Our Analysis of CBO's January 2016 Budget and Economic Outlook Summary

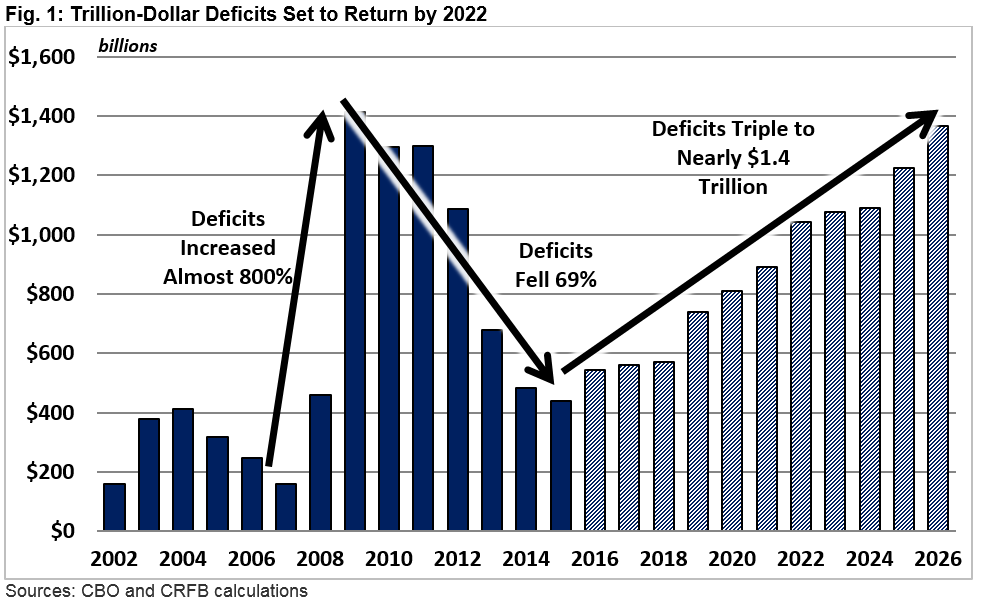

The era of declining deficits is over. That's the conclusion of our analysis of the Congressional Budget Office's (CBO) January 2016 Budget and Economic Outlook summary. The report shows that deficits will once again start increasing by $105 billion from Fiscal Year (FY) 2015 to 2016. They will balloon to $1.4 trillion by FY 2026. Trillion-dollar deficits will reappear as soon as FY 2022 – 3 years earlier than CBO projected in August.

The paper discusses how this year's forecast is much worse than last year's, largely due to lawmakers' fiscally irresponsible behavior – including passage of the unpaid-for tax extenders and omnibus legislation in December – as well as a gloomier economic picture. At this rate, public debt levels are expected to reach 86 percent of Gross Domestic Product (GDP) by 2026 – an even-more unsustainable level than our current debt of 74 percent of GDP.

The report reiterates:

Last year, lawmakers took for granted temporarily declining deficits and chose to impose significant new borrowing. In part as a result, rising deficits have now returned, and the debt is on an even more unsustainable path than previously projected. Hopefully, the newest projections will serve as a wakeup call for serious action on spending and tax reform in order to put the debt to a downward, sustainable path.

Despite progress in recent years on deficit reduction, 2016 will be the first year the deficit increases since 2009, and deficits will approach 2009 levels by 2026, making it the largest nominal-dollar deficit ever outside of a recession.

We also stressed that, though it seems hard to do, lawmakers could continue to make the deficit even worse by continuing temporary policies:

The budget outlook could be even worse than projected if lawmakers continue to pass legislation without truly offsetting its costs. For example, if lawmakers fully repeal (and don’t offset) future “sequester” cuts, continue various temporary tax breaks, and repeal the Affordable Care Act taxes delayed last December, debt would rise well beyond the projected $23.8 trillion (86 percent of GDP) by 2026, to $25.2 trillion (91 percent of GDP) in that year.

CBO's projections this year heighten the need for serious discussion on how to reform our entitlement programs and tax system in order to fund the country's priorities. Debt ought to return to a sustainable path in order to secure the economy and give lawmakers the needed flexibility in the event of an economic downturn.