Re-visiting the President's Budget: OMB's Mid-Session Review

The OMB has released its Mid-Session Review (MSR), essentially a re-estimate of the President's budget taking into new legislative, economic, and technical factors since February. We also put out a paper breaking down the MSR.

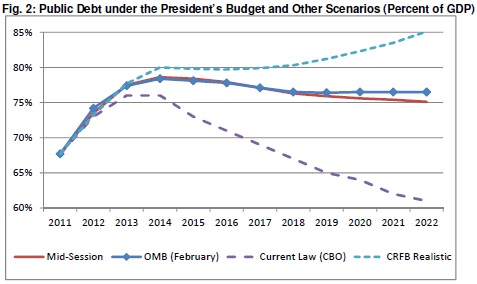

This year's MSR shows ten year budget deficits that are $240 billion than estimated in the President's budget. In addition, debt as a percent of GDP is slightly lower at 75.1 percent in 2022, compared to 76.5 percent in February. This compares to 61.3 percent under current law and 85.1 percent under the CRFB Realistic baseline.

Driving these changes are a $500 billion ten-year drop in projected revenue, more than offset by a $741 billion drop in outlays. Most of these changes are the result of economic and technical changes. Slower projected GDP growth is mainly responsible for the decrease in revenue projections. On the other hand, lower than expected interest rates reduced spending on interest on the debt significantly. In addition, lower than expected health care and food price inflation reduced projected spending on Medicare, Medicaid, and Social Security, and lower enrollment reduced spending on Social Security and unemployment insurance.

Legislative changes are a minor portion of the overall effect. Although the payroll tax cut extension significantly increased deficits through 2022, many of the deficit-increasing policies and some of the offsets were already included in the President's budget. As a result, the legislation only affected projected deficits by $1 billion. In addition, the transportation bill reduced deficits by $5 billion over ten years.

Overall, the MSR shows debt on a slightly downward path over the medium term, but it is still at a high level as a share of the economy. Furthermore, based on OMB's long-term budget outlook, debt would almost certainly resume rising beyond the ten-year window. In short, the MSR shows that the President's budget is a start, but it does not get us all the way there. What would? As our paper says:

When a bipartisan deficit reduction plan is agreed to, it should go much further than the President by bringing the debt down to a lower level and putting it on a clearer downward path over the medium term. That plan should also do more to slow the growth of entitlement spending over the long-term.

With a fiscal cliff looming at the end of the year, the next several months present an opportunity for policymakers to work together on a sensible plan to both avoid the fiscal cliff while also controlling rising debt. The strength of the American economy and standard of living will suffer if they do not.