House Tax Plan May Add Over $2 Trillion to the Debt

Note: This blog has been updated from its original posting to account for the new JCT score and a new estimate for the cost of extending the family credit.

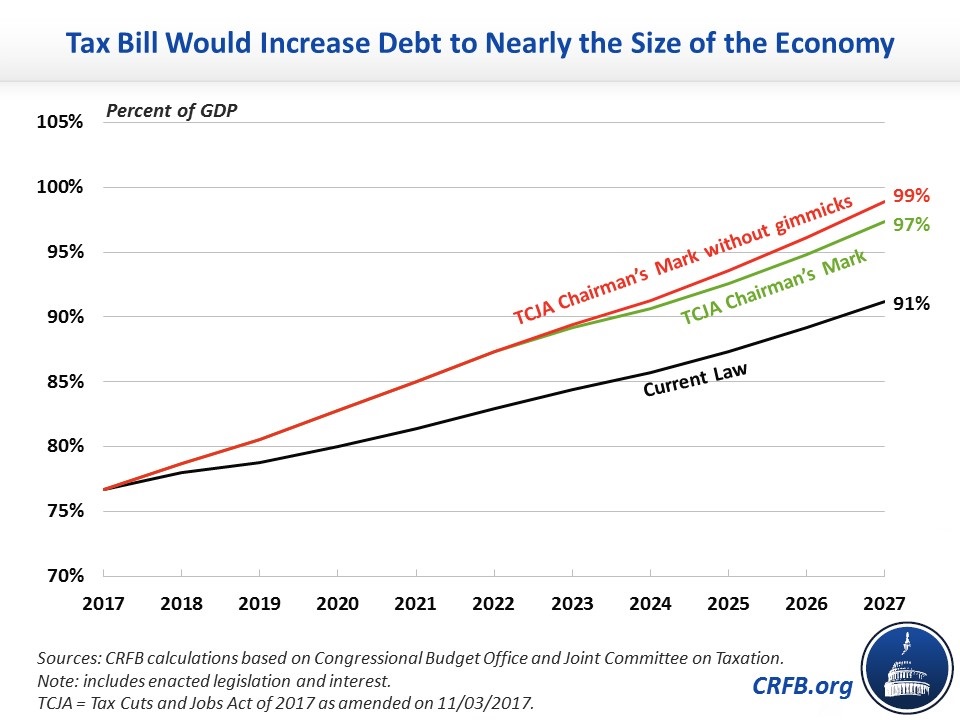

The Tax Cuts and Jobs Act (TCJA) would lose $1.4 trillion and significantly worsen our already unsustainable budget outlook. However, the cost could be even higher after accounting for higher interest spending and gimmicks embedded in the bill. Ultimately, the House tax plan could add over $2 trillion to the debt. As a result, trillion-dollar deficits would return by 2020 and debt would exceed the size of the economy in just over a decade.

According to the Joint Committee on Taxation (JCT), the TCJA would increase deficits by $1.414 trillion over ten years. Those deficits would lead to higher debt, resulting in $260 billion in additional interest costs. As a result, the legislation would add $1.67 trillion to the national debt by 2027.

However, the bill also sets the stage for further debt increases. Three major provisions in the bill arbitrarily expire after five years, making them look much cheaper than they actually are. There is no legitimate policy justification for these sunsets – the intent is clearly to force Congress to extend them in the future. Doing so would add about $430 billion (including interest) to the cost of the bill.

| Ten-Year Cost | |

|---|---|

| Tax Cuts and Jobs Act as scored by JCT | $1.41 trillion |

| Additional interest costs | $260 billion |

| Total "official" cost | $1.67 trillion |

| Temporary credits made permanent | $225 billion |

| Temporary expensing made permanent | $175 billion |

| Additional interest costs | $30 billion |

| Total "real" cost | $2.1 trillion |

Source: CRFB calculations based on 11/3/2017 JCT estimate of H.R. 1, the Tax Cuts and Jobs Act and CBO data. Numbers may not sum due to rounding

The new $300 per-person tax credits, expanded small business expensing, and temporary expensing for equipment would all expire in 2023, but policymakers would feel significant pressure to make them permanent if the TCJA was passed into law. Indeed, lawmakers have reportedly already promised to fight to extend the temporary tax credits.

Even without these extensions, the tax bill would be expensive enough to lift deficits to $1 trillion by 2020 (compared to $780 billion under current law, including the cost of recent disaster relief) and increase the debt-to-GDP ratio to 97 percent of GDP by 2027 (compared to 77 percent today and 91 percent by 2027 under current law). With expiring provisions extended, debt would reach 99 percent of GDP by 2027 and exceed the size of the economy the very next year. This high level of debt is likely to dampen or even ultimately reverse the pro-growth effects of tax reform.

Adding $1.4 trillion to the debt is bad enough, but potentially adding $2.1 trillion to the nation's credit card would be even more fiscally irresponsible. Lawmakers in Congress should identify additional base broadening measures or scale back some of the bill's tax cuts to ensure the legislation is fully paid for without resorting to budget gimmicks like the ones already included. Tax reform should not come at the expense of future generations.