Factchecking Tax Claims in the 2020 Election

In recent days, President Trump and former Vice President Joe Biden have made several competing claims about the other's tax agenda. We summarize and explain three recent claims.

- Trump: Joe Biden wants to raise taxes on all Americans. Largely False

- Trump: Joe Biden would have the largest tax increase in history. Almost True.

- Biden: $1.3 trillion out of the $2 trillion tax cut went to the top 0.1%. False.

Claim #1: Joe Biden wants to raise taxes on all Americans.

During a presidential candidate town hall held in lieu of the second debate, President Trump said "...Biden comes in and raises taxes on everybody, including middle income taxes, which he wants to do." We previously factchecked similar claims by United Nations Ambassador Nikki Haley and Eric Trump and found them somewhat misleading to largely false. We have adapted this factcheck from Would Joe Biden Significantly Raise Taxes on Middle Class Americans? and find that this claim is largely false.

The Biden tax plan appears designed to honor his pledge to not raise direct taxes on households earning less than $400,000 per year. While middle-class Americans could see an increase in their net tax burden under a Biden administration, this would be an indirect result of higher corporate taxes, not from direct tax increases. Furthermore, any potential indirect increases in middle-class tax burdens would be modest.

Our recent paper, Understanding Joe Biden’s 2020 Tax plan, we show Biden's tax proposals would raise between $3.35 and $3.67 trillion over a ten-year period, which is a net figure including all of his proposed increases and targeted tax reductions. His tax plan contains $4.3 trillion of gross tax increases, which we estimated in our paper The Cost of the Trump and Biden Campaign Plans. Other estimates differ in some ways but reach similar conclusions.

Biden's $2.3 trillion of tax increases on individuals include higher individual income and payroll tax rates, fewer deductions, and higher taxes on capital gains and dividends. However, all of these tax increases would be limited to households making over $400,000, which is only around 1.5 percent of total households.

Biden proposes another $1.8 trillion of taxes on corporations, under our central estimate. Most economists and estimators believe corporate tax burdens are borne by some combination of shareholders, owners of capital, and workers. Since many middle-class households include both workers and shareholders (through pensions and retirement accounts, for example), any increase in corporate taxes would indirectly increase their tax burden, albeit modestly.

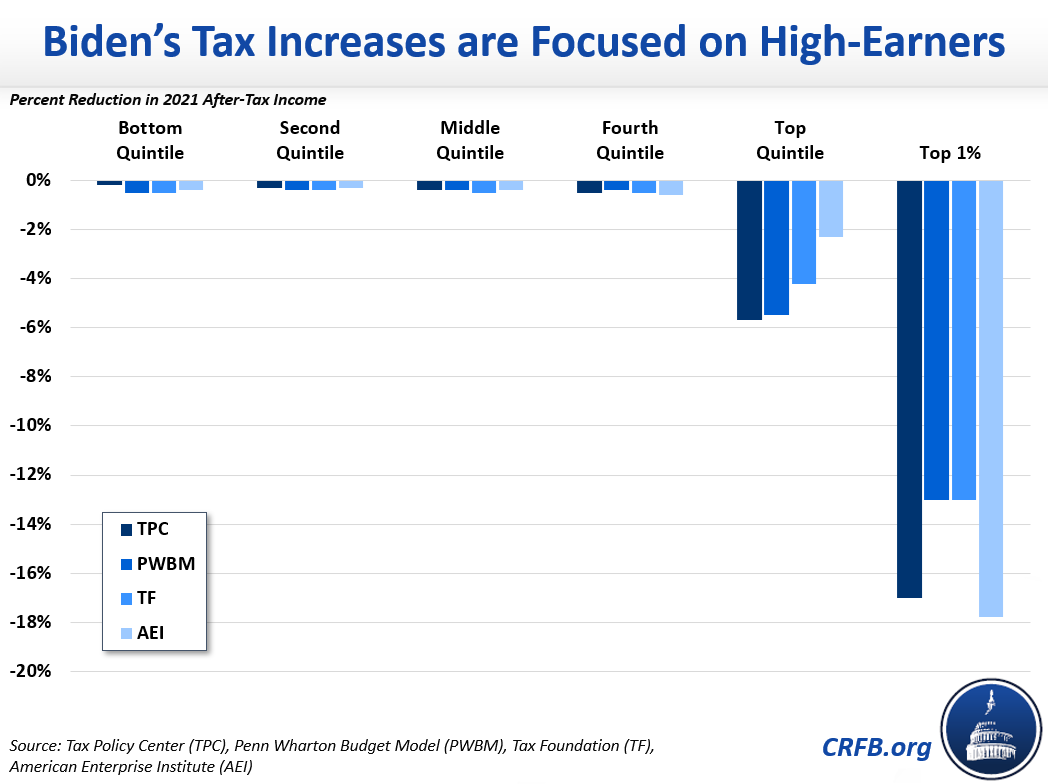

Based on analyses and estimates of Biden's tax plan published by the Tax Policy Center, Penn Wharton Budget Model, Tax Foundation, and American Enterprise Institute, tax burdens among the bottom 80 percent of households in the income distribution would see a 0.2 to 0.6 percent reduction in after-tax income. For a typical family in the middle of the income distribution, this amounts to $180 to $260 per year. But again, these are indirect tax increases. And they don't include many of the tax cuts proposed by Vice President Biden, which will more than offset the increase for many households.

It is important to note that Biden's plans, as we've estimated in The Cost of the Trump and Biden Campaign Plans, fall $5.6 trillion short of being offset. Covering this cost may in fact require new taxes on a broader swath of Americans. But as of now, only a small share of Americans would face a tax increase under Biden's plans.

