Trust Fund Solutions Would Be Pro-Growth

In our recent paper “The Case for Trust Fund Solutions,” we showed that making the Social Security, Medicare, and highway trust funds solvent would not only prevent sharp benefit cuts and improve the fiscal outlook, but would actually grow the economy. A new Penn Wharton Budget Model (PWBM) analysis backs up these findings. In our paper, we estimated trust fund solutions would reduce debt by between 65 to 80 percent of Gross Domestic Product (GDP) and increase economic output by between 3.5 to 9.0 percent by 2051. PWBM’s own illustrative package of solutions would reduce debt-to-GDP by 92 percentage points and increase economic output by 5.0 percent in 2050.

As part of a new set of Interactive Tools, PWBM estimated the macroeconomic and fiscal effects of a comprehensive entitlement reform package. The package would increase the Social Security payroll tax rate by 2 percentage points, double the cap on wages subject to that tax, adopt a more progressive benefit formula, and calculate Social Security cost-of-living adjustments (COLAs) using the Chained Consumer Price Index (Chained-CPI). It would also raise the Social Security and Medicare retirement ages and allow Medicare to negotiate drug prices directly with manufacturers, with a cap based on an international index.

While not all of these proposals would directly impact the trust funds (for example, part of the savings from raising the Medicare retirement age and all of the drug savings would fall outside of Medicare Part A), the size of the plan is consistent with achieving full Social Security and Medicare solvency. In 2031, for example, the package would save $528 billion, compared to currently-projected Social Security and Medicare Part A trust fund deficits of $537 billion.

PWBM’s Illustrative Entitlement Reform Package

| Reform | 2022-2031 Savings | 2031 Savings |

|---|---|---|

| Increase Social Security payroll tax rate from 12.4 to 14.4 percent | $1,490 billion | $171 billion |

| Allow Medicare to negotiate drug prices | $1,152 billion | $149 billion |

| Double Social Security taxable maximum earnings threshold | $848 billion | $99 billion |

| Raise Medicare retirement age from 65 to 67 | $161 billion | $21 billion |

| Used Chained-CPI to calculate Social Security COLAs | $155 billion | $30 billion |

| Raise Social Security full-benefit retirement age from 67 to 70 | $103 billion | $37 billion |

| Make Social Security benefit formula more progressive | $29 billion | $9 billion |

| Interactions | $113 billion | $12 billion |

| Total | $4,051 billion | $528 billion |

| Memo: Social Security and Medicare HI trust fund deficits | $3,088 billion | $537 billion |

Source: Penn Wharton Budget Model, Congressional Budget Office, and Committee for a Responsible Federal Budget calculations.

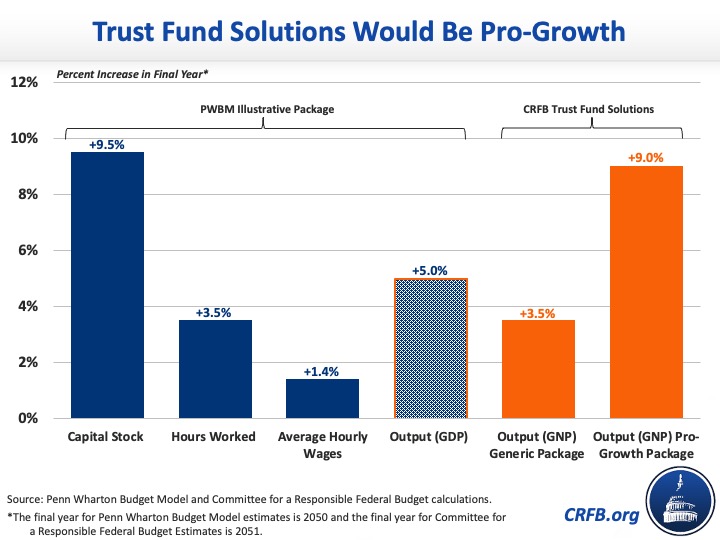

In our paper, we argue that trust fund solvency packages could “substantially increase output by reducing debt and increasing overall savings, investment, and labor force participation.” PWBM’s estimates confirm this claim. By reducing future deficits, PWBM estimates its package would crowd out less investment and help boost the capital stock by nearly 10.0 percent. Meanwhile, increases in the retirement age would help to boost labor supply by 3.5 percent.

Overall, PWBM estimates its illustrative package would boost output 5.0 percent in 2050, which is more than our estimated 3.5 percent boost for a generic trust fund solvency plan, but less than our 9.0 percent boost for a pro-growth plan. On an apples-to-apples basis, PWBM’s estimates might be closer to our upper end, since PWBM measures a boost to GDP while we estimate the boost in Gross National Product (GNP).1

To put a 5.0 percent boost to GDP in context, it is 5 to 10 times as large as the increase from the 2017 tax cuts, 20 times as large as the increase in GDP from a $2 trillion infrastructure package, and about as large as the economic gains from the 2013 immigration bill.

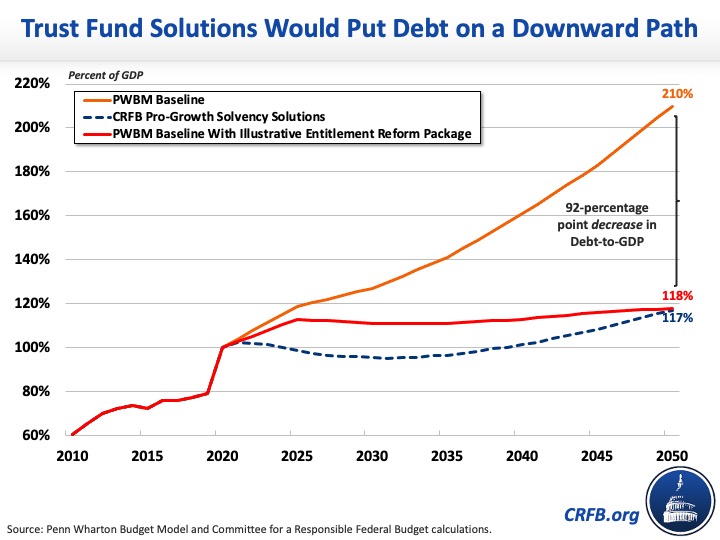

In addition to boosting economic output, trust fund solutions would dramatically improve the fiscal outlook. PWBM estimates its package would reduce debt to 118 percent of GDP by 2050, a 92-percentage point reduction from its baseline projection of 210 percent of GDP. This very closely matches our previous estimate that debt would be reduced to 117 percent of GDP with a set of pro-growth solvency solutions.

As our paper and PWBM’s analysis shows, restoring trust fund solvency would greatly improve the fiscal outlook and boost economic and income growth. Solvency measures would also eliminate the risk of sharp across-the-board cuts to important benefits and spending. Policymakers should act sooner rather than later to enact trust fund solutions – either by passing solvency legislation or at the very least by supporting commissions to develop solvency packages.

1 Because international financial flows mitigate the effects of debt on GDP more than GNP, we expect PWBM’s model would estimate a higher boost to GNP under their illustrative package.