Did the 1986 Tax Act Lead to Long Sustained Growth?

In the debate, Governor Scott Walker (R-WI) claimed that “the Ronald Reagan tax cuts of 1986…brought about one of the longest sustained periods of economic growth in American history.”

For starters, the Tax Reform Act of 1986 was not a tax cut, but rather revenue-neutral tax reform.

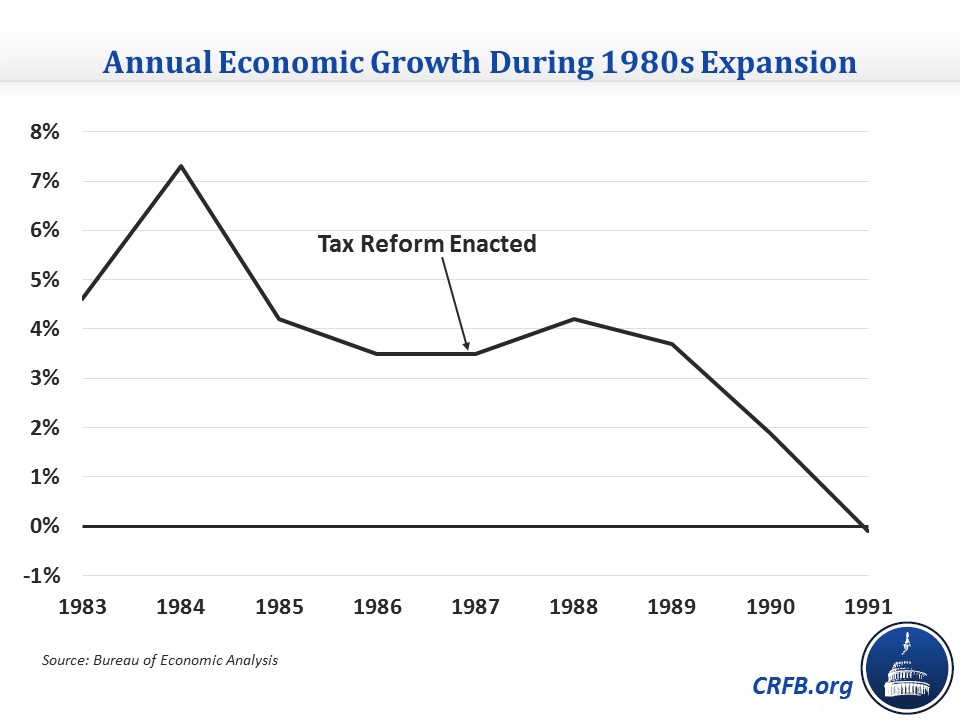

More to the point, while comprehensive tax reform has the potential to promote economic growth and increase GDP, the economy only expanded for 4 years after the 1986 reform before the economic recession of 1990, not a particularly long expansion by historical standards.

Perhaps instead Gov. Walker was referring to economic expansion of the 1990s – which lasted 10 full years and is the longest on record. Although it is possible the 1986 reform did fuel some of this expansion, there is little economic evidence we are aware of to verify this assertion. Indeed, some of the 1986 reform was undone by changes in 1990, 1993, and 1997 – such as the top rate rising from 28 percent to 39.6 percent – making it impossible to know what the impact of the 1986 reform itself would have been.