Ruling: Largely False

Claim #2: Joe Biden would have the largest tax increase in history.

In a tweet on Saturday afternoon and again Wednesday morning, President Trump claimed that Vice President Biden's proposed tax increases would be the largest in history.

SLEEPY JOE BIDEN IS PROPOSING THE BIGGEST TAX HIKE IN OUR COUNTRY’S HISTORY! CAN ANYBODY REALLY VOTE FOR THIS?

— Donald J. Trump (@realDonaldTrump) October 17, 2020

Biden's proposed tax increases, if enacted all at once, would constitute the first or second largest tax increase since World War II, but not literally the largest in all of history. We rank this as almost true.

The President may have been referring to Biden's $4 trillion tax increase (as some PAC-funded campaign ads suggest) as a record in nominal dollars. If interpreted that way, the President's statement is technically true but also largely meaningless when it comes to historical comparisons. One of the appropriate ways to compare a given tax increase to past tax increases would be to compare their relative size as a share of the economy at the time they were enacted. We recently estimated that Biden's tax increases would raise $4.3 trillion over the next decade, assuming immediate enactment and excluding any targeted tax cuts he would make or any COVID-specific relief policies. That $4.3 trillion is equivalent to 1.7 percent of projected GDP over the same time period. A tax increase of that size would be the largest in post-WWII history, but not the largest as far back as data is available. According to a 2013 report from the Treasury Department that examines tax bills since 1940, tax increases enacted in 1941 and 1942 were larger, at 2.2 and 5.0 percent of GDP, respectively.

A fairer approach might be to incorporate targeted tax breaks in the net cost of Biden's tax plan. Our paper Understanding Joe Biden’s 2020 Tax plan compiled several estimates of Biden's tax plan and found that it would result in a tax increase equivalent to between 1.3 and 1.4 percent of GDP, though this would include outlays from refundable tax credits as revenue instead of appropriately as spending. That would make Biden's plan the second-largest tax increase in post-war history and fourth-largest tax increase since 1940.

In reality, Biden's proposed tax increases are largely designated to offset specific spending proposals (or to improve Social Security solvency) and thus would more likely to be enacted in multiple pieces. In that case, any one piece of the plan is unlikely to be the largest in recent history. However, if they are fully enacted over his presidency, Biden will sign into law more in net tax increases than any modern president other than Franklin Roosevelt.

Biden is proposing to increase taxes substantially; far less drastically than the taxes used to finance World War II, but moreso than any time or almost any time since.

Ruling: Almost True

Claim #3: $1.3 trillion out of the $2 trillion tax cut went to the top 0.1%.

During a presidential candidate town hall held in lieu of the cancelled second debate, former Vice President Joe Biden made the following claim regarding the Tax Cuts and Jobs Act (TCJA), sometimes referred to as the Trump tax cuts: "About $1.3 trillion of the $2 trillion in his tax cuts went to the top one-tenth of 1 percent."

Although a significant portion of the tax cuts in the TCJA went to the wealthiest Americans, it was not as much as $1.3 trillion. We rate the claim false.

Several estimators have looked at the distribution of the 2017 tax cuts. Estimates from the Tax Policy Center show that between 2018 and 2025, 20 to 25 percent of the tax cut goes to the top 1 percent of earners, with 8 to 10 percent going to the top 0.1 percent of earners. In total, the Congressional Budget Office estimates that the tax cut will ultimately cost $1.84 trillion over a decade, and $1.95 trillion through 2026. The Tax Policy Center estimates therefore imply that between $150 and $200 billion in tax cuts went to the top 0.1 percent of earners, not $1.3 trillion as Biden claimed.

It appears that Biden was referring to the distribution of the tax cut after the bulk of it expires at the end of 2025. A few portions of the bill are permanent, including the corporate tax changes, which are primarily a tax cut for shareholders concentrated at the top of the income spectrum, and a slower rate of inflation used to index tax brackets, which increases taxes on all income groups. As a result, the Tax Policy Center estimates that, in 2027, 60 percent of the net tax cuts in the bill will go to the top 0.1 percent. However, the total tax cut in 2027 is quite small, only about one-tenth of what it is in 2018 or 2025, so the 2027 distribution cannot be applied to the overall cost of the bill.

While Biden is correct that 60 percent of the tax cut in 2027 goes to the top 0.1 percent, he erred in applying that percentage to its entire ten-year cost, which is concentrated before the individual income tax provisions expire at the end of 2025. Before 2025, the top 0.1 percent of earners would receive 8 to 10 percent of the benefits, on average.

Ruling: False

These factchecks are part of US Budget Watch 2020, a project focused on the fiscal and budgetary impact of proposals put forward in the 2020 presidential election. You can click here to read the analyses, explainers, and fact checks we’ve produced to date. US Budget Watch 2020 is designed to inform the public and is not intended to express a view for or against any candidate or any specific policy proposal. Candidates’ proposals should be evaluated on a broad array of policy perspectives, including, but certainly not limited to, their approaches on deficits and debt.

These factchecks are part of US Budget Watch 2020, a project focused on the fiscal and budgetary impact of proposals put forward in the 2020 presidential election. You can click here to read the analyses, explainers, and fact checks we’ve produced to date. US Budget Watch 2020 is designed to inform the public and is not intended to express a view for or against any candidate or any specific policy proposal. Candidates’ proposals should be evaluated on a broad array of policy perspectives, including, but certainly not limited to, their approaches on deficits and debt.