The Ups and Downs of Buttressing the Economy

Yesterday, the Wall Street Journal posted an article discussing the FDIC’s soon-to-be urgent need to draw money from its $500 billion Treasury line of credit. Last week, the FDIC reported that its deposit insurance fund, which insures over $4.5 trillion in U.S. bank deposits, fell to $10.4 billion by July. That’s down from $45.2 billion a year ago.

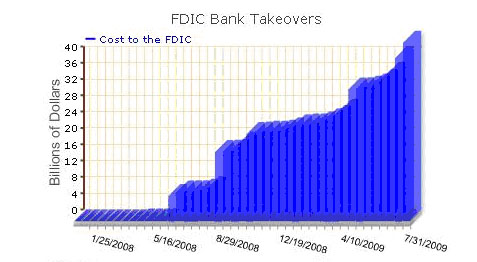

As of August 28, 2009, the FDIC has taken over 84 banks this year and had 416 banks on its “problem list” at the end of June, up from 305 in March. Last week, the FDIC also reported that insured institutions lost $3.7 billion in the second quarter of this year.

According to our own Stimulus.org, the FDIC has closed 84 banks this year, insuring over $74 billion in failed bank deposits in 2009. Since the beginning of 2008, we show that the FDIC has presided over $308 billion in deposits, costing the deposit insurance fund a total of $43.8 billion.

The increasing number of bank failures and problem banks has come alongside Congress’s actions in October, which increased deposit insurance on individual accounts from $100,000 to $250,000. With decreasing resources and an expanded mandate, the FDIC may soon become hard-pressed for cash.

However, as bank failures have continued, the Federal Reserve has managed to make a $14 billion profit on loan programs since the start of the crisis in August 2007. In a recent Financial Times article, the Fed earned around $19 billion from charging interest and fees to financial institutions, whereas it would only have earned $5 billion by investing the same funds in three-month Treasury bills, leaving a $14 billion net profit. The figure includes only the Fed’s loan facilities, excluding company bailouts and the purchases of long-term assets.