Omnibus Spends $110 Billion Above New Budget Caps

Last week's omnibus spending bill enacted a 13 percent increase in base appropriations, spending virtually all of the additional $143 billion allowed for under the recent (fiscally irresponsible) Bipartisan Budget Act of 2018. In addition to appropriating roughly $1.21 trillion within the budget caps, however, the omnibus spent almost $110 billion above the caps (which are already $143 billion higher than the caps previously set under the Budget Control Act). While most of this additional spending is allowable by intent, some of it represents clear budget gimmickry.

Broadly speaking, the nearly $110 billion of additional costs we identify from the bill come from four sources: changes in mandatory programs (CHIMPs) that generate no real savings, disaster relief and program integrity spending exempted from the caps, new hidden additional mandatory spending increases and tax cuts that are not fully offset, and Overseas Contingency Operations (OCO) spending. Likely about one-quarter of this new funding represents gimmicks designed to skirt current budget rules.

Spending (and Tax Cuts) Above the Caps Under the Omnibus Bill

| Policy | Deficit Increase |

|---|---|

| Phantom Changes in Mandatory Spending (CHIMPS) | $17 billion |

| Net Mandatory Spending & Revenue Changes | $4 billion |

| Disaster Relief and Program Integrity Funding | $9 billion |

| Overseas Contingency Operations (OCO) Spending | $78 billion |

| Total | $108 billion |

Source: Congressional Budget Office, Office of Management and Budget, and rough CRFB calculations. Numbers do not equal total due to rounding. Totals are budget authority except for the mandatory spending changes, which are outlays.

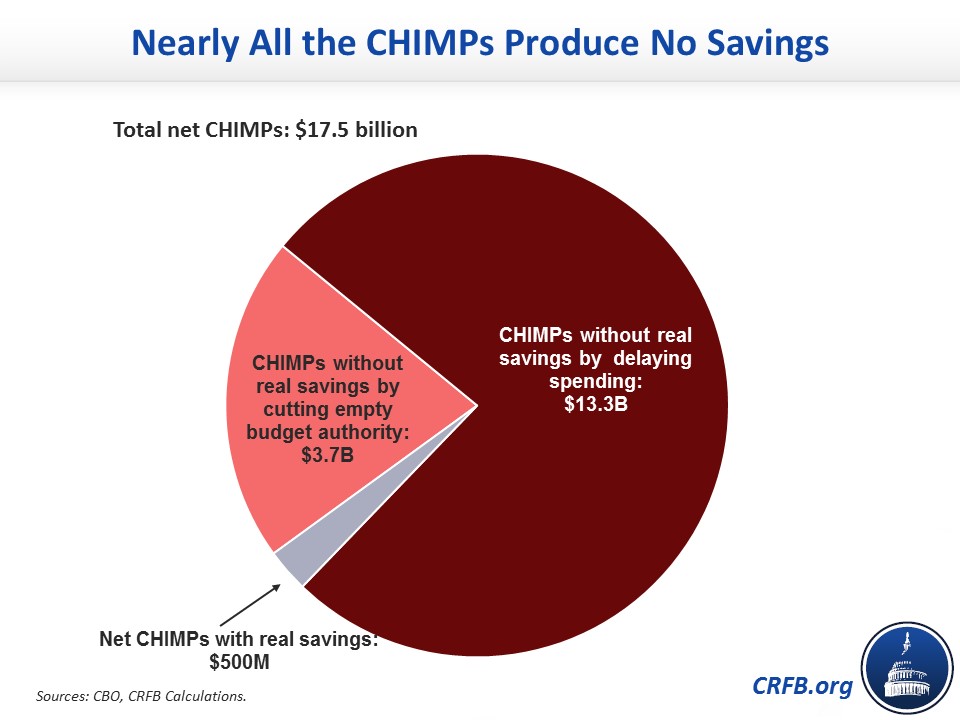

Phantom CHIMPs – Changes in mandatory programs (CHIMPs) allow policymakers to cut mandatory budget authority (BA) to offset increases in discretionary BA. The omnibus bill included $17.5 billion of net CHIMPs in Fiscal Year (FY) 2018. While there is nothing wrong with swapping mandatory spending for discretionary spending in theory, the reality is that nearly all of these CHIMPs represented phony spending cuts.

