CRS Talks About Need for Fiscal Sustainability and Plans to Achieve It

The Congressional Research Service's Jane Gravelle recently put out a paper on plans to address long-term deficits and debt. The piece both goes through the many problems with the current budget outlook and different plans that have tried to address it.

Gravelle notes that debt will rise significantly over the next quarter-century to exceed the size of the economy, despite the fact that non-health and non-Social Security spending will decline as a share of GDP.

Although the debt held by the public is projected to be relatively stable over the next decade, the Congressional Budget Office (CBO) projects it will rise to 106% of GDP by 2039. This increase in debt is mainly due to growth in federal spending on health care programs and Social Security, as well as increasing interest payments that typically accompany rising budget deficits. Although spending on these programs is rising, other types of federal spending have remained constant or declined. These trajectories are projected to continue under current policy.

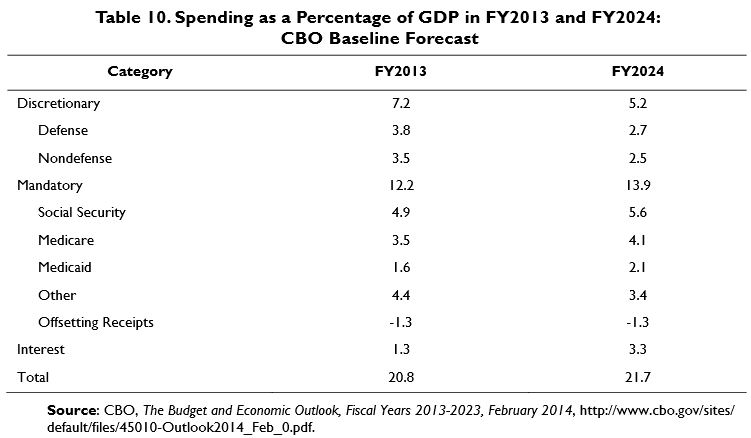

The following table shows how certain areas of the budget are expected to grow or contract as a percent of the economy between 2013 or 2024.

This distribution of projected spending means that, in order to constrain debt, lawmakers will have to go after entitlements or raise taxes to avoid starving discretionary spending.

Because reductions in the spending allocated for federal provision of goods and services appear inadequate to reduce the future deficit and debt to a sustainable level, limiting taxes as a percentage of output or constraining the overall size of the government to current levels would likely require significant cuts in transfers, which include entitlement programs such as Social Security, Medicare, and Medicaid.

Preserving entitlements would eventually require increases in taxes; CBO’s baseline projection shows spending on Social Security, health, and interest will absorb virtually all revenue collected by 2039, leaving little room for any discretionary and other mandatory spending. Options to put the federal budget on a more sustainable path include raising tax rates, reducing tax expenditures, increasing other taxes, or introducing new revenue sources.

In comparing the plans -- which include Simpson-Bowles, Domenici-Rivlin, Galston-MacGuineas, President Obama's framework released in 2011, and the House budget resolution from 2011 -- Gravelle utilizes CRFB's deficit reduction plan comparison tool. The tool allows for a side-by-side comparison of each of the plans, making their differences and similarities in each area apparent.

All of the plans relied on discretionary spending cuts, which lawmakers ended up doing anyway, and all of them reduced health care spending in various ways. They differed, though, on Social Security and tax reform, with a few plans neglecting to make changes in one of those areas and instead rely on other categories for deficit reduction.

Gravelle's report is an important reminder of the challenge that lawmakers face with the federal budget and the kinds of measures they will need to take us back to a sustainable debt path.