Event Recap: Fixing the Budget Process

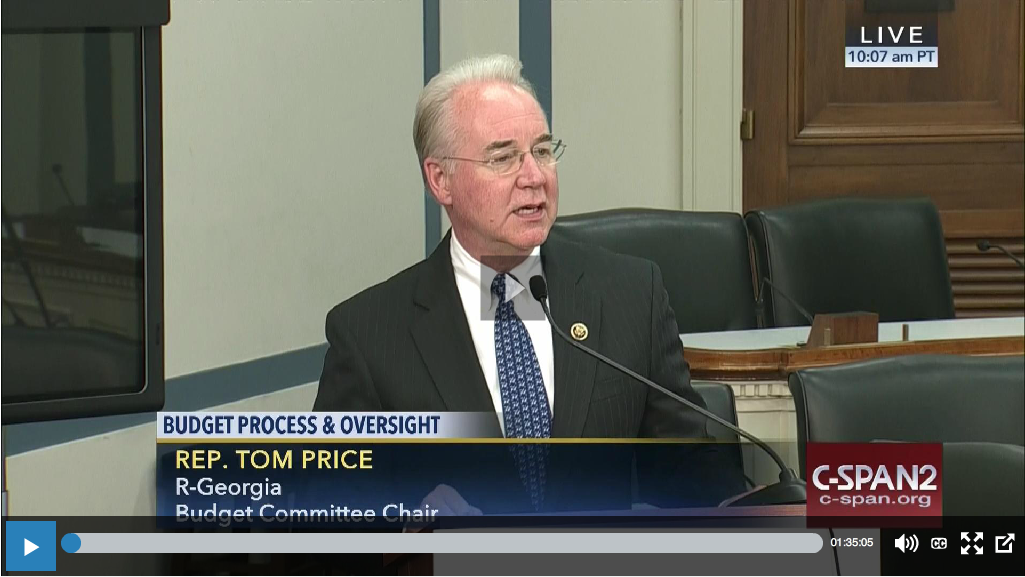

As part of our Better Budget Process Initiative, the Committee for a Responsible Federal Budget recently hosted a briefing on Capitol Hill called “Fixing the Budget Process.” The event featured remarks from the House Budget Committee Chairman Tom Price (R-GA) and a panel of experts made up of Maya MacGuineas, president of the Committee for a Responsible Federal Budget; Paul Posner, former federal budget managing director at the Government Accountability Office; Dr. Stuart Butler, senior fellow in economic studies at the Brookings Institute; and Dr. Marvin Phaup, public policy & public administration professor at The George Washington University. The event was moderated by Kelsey Snell, a reporter for The Washington Post. It aired live on C-SPAN and can be viewed here.

Chairman Price kicked off the event with an overview of the country’s dire fiscal situation by describing the high and growing debt and slow economic growth. He noted that many of the problems we face are attributed to “extremely weak budget enforcement,” and he stressed the importance of reforming the budget process now instead of waiting for the debt to grow to 86 percent of Gross Domestic Product (GDP) by 2026. In lieu of offering specific suggestions for reform, Chairman Price gave three basic options for policymakers to choose from moving forward: increase taxes, decrease spending, or grow the economy. He also raised questions to frame the debate for budget process reform, inquiring whether Congress should face enforceable consequences for failing to produce a budget by a deadline, whether we ought to have fiscal targets and what they should be, what authority the budget committees should have in shaping and enforcing fiscal policy, what role the executive and the Congressional Budget Office should have in the process, what the budget baseline ought to be (current law, current policy, or zero baseline), how often a budget should be presented, and what should be done with unauthorized programs.

Following Chairman Price's remarks, each panelist spoke on a specific reform topic. Mr. Posner made the case for portfolio budgeting, which would categorize federal fiscal activity into different “portfolios” like education or defense, study how well the current portfolio of programs are working, and ferret out the programs that do not work well. He suggests this would lead to more rationalized budgeting, ostensibly generating savings.

Ms. MacGuineas discussed the problem of budgeting for the short term, which forces the current budget to overlook long-term issues like entitlement spending by focusing on the present year and only looking at the discretionary budget that accounts for roughly one-third of all spending. Short-term budgeting also opens the door for gimmicks like increased spending or tax cuts in the first year with promises to save in subsequent years; as we see, this process of spending now saving later is frequently repeated and is a contributor to our ever-growing debt and deficit. Ms. MacGuineas offered several solutions to short-term budgeting: include more long term projections in budget summary tables, provide fiscal targets over the long term (10 to 20 years for the debt and deficit), impose requirements that prohibit fiscal worsening over time, and prohibit budgets that promise spending more in future than we would be willing to pay for today.

Dr. Butler proposed making entitlement programs accountable through the budgeting process with four key reforms. First, he said Congress should create a long-term budget for all major entitlements including Social Security, Medicare, and Medicaid. Second, he advocated for Congress having a long-term budget for tax revenues. Third, he explained that these budgets should be formally reassessed every four years in order. Finally, Dr. Butler said there should be a trigger mechanism that ensures entitlement spending stays on budget. The difficulty with this approach, as Dr. Butler admitted, is devising an effective trigger to ensure spending remains controlled.

Finally, Dr. Phaup discussed how tax expenditures are not currently accounted for in the budget and identified several key factors for lawmakers to consider during their budget process reform efforts. He first mentioned that tax expenditures are quite large currently, with an annual value that exceeds $1 trillion (25 percent of cash spending or 5 percent of GDP). Second, he explained that they are equivalent to cash spending for “almost anything” and are almost invisible in the budget despite their significant fiscal impact Finally, Dr. Phaup noted that tax expenditures distort decision making.

We are grateful to Chairman Price and the panelists for participating. We hope this discussion will prove constructive as the House and Senate Budget Committees proceed with budget process reform efforts. For additional detail, click here to view the event.

Further Reading on the Better Budget Process Initiative: