Pre-COVID, Social Security and Medicare Faced Insolvency

The Social Security and Medicare Trustees have released their reports on the financial state of their programs. Even though the Trustees do not incorporate the adverse economic or health consequences of COVID-19, they find Medicare Part A will face insolvency in 6 years and Social Security’s trust funds will run out in 15 years. Accounting for the pandemic, the actual outlook is likely to be far worse. We'll be providing in-depth analysis about the Social Security report later today and the Medicare report later in the week.

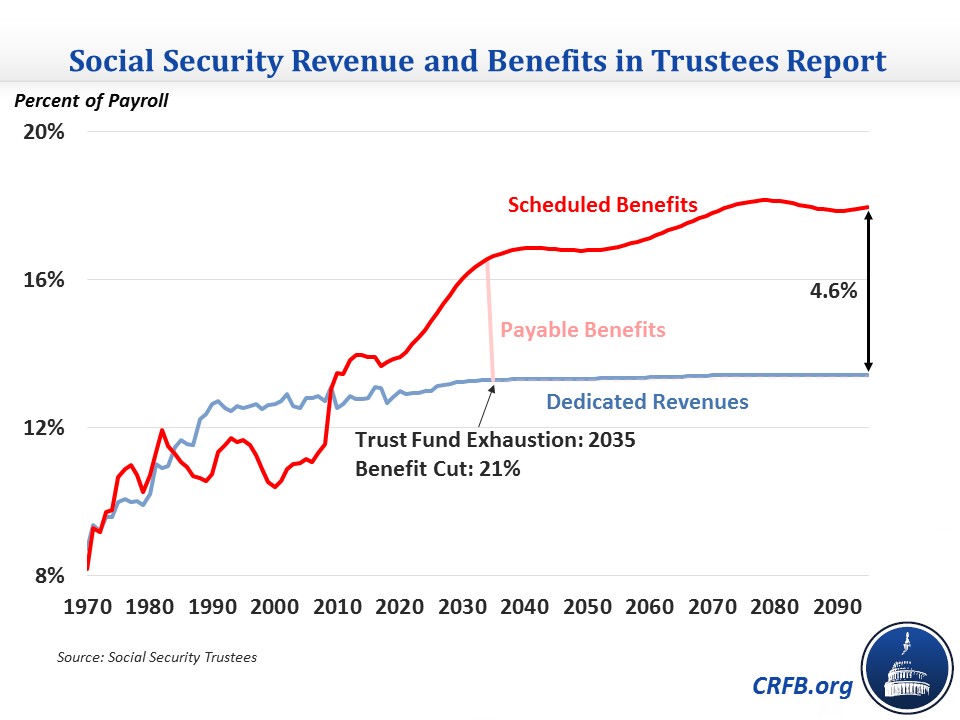

The Social Security Trustees continue to show that Social Security is headed towards insolvency and faces a large and growing shortfall. They project that the Old-Age and Survivors Insurance (OASI) trust fund will be exhausted in 2034, the Social Security Disability Insurance (SSDI) trust fund in 2065, and the theoretical combined Social Security trust funds will run out in 2035. Benefits would be cut by 21 percent when the combined trust fund run out. These dates are similar to last year's report, with the exception of SSDI's exhaustion date, which was 2052 in the 2019 report.

The Trustees project that Social Security faces a combined 75-year shortfall of 3.21 percent of payroll (1.1 percent of GDP), and the annual deficit will grow significantly over time from 0.9 percent of payroll this year to 4.6 percent of payroll by 2095. Maintaining solvency for 75 years would require immediately raising payroll taxes by one-quarter (3.1 percentage points), reducing all benefits by 19 percent, reducing new benefits by 23 percent, or some combination of the three. To ensure sustainable solvency, meaning the trust fund would remain solvent beyond 75 years, lawmakers would have to increase the payroll tax rate by one-third or reduce benefits by one-quarter.

Social Security's deficits are the result of growing spending on benefits and flat revenue as a share of payroll. Benefits have already grown from 10.4 percent of payroll in 2000 to 13.9 percent of payroll in 2019 and are projected to rise further to 16.9 percent of payroll by 2040 and 18 percent by 2095. Revenue will rise slightly from 12.8 percent of payroll in 2019 to 13.4 percent by 2095.

