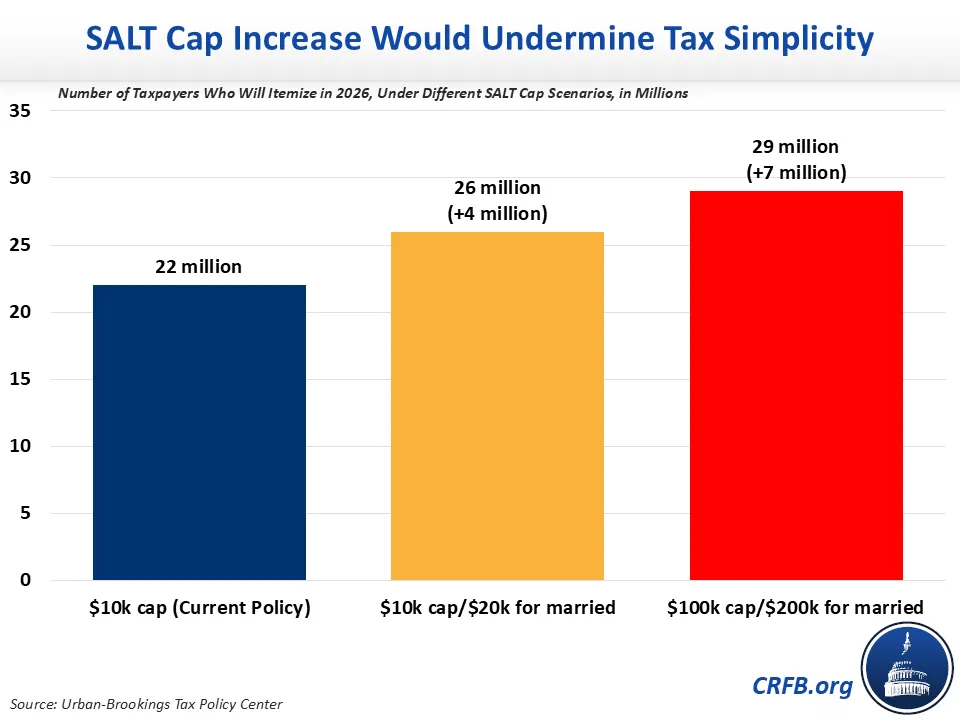

- Undermine progress in tax simplicity, increasing the number of itemizers by 4 to 7 million – as much as one-third.

Extending the expiring individual and estate tax provisions under the TCJA would reduce revenue by $3.9 trillion if extended for a decade without offsets, but that impact would be far higher without the full $10,000 SALT cap for individuals and couples.

Based on TPC estimates, lifting the cap to $20,000 for couples would require $230 billion of additional borrowing (This estimate is substantially higher than the $170 billion we cited recently, which was based on Penn Wharton Budget Model estimates produced a year ago), lifting the cap to $30,000 for singles and $60,000 for couples would reduce revenue by an additional $820 billion, and lifting it to $100,000 for singles and $200,000 for couples would lose an additional $1.1 trillion. These options would increase the price tag of a TCJA extension by 6 to 28 percent.

The benefits would also go almost exclusively to higher earners. Between 91 and 94 percent of the benefits of these options would flow to taxpayers reporting more than $200,000 in income, including 44 to 61 percent to those making over $500,000. One percent or less of the benefits, in any scenario, would go to those making below $100,000 per year.

TPC also finds that as proposals to increase the SALT cap become more generous, they offer larger windfalls to the very rich. For example, doubling the cap for married couples to $20,000 would deliver an average tax cut of $2,200 to households making over $1 million per year, while raising the SALT cap to $100,000/$200,000 would deliver them a $20,700 average tax cut. For households making between $200,000 and $300,000 per year, the average tax cut would only rise modestly – from $250 to $630.

Taxpayers would also face more complexity if the SALT cap were increased, as more would be pushed to itemize deductions or pay the Alternative Minimum Tax (AMT). According to an analysis from scholars at the American Enterprise Institute, increasing the SALT cap would increase the number of itemizers by 4 million to 7 million – a one-fifth to one-third increase. And potentially hundreds of thousands more would have AMT liabilities – up to three times as much under the current SALT cap.

The IRS estimates that filing just form Schedule A: Itemized Deductions increases a taxpayer’s time burden to prepare their taxes by more than 5.5 hours, on average. Itemizing also typically incurs taxpayers added fees with a tax preparer. The compliance burden also rises for those who still take the standard deduction but believe they may be better off itemizing – a number that will go up as the SALT cap does. And the AMT adds even more complexity than itemizing and requires additional filing time and costs.

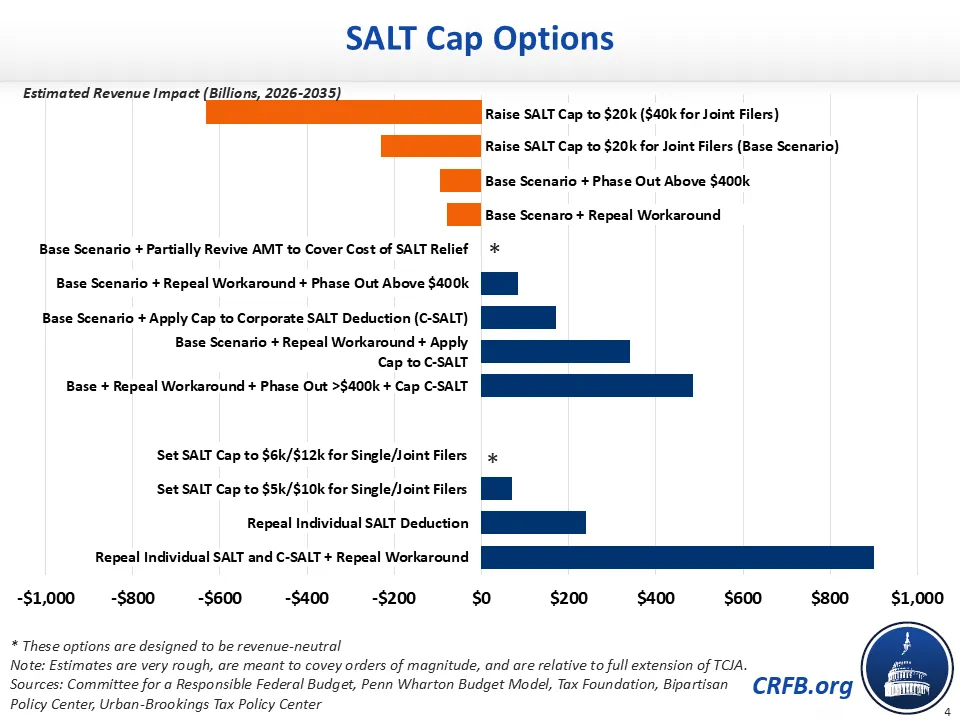

Instead of making the TCJA more expensive, lawmakers should be finding ways to pay for the extension of the TCJA, including by tightening the SALT cap. At a minimum, any SALT relief should be more-than-fully offset so that, on net, SALT changes raise revenue to help cover the revenue loss of any other tax cut extensions. We’ve outlined numerous options in our Budget Offsets Bank and recent SALT cap analysis.

Given the $3.9 trillion deficit impact of a straight extension of the TCJA, as well as our mounting federal debt, policymakers should be pursuing options to reduce rather than expand the revenue loss from any tax cut extensions. Tightening the SALT cap can help raise revenue and improve the tax code. Raising it will distribute windfall gains to high earners, undermine tax simplicity, and add hundreds of billions or more to the national debt.