Don't Use the Immigration Reform Bill as a Slush Fund

The Congressional Budget Office's cost estimate of the Senate's immigration bill attracted a great deal of attention due to the $197 billion in deficit reduction the bill would produce over ten years. But with this positive news comes a danger that if lawmakers are not careful, there may be a temptation to spend the windfall money on things like enhanced border security or other initiatives. Even if new initiatives are warranted, they should think twice before trying to use these savings as a slush fund.

On net, more than the entirety of the $197 billion in savings comes from payroll tax revenue dedicated to the Social Security trust fund. This is real money that will have real fiscal implications, but it is also technically "off-budget" and dedicated to a specific purpose. We've written before that Social Security can be viewed in one of two ways: as part of the broader budget or as its own self-financed program. Those who view it as the latter should be particularly wary of using Social Security revenue to offset non-Social Security spending. But even those who view Social Security as part of the budget should recognize that money counted both to offset new spending and strengthen the trust fund (to 2035, by our estimate) will result in less net long-term debt reduction as policymakers target only trust fund solvency. Savings cannot be used twice; either they result in deficit reduction or the extend the life of the trust fund.

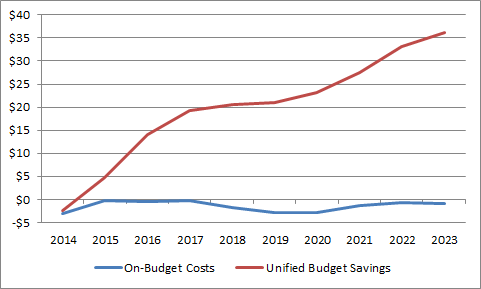

Indeed, this is part of the reason that PAYGO rules and law exclude the effects of Social Security. And on an on-budget basis, the legislation currently increases the deficit by $14 billion, meaning it violates PAYGO rules.

Deficit Impact of the Original Senate Immigration Bill

Source: CBO

Given this reality, future amendments to the immigration bill must actually fill a $14 billion hole, not dig that hole $200 billion deeper.

This is important, as recent proposal from Sens. John Hoeven (R-ND) and Bob Corker (R-TN) to enhance border security would likely add to the deficit relative to the prior bill. The admendment includes an additiona $38 billion in border security spending to hire nearly 20,000 new Border Patrol agents and construct fencing. Their proposal attempts to avoid the pitfall of spending the Social Security surplus funds by allowing DHS to collect more fees, but CBO estimates that the authority would not result in additional deficit reduction, as it does not mandate these fees and the authority would be subject to future appropriations. The admendment, while making an attempt to offset the additional spending, falls short and would reduce the total savings by "something less than $40 billion" compared to the original bill, according to CBO.

Of course, we expect there will always be an urge to drop the offset in favor of simply counting the Social Security savings. Short of transferring money out of the Social Security trust fund, however, doing so would be akin to double counting and would be an unfortunate act of fiscal irresponsibility.