The Trustees projections were formulated before the full impact of COVID-19 was apparent, therefore they do not incorporate any economic or health consequences of the pandemic into the projections. We would expect incorporating these effects to significantly lower payroll tax revenue in the near term, which could accelerate the trust fund insolvency date, and other effects may also noticeably change the Trustees' projections.

Compared to the last year's report, this report shows a larger 75-year shortfall (3.21 percent of payroll compared to 2.78 percent). The repeal of the Cadillac tax in last December's appropriations package, which will increase tax-exempt compensation going to health insurance premiums, is a main reason for the larger shortfall, as well as lower birth rates, lower inflation, and lower interest rates. Lower disability rates slightly offset these factors.

Change in 75-Year Shortfall Since Last Year (Percent of Payroll)

| Source of Change | Effect on 75-Year Shortfall |

|---|---|

| 2019 Report's 75-Year Shortfall | 2.78% |

| Legislation/Regulation | +0.12% |

| Change in 75-Year Window | +0.05% |

| Demographic Data and Assumptions | +0.13% |

| Economic Data and Assumptions | +0.18% |

| Disability Data and Assumptions | -0.05% |

| Methods and Program Data | 0.00% |

| 2020 Report's 75-Year Shortfall | 3.21% |

Source: Social Security Administration.

Note: Numbers do not sum due to rounding. Positive numbers add to shortfall and vice versa.

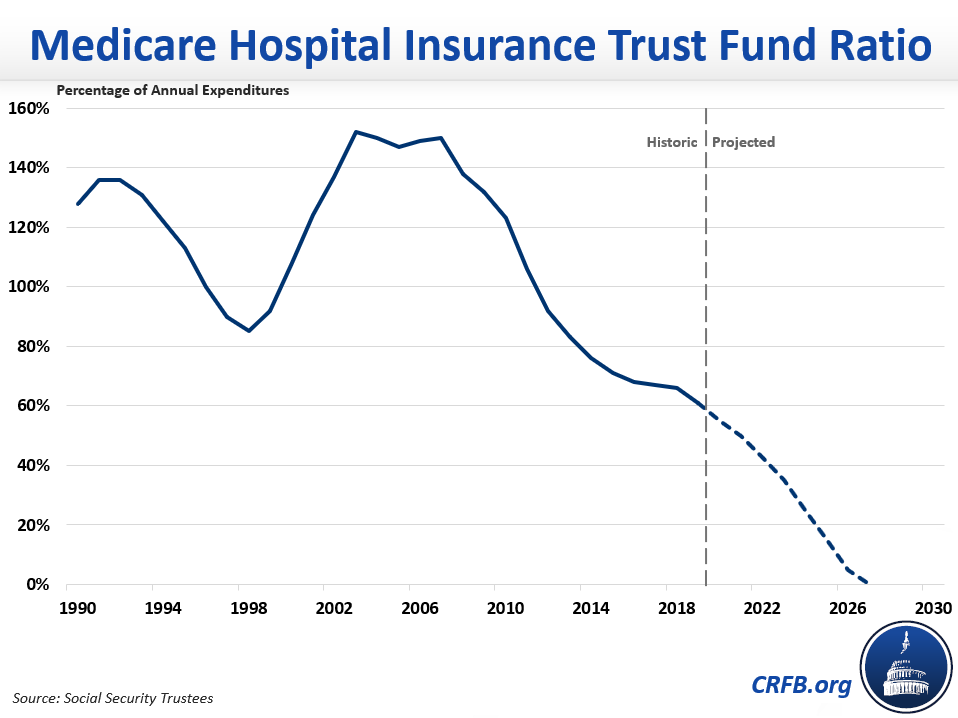

The Medicare Trustees project that the Part A Hospital Insurance (HI) trust fund will go insolvent in 2026, the same as last year's date. The trust fund faces a 75-year shortfall of 0.76 percent of payroll, meaning it would take roughly that size of payroll tax increase to ensure 75-year solvency. Including other parts of Medicare, total Medicare spending is projected to increase from 3.9 percent of GDP this year to 5.9 percent by 2040 and 6.5 percent by 2094. COVID-19 is likely to both increase hospital insurance spending and depress payroll tax revenue, substantially advancing the date of Medicare insolvency.

Try your hand at fixing Social Security here or see how old you'll be when the retirement program becomes insolvent, and what you stand to lose.