Roughly $13.3 billion of CHIMPs in the omnibus came from delaying spending from 2018 to 2019 (or later) and taking credit for the 2018 savings while ignoring the future year costs. Most significantly, the omnibus delayed roughly $10 billion of spending from the Crime Victims Fund (CVF) and $3 billion from the Child Enrollment Contingency Fund. Meanwhile, another $3.7 billion of CHIMPs represent reductions in mandatory BA that would never have been spent anyway - with most of that coming from a rescission of Children's Health Insurance Program (CHIP) funding that was never scored to cost the federal government anything. Finally, slightly more than $2 billion of actual reductions in mandatory spending are mostly used to offset actual increases, leaving only about $500 million of the net CHIMPs representing actual savings. As a result, the omnibus includes $17 billion of CHIMPs that don't produce any actual savings and thus allow for non-offset increases in discretionary spending. This number is consistent with the limit set by the FY 2018 budget resolution.

Net Mandatory Spending & Revenue Changes – In addition to phony CHIMPs allowing for discretionary spending increases, the omnibus also enacted a number of small increases in mandatory spending and reductions in revenue. Most of the spending increases were hidden among CHIMPs; increases included $500 million for the Office of Federal Student Aid, over $400 million for rural schools, $400 million for broadcast spectrum, and $200 million for agriculture marketing. The omnibus also reduced revenue – mainly through a $2.8 billion expansion of the Low-Income Housing Tax Credit and a $1.4 billion extension of certain tariff reductions.

Mandatory spending increases and revenue reductions in the omnibus are partially offset through a correction to the “grain glitch” from last December’s tax bill, an extension of customs fees, sale of government-owned petroleum, and other adjustments. However, we still estimate over $4 billion of unpaid-for mandatory spending increases and tax cuts in the omnibus.

Disaster Relief and Program Integrity Spending – On top of the $20+ billion of phony CHIMPs and hidden spending and revenue changes, the omnibus included roughly $9 billion of allowable spending increases above the caps to finance disaster relief and program integrity spending. Of this $9 billion, $7.4 billion was spent on replenishing the Federal Emergency Management Agency (FEMA) disaster relief fund. This funding was on top of the $126 billion of emergency discretionary funds already spent in FY 2018. While some disaster funding is allowable above the caps, this spending really should have been offset given the massive amount spent already, the ample time that has passed since the hurricanes, the large increases in the non-defense caps, and the numerous potential offsets for disaster funding.

The omnibus also included nearly $1.9 billion of program integrity spending for Social Security eligibility redeterminations and for the health care fraud abuse control program within the Department of Health and Human Services, the maximum allowed under the cap adjustments for those purposes included in the 2015 Bipartisan Budget Act and the 2011 Budget Control Act. This spending is likely to save money over time, even though the Congressional Budget Office (CBO) does not conventionally score it as such. We hope the next spending bill also funds Internal Revenue Service (IRS) program integrity, which both President Obama and President Trump recommended and which could save more than $5 billion per year.

Overseas Contingency Operations – Most of the funds in excess of the caps were spent on Overseas Contingency Operations, or OCO. The OCO designation is designed to allow policymakers to spend above the defense and non-defense discretionary spending caps in order to fund the wars in Afghanistan, Iraq, and elsewhere in the Middle East. In recent years, unfortunately, this designation has been used in part to fund ordinary defense and even non-defense priorities – effectively backfilling appropriations and circumventing the caps.

Encouragingly, policymakers seem to have scaled back on this practice dramatically this year. While last year's OCO appropriation totaled $104 billion (including $21 billion for non-defense spending), this year's OCO appropriation has dropped to $78 billion (including $12 billion for non-defense). This level of spending is just $1.5 billion above the President's request, and while some of it may still be going toward ordinary defense operations, there is no question that this is a significant improvement. It also nearly tracks recent recommendations we made to limit OCO spending to the President's request.

In light of generous new cap increases and continued unwinding of wars abroad, our hope is OCO funding can be reduced further next year and could ultimately be capped and continued at a much lower level meant to reflect the cost of our long-term commitments in Iraq and Afghanistan.

***

The Bipartisan Budget Act added $320 billion to the deficit, mostly over the next two years. It did so by going well beyond repealing the 'sequester-level caps' and increasing both defense and non-defense appropriations well in excess of the bipartisan caps agreed to under the Budget Control Act. The recent omnibus bill then allocated the funds from these cap increases, increasing the size of appropriations by an average of 13 percent – with the hikes ranging from 5 percent to 22 percent. It is unfortunate that even with these massive cap increases, policymakers felt the need to spend $110 billion more.

Encouragingly, spending in excess of the caps is considerably lower this year than last. Last year, policymakers spent nearly $130 billion above the caps, relying on at least $40 billion worth of gimmicks. This year, spending is $110 billion above the caps, with gimmicks likely totaling closer to between $20 billion and $30 billion.

Unfortunately, our fiscal situation has deteriorated dramatically over the past year, making it more important than ever to crack down on gimmicks that threaten to make it even worse. Hopefully the new Joint Select Committee on Budget and Appropriations Process Reform can come up with a better way to structure caps and make many of these gimmicks a thing of the past.