Five Reasons to Oppose the Budget Deal

Congressional leaders and the President announced a proposed budget deal yesterday to raise the caps on discretionary spending for Fiscal Years (FY) 2020 and 2021. Unfortunately, the deal's two-year cost of $320 billion includes just $55 billion of ten-year offsets and sets the stage for a total of $1.7 trillion in additional debt.

Below we outline five reasons why lawmakers should reject the deal in its current form without full offsets.

1. The Budget Deal Would Add $1.7 Trillion to Projected Debt Levels

The proposed budget deal would lift spending caps for the next two years by a combined $320 billion, which over the next decade will result in $1.7 trillion of additional projected debt. Negotiators explicitly chose not to extend the Budget Control Act (BCA) caps, which will expire in 2021. The Congressional Budget Office (CBO) will thus assume discretionary spending rises with inflation after 2021 in its baseline, leading to roughly $1.5 trillion more of outlays through 2029. Netting interest and offsets brings the total cost to $1.7 trillion.

2. The Budget Deal Would Cost Nearly As Much As the Tax Cuts

While we and many others have decried the cost of the unpaid-for 2017 tax law, passing this deal would enshrine nearly as much debt as the tax cuts did. According to CBO, the 2017 tax law will cost $1.9 trillion over a decade, including the dynamic effects from economic growth and interest. We project that the proposed budget deal will enshrine $1.7 trillion of debt over a decade, including interest. As a result, lawmakers will have added almost as much to the debt with this round of spending increases as they did with tax cuts.

3. The Budget Deal Would Cost Nearly Twice as Much as Sequester Repeal

Much of the rationale for past budget deals has been to avoid sequestration, which was a consequence of the 2012 Joint Select Committee on Deficit Reduction's ("Super Committee") failure to come to agreement on a debt reduction deal. Cap increases in 2013 and 2015 set spending higher than sequester levels but still below the pre-sequester levels agreed to on a bipartisan basis in the 2011 BCA. This deal would not only fully repeal the sequester, but it would also spend substantial money above the original BCA caps. In total, it would cost nearly twice as much as full sequester repeal.

