IRS Taxpayer Advocate Report Shows the Need for Tax Reform

The complexity of our tax code has many advocates making the case for tax reform as we head toward the second round of fiscal negotiations.

In a recently released annual report to Congress from the IRS's National Taxpayer Advocate Nina Olson, it was estimated that individual and business tapayers spent 6.1 billion hours to complete filings, with a tax code that contains almost four million words. The report argues the complexity leads to errors and abuse of loopholes. Meanwhile, the report suggests that a significant amount of revenue could be raised from reform, citing the JCT estimate of individual income tax expenditures in FY 2013 of $1.09 trillion dollars, compared to the $1.36 trillion that the individual income tax raises.

The Taxpayer Advocate report recommends that Congress employ a zero-based budget approach, in which lawmakers would start from a baseline where all tax expenditures are eliminated and debate whether certain provisions should be added back in, an approach embodied in the Fiscal Commission's Zero Plan.

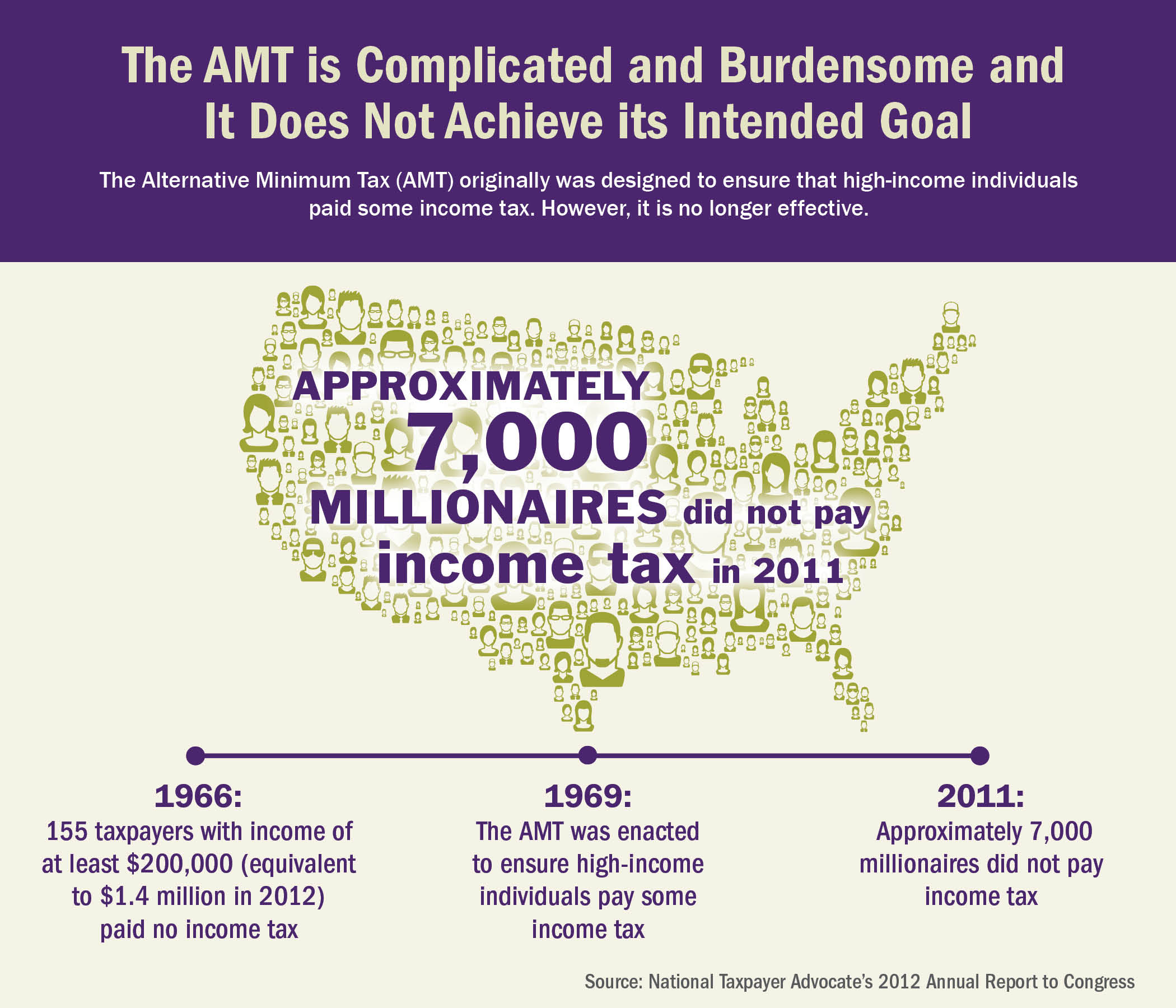

The Alternative Minimum Tax was listed as the second greatest problem in the current tax code by the Taxpayer Advocate after the overall complexity of the code. Part of the problem previously was the continuous patching of the AMT exemption to ensure that it did not hit millions more taxpayers. The exemption has since been permanently patched by indexing it to inflation in the American Taxpayer Relief Act.

But even with that problem fixed, the AMT's complexity and filing burden on taxpayers remains a problem. As the graphic below demonstrates, the AMT itself has holes which allow high-income taxpayers to reduce their tax liability to zero, an issue which was the original impetus for the tax. Olson's report recommended repealing the AMT, although this would lose a significant amount of revenue that would have to be offset elsewhere in tax reform.

Olson also expresses concern about the sequester, which would further reduce the IRS's funding. According to the report, the tax gap between actual tax liability and taxes collected is about $400 billion. Should the agency lose resources, this number could be even larger and would likely offset the original cuts to the program and then some.

The IRS report is another reason for taking a serious look at tax expenditures and other provisions which add unnecessary complexity to the code and lose revenue. Well-designed tax reform can make the code simplier and raise more revenue than the current code even while lowering marginal tax rates.

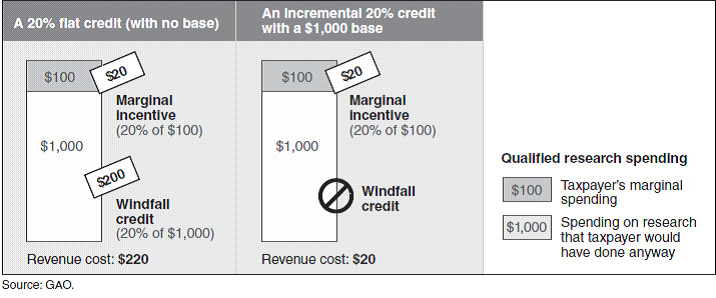

On a related note, the GAO has a report on the evaluation of tax expenditures, saying that these preferences are good policy only if they acheive desired objectives efficently, outweighing the downsides of revenue loss and added complexity. By that measure, many tax expenditures could be eliminated or better designed to achieve their desired goals. As one example, they show how the R&E tax credit gave taxpayers a subsidy on research that would have been done anyways without the credit, estimating in 2009 that half of what was claimed for the credit was a windfall. They make the case for a floor only above which R&E expenditures would be eligible for the credit. In general, better designs for tax expenditures could make the code more efficient and allow the system to raise more revenue.

The recent fiscal cliff fight was a clear sign that our tax code could benefit from reform and stability. As a result of the last minute changes under the fiscal cliff, the IRS will be forced to delay the start of the tax filing season one week to January 30th, and some taxpayers will have to wait as long as late February or March to begin filing.

For a still-weak economy, tax reform that gives the markets and public greater confidence in our fiscal path and tax code and greater stability would be a significant help.