The True Size of Government?

It is often said that tax expenditures operate as "spending through the tax code" and often obscure what the true size of government is. With the amount of tax breaks exceeding $1 trillion, that obfuscation has become increasingly important. To clarify things, Donald Marron and Eric Toder of Tax Policy Center have attempted to quantify what government spending would equal if we counted tax expenditures that substitute for spending as outlays in the federal budget.

A difficult question is determining which tax expenditures are truly "spending in the tax code" and which are simply features of the tax code or broad tax structure choices. Normally, tax expenditure analyses count the standard deduction and personal exemptions as part of the tax code rather than tax expenditures. Beyond that, Marron and Toder exclude some tax preferences that they label as structural choices rather than faux-spending. These include:

- Preferential rates and other treatment for long-term capital gains and qualified dividends

- Accelerated depreciation

- Deferral of income for controlled foreign corporations

- Retirement savings provisions (which could be said to move the tax code closer to a "consumption tax" rather than representing a particular preference)

- Exclusion of some Social Security benefits from income taxation

What's left? Big ticket items include the mortgage interest deduction, the exclusion for employer-paid health insurance premiums, the charitable deduction, and the Earned Income Tax Credit. These four items alone are estimated to cost over $2 trillion from 2012-2016.

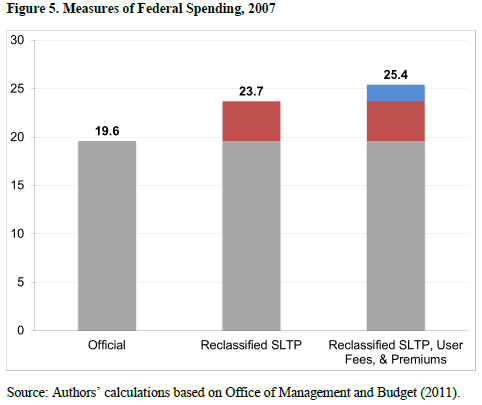

Another difficult question is how to account for various items like premiums or user fees. These items count as negative spending in the federal budget (for example, Medicare premiums net against Medicare spending) instead of revenue. Marron and Toder argue that while the traditional method is appropriate to account for the amount of spending that must be financed by general revenue or borrowing, for the purpose of determining the size of government, it is better to use the gross cost. Nonetheless, they present their measures of government spending both including and excluding user fees and premiums. The chart below is from the report, detailing spending as a percent of GDP in FY 2007 when you include tax expenditures (labelled SLTP or "spending-like tax preferences").

Thus, the report finds that spending would have been shown as 20 percent higher in FY 2007 if the spending-substitute tax expenditures had been accounted in that way and 30 percent higher if offsetting receipts are counted.

In other words, the government might be 6 percent of GDP larger than we think.

Click here to read the full paper.