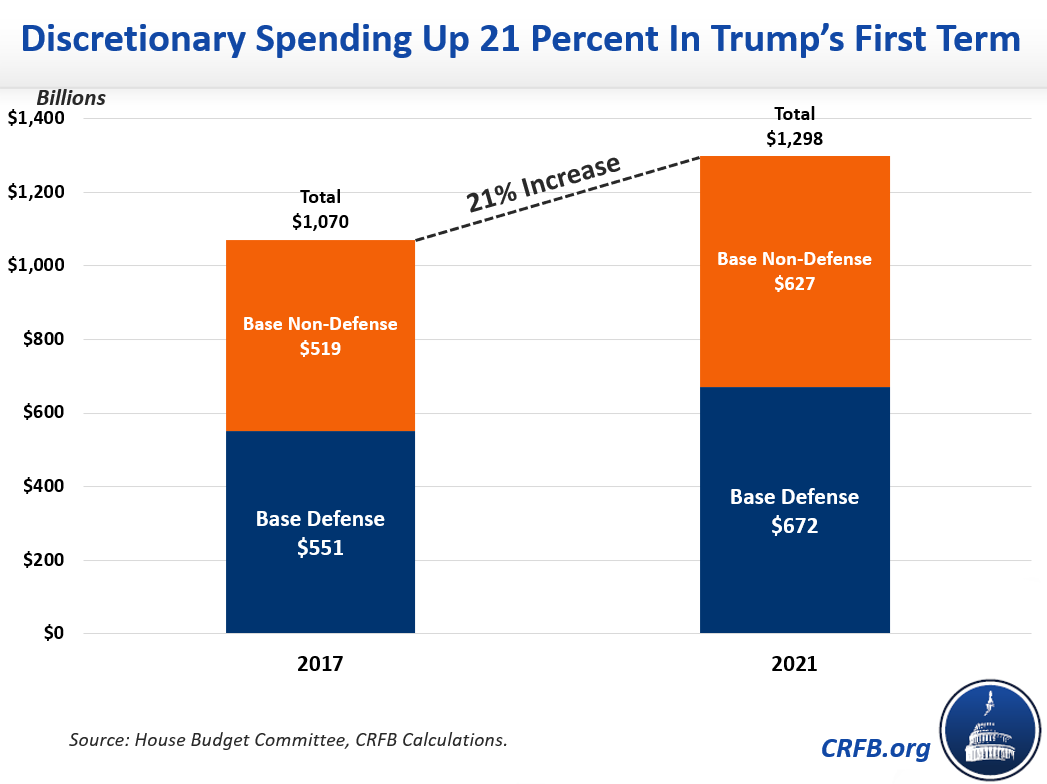

4. Under this Deal, Discretionary Spending Would Rise 21 Percent in President Trump's First Term

In FY 2017, discretionary spending subject to the caps totaled $1.07 trillion. Under this deal, it will reach nearly $1.3 trillion by 2021. That's a 21 percent increase over just four years. By comparison, the economy is projected to grow 19 percent and price levels 9 percent over that time period.

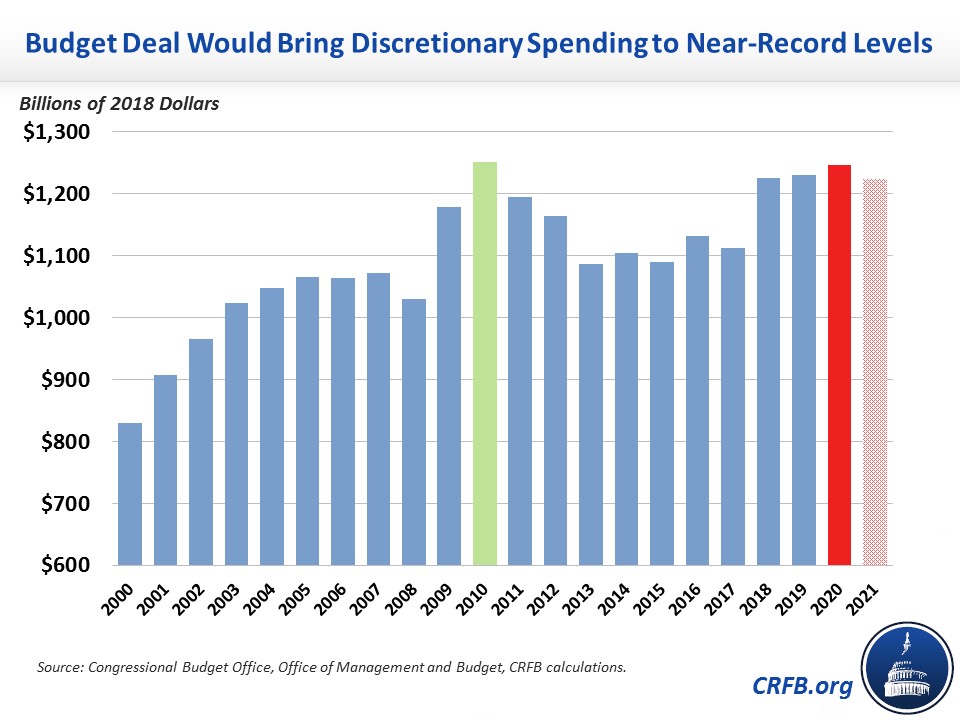

5. The Budget Deal Would Bring Discretionary Spending to Near-Record Levels

The proposed budget deal would unravel recent restraint on discretionary spending, returning spending to inflation-adjusted levels on par with the record high set in 2010 in the midst of the Great Recession when both parties recognized spending needed to be reined in. While one could argue such levels are justified given current needs, it is hard to argue they are austere and especially concerning that policymakers won't offset the costs of proposed spending increases.

Lawmakers should think carefully about our current fiscal situation before adding another $1.7 trillion in debt. The proposed budget deal should be fully offset with increased revenue, reduced mandatory spending, and/or otherwise paring back the increases to a reasonable level for lawmakers to pay for it. We recently put forward a plan that proposes a combination of all three.

If this budget deal is worth doing, it's worth paying for.

Tweet this chart

Tweet this chart