The President's FY2015 Budget

This morning, President Obama released his FY2015 budget, outlining the priorities for FY2015 and the coming decade. In this blog, we provide an overview of the projections contained in the President's budget and outline some of his major proposals. Be sure to stay tuned to CRFB and The Bottom Line throughout the day and throughout the week as we take closer looks at all aspects of the President’s budget.

Budget Metrics

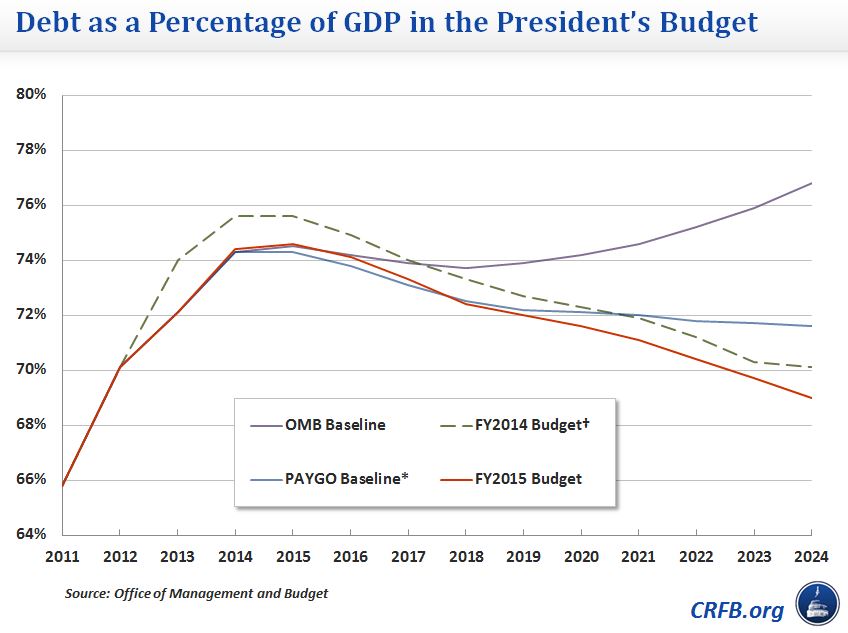

The President's budget would reduce medium-term deficit and debt levels relative to current projections, putting the debt on a modest downward path relative to the economy. Under the budget, deficits would fall from 3.7 percent of GDP in 2014 to 2.3 percent by 2019 before stabilizing at about 2 percent for the rest of the ten-year window. Debt would rise to a post-World War II record of nearly 75 percent of GDP in 2015 before declining to 69 percent by 2024.

Both spending and revenues would grow over time under the budget, with revenues growing more quickly and therefore pushing down deficit levels. Specifically, spending would grow from 20.8 percent of GDP in 2013 to 21.7 percent in 2024, after accounting for timing shifts. Revenues, meanwhile, would rise from 16.7 percent in 2013 to 19.9 percent in 2024 -- due to the combination of the continued economic recovery, current law tax increases already in place, and new revenue proposals in the President's budget.

The Key Numbers in the President's Budget

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | Ten-Yearr | |

| Revenues | |||||||||||

| $ (trillions) | $3.34 | $3.57 | $3.81 | $4.03 | $4.23 | $4.45 | $4.71 | $4.95 | $5.21 | $5.48 | $43.78 |

| % of GDP | 18.3% | 18.6% | 18.9% | 19.0% | 19.0% | 19.2% | 19.4% | 19.6% | 19.8% | 19.9% | 19.2% |

| Outlays | |||||||||||

| $ (trillions) | $3.90 | $4.10 | $4.27 | $4.44 | $4.73 | $4.96 | $5.21 | $5.49 | $5.69 | $5.91 | $48.71 |

| % of GDP | 21.4% | 21.4% | 21.1% | 20.9% | 21.3% | 21.4% | 21.5% | 21.7% | 21.6% | 21.5% | 21.4% |

| Deficits | |||||||||||

| $ (billions) | $564 | $531 | $458 | $413 | $503 | $512 | $504 | $530 | $482 | $434 | $4,930 |

| % of GDP | 3.1% | 2.8% | 2.3% | 1.9% | 2.3% | 2.2% | 2.1% | 2.1% | 1.8% | 1.6% | 2.2% |

| Deficits (corrected for timing shifts) | |||||||||||

| $ (billions) | $564 | $498 | $454 | $450 | $503 | $512 | $504 | $481 | $478 | $488 | $4,930 |

| % of GDP | 3.1% | 2.6% | 2.3% | 2.1% | 2.3% | 2.2% | 2.1% | 1.9% | 1.8% | 1.8% | 2.2% |

| Public debt | |||||||||||

| $ (trillions) | $13.59 | $14.26 | $14.84 | $15.37 | $15.98 | $16.6 | $17.21 | $17.85 | $18.44 | $18.99 | N/A |

| % of GDP | 74.6% | 74.3% | 73.5% | 72.4% | 72.0% | 71.6% | 71.1% | 70.6% | 69.9% | 69.0% | N/A |

New Initiatives and Savings Proposals

The President calls for several new initiatives on both the tax and spending side of the budget. Among the more notable elements, the President calls for:

- Comprehensive immigration reform (saves nearly $160 billion)

- Additional funding for defense and non-defense discretionary programs in FY2015, split evenly (costs about $55 billion)

- Partial sequester relief from 2016 through 2021 (costs $140 - $350 billion depending on the baseline)

- Funding for universal pre-K education (costs about $75 billion)

- Expanded EITC for childless adults (costs about $60 billion)

- New funding for surface transportation projects (costs about $70 billion and funds additional existing spending)

- Comprehensive business tax reform (revenue neutral over the long term)

- Other initiatives for infrastructure projects, education, worker training, and targeted tax cuts

We have already expressed our disappointment that the President's budget no longer incorporates the adoption of the more accurate chained CPI. However, we are encouraged that the President fully pays for the costs of his new initiatives and maintains most of the deficit reduction proposals put forward in his budget last year. Here are some of the larger savings measures:

- Reduces health care spending by reducing drug costs and provider payments while increasing means-testing of premiums and modestly increasing Medicare cost-sharing (saves about $400 billion)

- Limits the value of various itemized deductions and exclusions to the 28 percent tax bracket (saves about $600 billion)

- Establishes a minimum tax for millionaires (saves about $50 billion)

- Reduces Social Security fraud (saves about $30 billion)

- Increases cigarette tax (saves about $80 billion)

- Reduces other spending by reducing farm subsidies, increasing user fees, and making other changes

- Raises additional revenues by taxing large financial institutions, increasing the estate tax, limiting various tax breaks, and other changes

Stay tuned for CRFB’s full overview of the budget later today.