GAO's Long Term Outlook

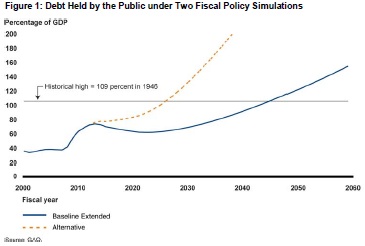

The Government Accountability Office (GAO) has released its Long Term Outlook for the federal budget, showing an ever-climbing debt path as a percentage of GDP over the long term. Under both its Baseline Extended and Alternative scenarios, debt rises rapidly as increasing health care spending, among other things, overtakes revenue. This is especially true of the Alternative, which assumes that expiring tax policies are extended and that revenue and discretionary spending are held to their historic averages over the long term.

GAO's outlook differs somewhat from CBO's outlook, which shows a disastrous fiscal path in its Alternative Fiscal Scenario but relatively stable debt in its Extended Baseline. The differences reflect different assumptions about each part of the federal budget (you can read a summary of CBO's assumptions here). In general, GAO's baseline builds off of CBO's ten-year projections from January. Their technical assumptions are the following:

- Revenue: GAO's Baseline Extended assumes that all expiring tax policies do so as scheduled. In the long term, GAO assumes that lawmakers will cut taxes to keep revenue constant as a percent of GDP at 21 percent (CBO assumes revenue will grow over the long term). In the Alternative scenario, GAO assumes that expiring tax policies are extended and that revenue remains at 18 percent of GDP beyond this decade.

- Social Security and Health Spending: The GAO Baseline Extended uses CBO projections of these categories for the first ten years and Social Security and Medicare Trustees current law projections (using the health care growth rates for other health spending) beyond that. The Alternative differs from the Baseline Extended by using the alternative Medicare Trustees projections, which have higher health care growth rates and incorporate the effect of the doc fix.

- Other Non-interest Spending: The GAO Baseline Extended uses CBO current law projections for the first ten years, and keeps these categories constant as a percent of GDP beyond that. The GAO Alternative assumes a repeal of the sequester during the first ten years and ramps these categories up to their historical averages beyond that (pushing up discretionary spending by two percentage points of GDP relative to the Baseline Extended).

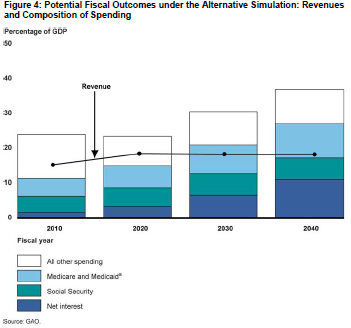

Given the assumptions of the Alternative scenario, spending rises sharply, mostly from health care spending and interest on higher debt.

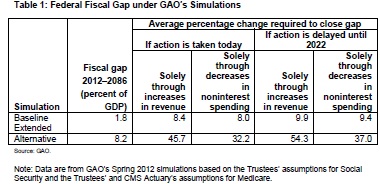

In addition, GAO shows the 75-year fiscal gap--the present value of the gap between spending and revenue--and what would be required to close it in each scenario. Also, they quantify how much more difficult solving the problem gets when action is delayed for ten years.

GAO's outlook underscores a point that remains constant: we will need to deviate from current projections or historical averages--or, more likely, a combination of both--in order to keep our fiscal path sustainable.