Time to Get to Work on a Highway Trust Fund Solution

Lawmakers have many potential options to address the shortfall in the Highway Trust Fund. With the President expected to sign a two-month extension of the highway authorization bill soon, lawmakers have bought themselves time to work on a solution to the Highway Trust Fund's $175 billion ten-year shortfall. Over the past several years, Congress has only enacted short-term solutions that have papered over the shortfall, but they should use this opportunity to provide a real and lasting solution to bring revenues and spending in line.

Our plan The Road to Sustainable Highway Spending provides one approach. It would fully pay for a $25 billion upfront transfer to the trust fund to pay for previously-authorized spending, and then bring dedicated revenue and highway spending in line by raising the gas tax by 9 cents and limiting spending to prior year's income. That policy is the default option, and lawmakers could instead use a fast-track process for tax reform that the plan provides to either raise the gas tax further or use another financing source if they wanted higher spending or a lower gas tax increase.

The report also provided four appendix tables with numerous options to increase revenue from current sources, use new transportation-related revenue sources for the trust fund, cut highway spending, or finance a general revenue transfer. The tables are shown below, and you can also download an Excel version of all four here.

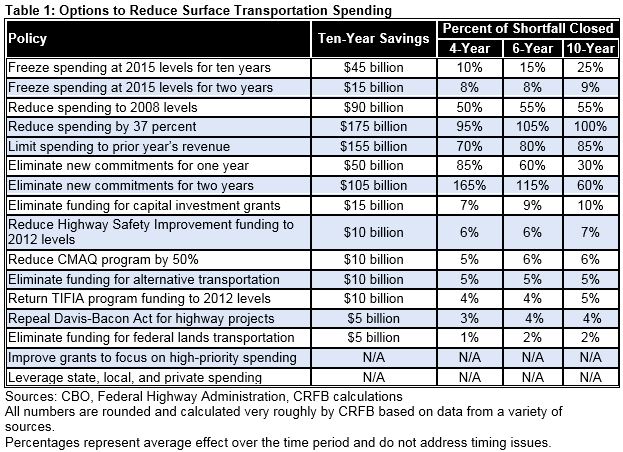

The first table includes alternate options to reduce highway spending. The options involve either broadly limiting/reducing new obligations or making the targeted changes that would be needed to live within those obligations.

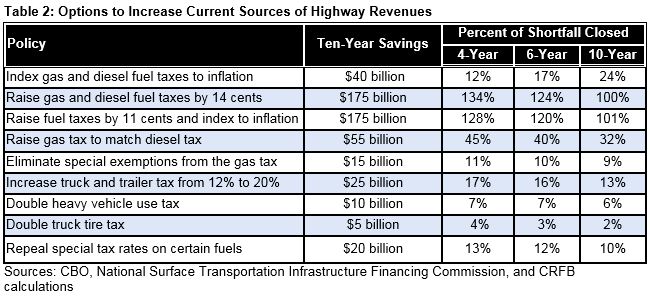

The second table involves alternate options to increase revenues from taxes currently devoted to the highway fund. These include different fuel tax increases (including adjusting them for inflation) and increases to the other smaller transportation taxes.

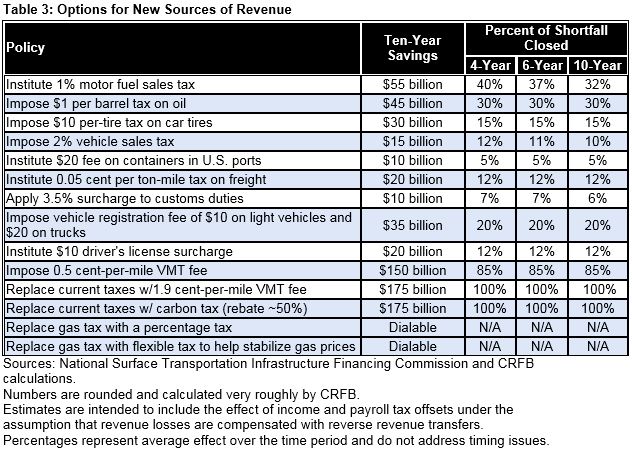

The third table lists options to raise revenue from new sources related to transportation. Perhaps the most prominent policy in the table is to replace the gas tax with a vehicle-miles-traveled (VMT) tax, which is one way to prevent tax revenue from being eroded by increased fuel efficiency.

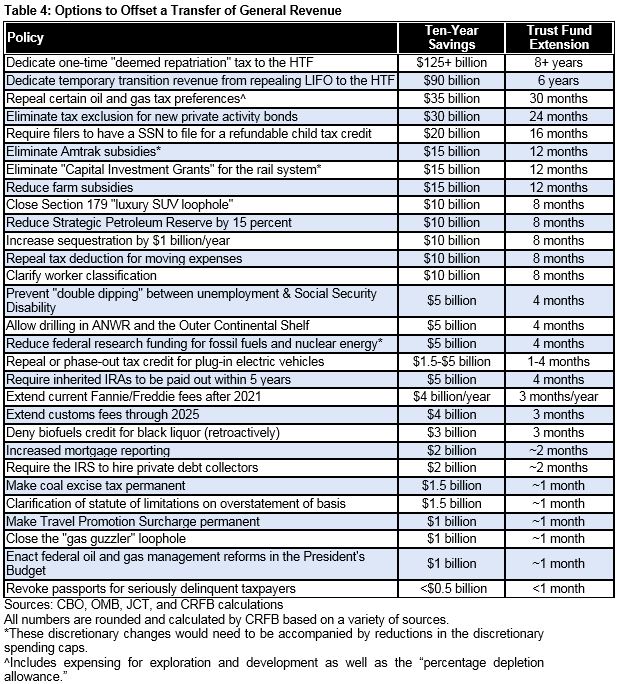

The three tables above would help to close the perennial gap between highway revenues and spending, but lawmakers could also transfer general revenue to buy additional time, paid for with savings elsewhere in the budget. Some of these options are in the last table. Many of these options are related to transportation or energy, but others are small savings options from other parts of the budget. There are also large options to finance a longer-term transfer, including the deemed repatriation tax that has gained popularity. Any real offset would be far better than gimmicks like pension smoothing.

Click here to download an Excel version of the four appendix tables.