Paying for the Extenders

With so many provisions set to expire at the end of the year, CRFB has released a new paper that details what lawmakers have to extend and how they can do it in a fiscally responsible way.

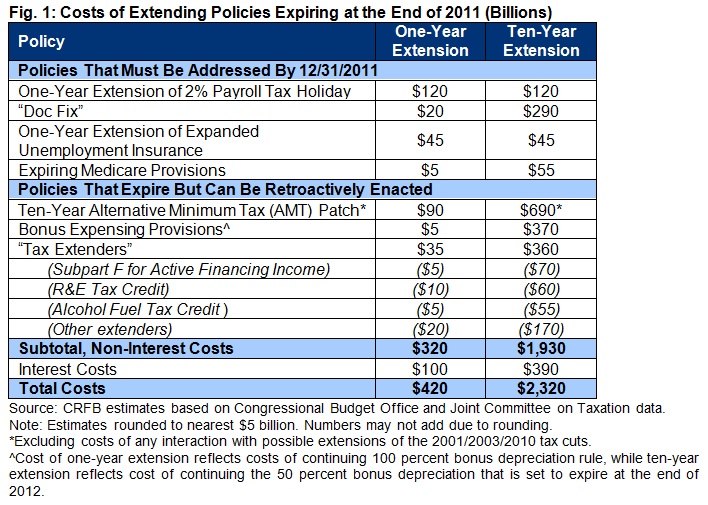

The paper sums up numerous policies that are set to expire, including the payroll tax cut, the "doc fix", the AMT patch, unemployment insurance, and numerous provisions related to Medicare payments and tax expenditures. A one-year extension of all of these policies would add $400 billion to the debt over ten years and $2.3 trillion if they were permanently extended (the latter estimate excludes the payroll tax cut and unemployment insurance). The paper says that every policy extension should be paid for, and ideally short-term extensions would be used only to keep in place pressure points for reaching a long-term budget deal. However, lawmakers should avoid using gimmicks to pay for these extensions at all costs, as doing so would be a step backwards for our fiscal responsibility.

We note the encouraging development that most policy extension proposals out there are fully paid for. We have already detailed two Senate Democratic and one Senate Republican payroll tax proposal on our blog. Today, House Republicans officially released their own package which would extend the payroll tax cut, doc fix, unemployment insurance, immediate expensing of capital investments and the Medicare payment provisions. In addition, Sens. Susan Collins (R-ME) and Claire McCaskill (D-MO) offered a bipartisan payroll tax cut extension that they paid for with a millionaire's surtax and repealing oil and gas tax breaks. So far, all these plans identify offsets in an effort to avoid adding to the debt over the long-run.

This morning, CRFB Policy Director Marc Goldwein offered his own suggestion to pay for a one-year payroll tax cut, doc fix, and unemployment insurance extension: switching to the chained CPI. This move would accrue savings to the federal budget in the same areas to which the extensions would accrue costs.

There are a number of ways out there to pay for the policy extensions that Congress is taking up, and we are hopeful that Congress will not only agree to offsets but also make efforts to move toward more comprehensive fiscal reform. As we conclude:

It is reassuring that lawmakers generally appear committed to offsetting not only any new job creation measures, but also policies that have been extended regularly for years. The seriousness of the country's fiscal outlook and recent demonstrations of concern in credit markets about U.S. debt must prompt lawmakers, at the very least, to not add to the debt.

But even fully offsetting the costs of any policy extensions or new measures, Congress and the White House will still have to Go Big in order to enact savings sufficient to stabilize and reduce the debt as a share of the economy while permanently addressing expiring policies. Economically, such a plan would significantly strengthen the economy over the long-term while providing the fiscal space for any additional job creation policies in the near-term. In addition, a Go Big approach would provide market confidence that the U.S. has its debt situation under control, while providing a healthy amount of certainty and predictability currently lacking in the economy.

The expiring provisions, both this year and in future years, offer an opportunity to address the debt under a comprehensive approach. What lawmakers must avoid is using expiring policies to blow another hole in future deficits and debt, like they did last year.