Interest Rates Continue to Fall in CBO's Forecast

CBO’s latest budget baseline projects ten-year deficit numbers to be slightly smaller than previously estimated, despite the passage of legislation increasing the deficit. The biggest cause: a drop in projected interest rates, which lead CBO to revise down total interest spending by $385 billion, or about 7 percent, through 2025.

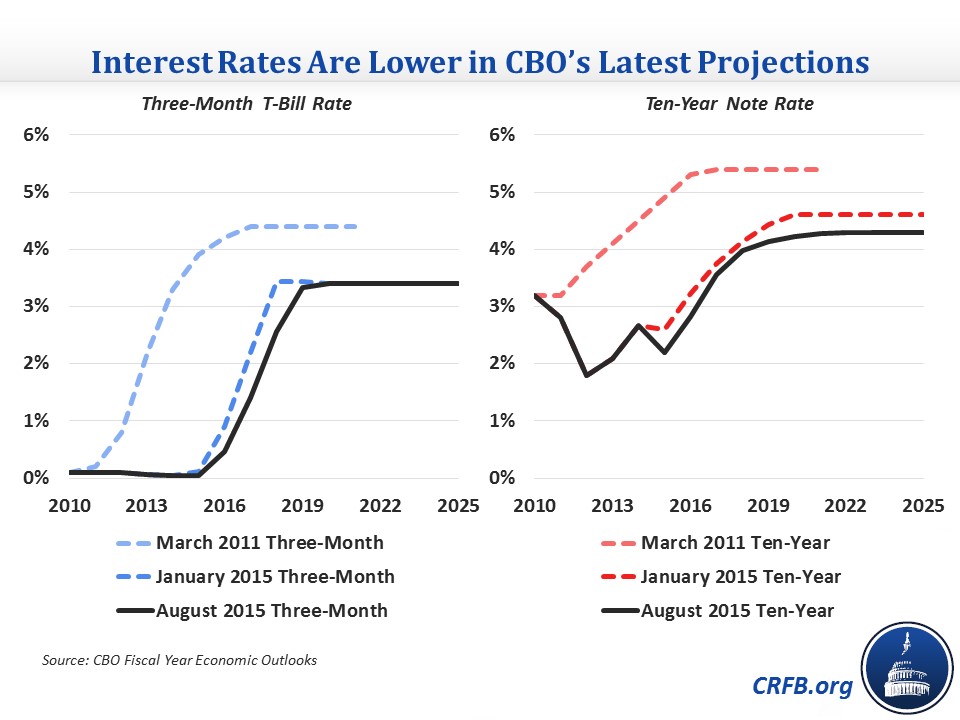

CBO now expects rates on three-month Treasury bills to be lower for the next three years before stabilizing at 3.4 percent in 2020, one year later than projected in January. CBO expects longer-term bonds to pay permanently lower interest rates, with ten-year notes ultimately reaching only 4.3 percent instead of 4.6 percent.

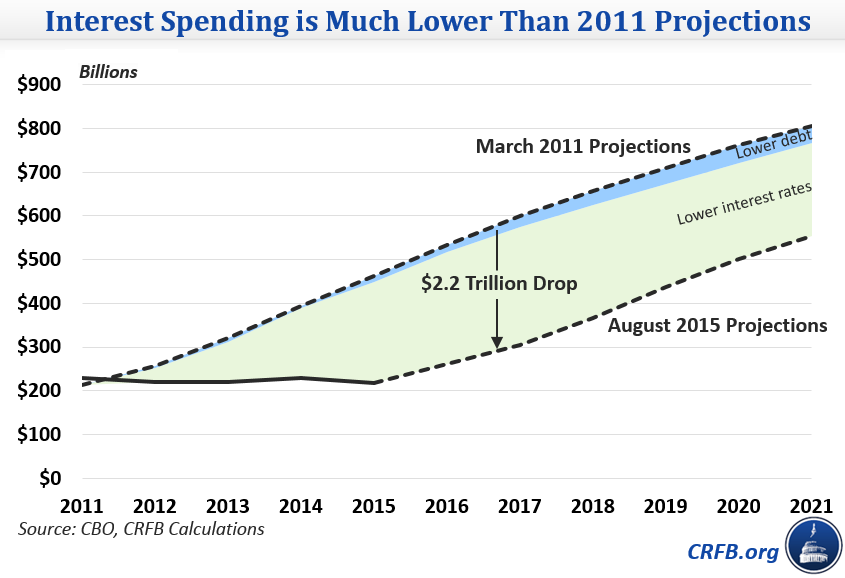

This downward revision represents the continuation of a trend we noted last year. Compared to its March 2011 projections, CBO now sees $2.2 trillion less interest spending over the 2011-2021 period, a drop of nearly 40 percent. About 90 percent of that drop is due to lower projections for interest rates and technical factors, and the rest is due to lower debt levels than projected in 2011.

As a percent of GDP, interest spending is now projected to average 1.7 percent over that period compared to 2.7 percent in 2011.

Actions by the Federal Reserve have helped interest rates remain steady and even fall since 2011. At that time, CBO anticipated an increase in the federal funds rate starting that year, but it is now not expected until later this year. The Federal Reserve has also undertaken more quantitative easing, expanding its balance sheet by almost $2 trillion since mid-2011 and putting more downward pressure on longer-term interest rates.

CBO now expects the equilibrium rates to be about one point lower than they had projected in 2011, and the currently projected ten-year rate of 4.3 percent is slightly lower than the 2011 three-month rate of 4.4 percent.

So long as interest rates remain low, it is good news for the budget, especially since the Treasury Department continues to lengthen the average maturity of debt issued. However, low interest rates should not lull lawmakers into complacency about the debt. The budget still remains in primary deficit, meaning that non-interest spending exceeds total revenue. Moreover, interest rates are still expected to rise substantially from the current levels – with the ten-year Treasury note projected to rise from 2.2 percent today to 4.3 percent by 2021.

This increase in rates, combined with higher debt, will cause interest spending to be the fastest growing part of the budget – doubling as a share of GDP between now and 2021, from 1.2 to 2.4 percent, and growing in nominal dollars from about $218 billion this year to $755 billion by 2025.

This growth will likely crowd out other important priorities as every dollar spent on servicing the debt is a dollar unavailable for new investments, lower taxes, or paying down the debt. And so long as debt remains high, the U.S. remains vulnerable to huge increases in interest spending as a result of higher-than-expected interest rates.

Lawmakers should not use the current low interest rates as an excuse not to work on reducing the deficit. Instead, they should use the opportunity presented by low rates to enact gradual and thoughtful deficit reduction to put the debt on a more sustainable long-term path.